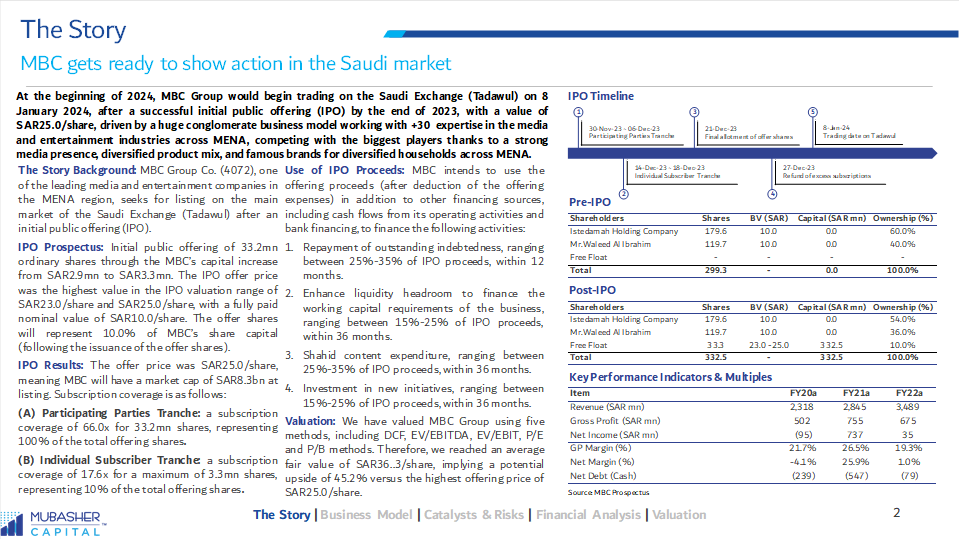

IPO Boom in the MENA Region

MENA sees surge in IPOs led by Saudi Arabia

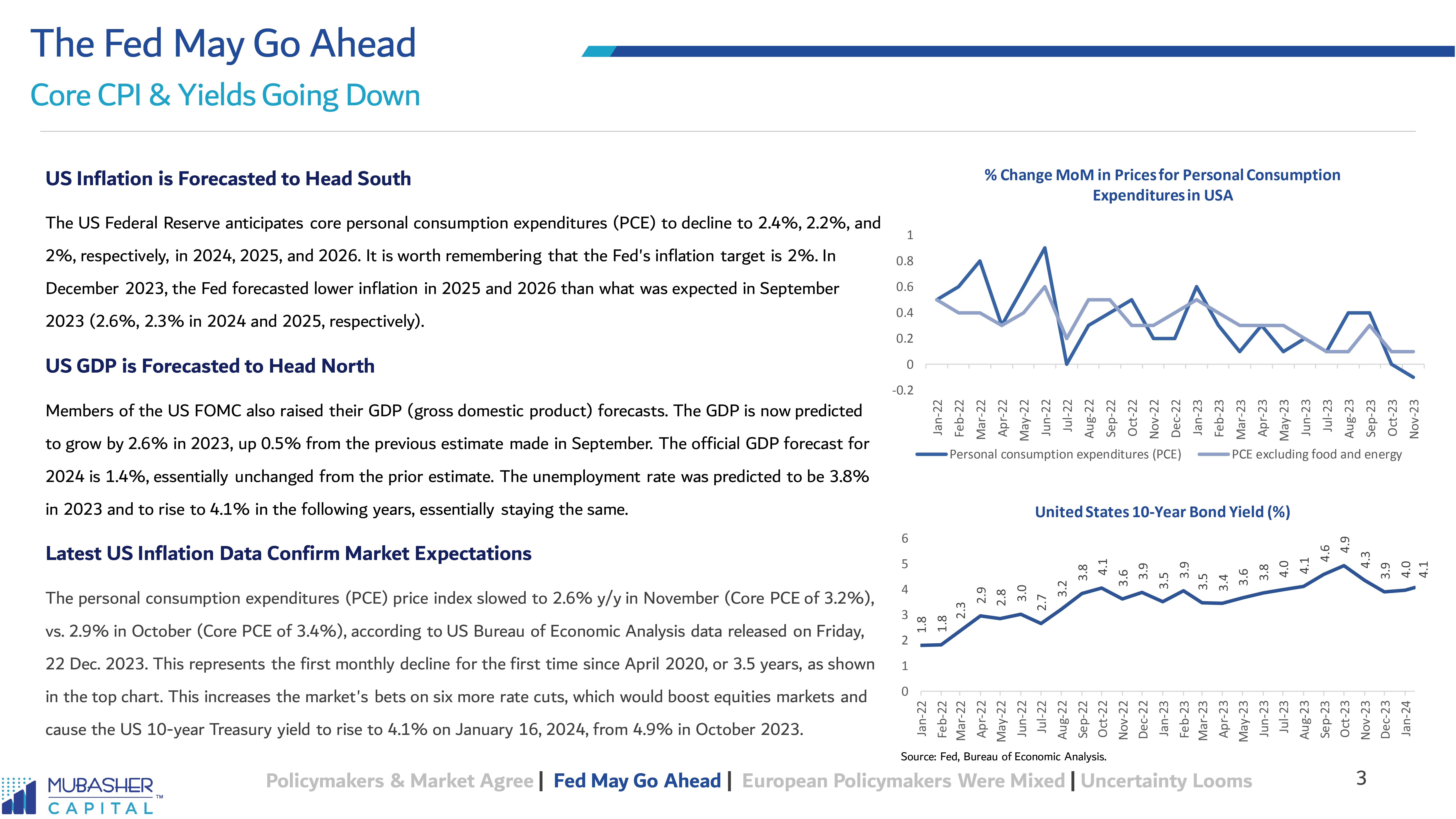

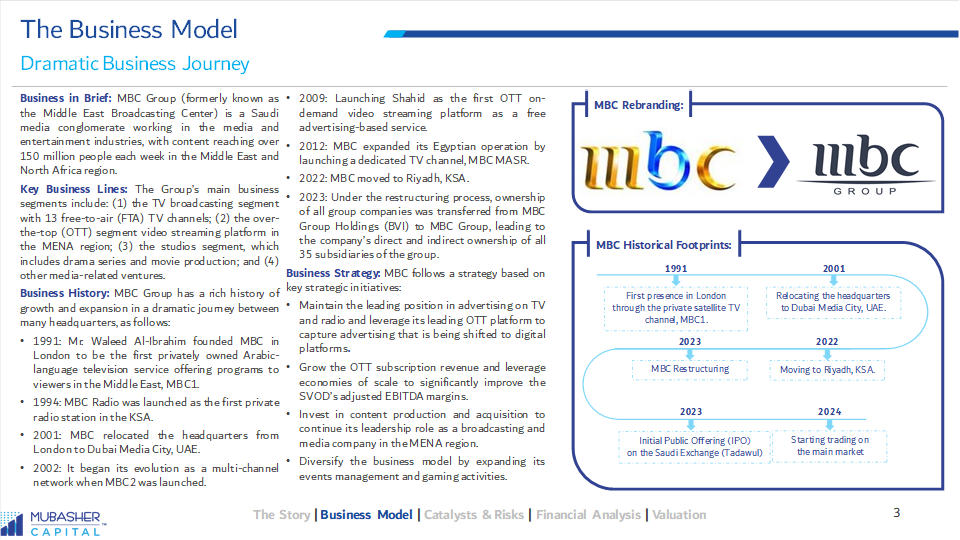

The MENA region has witnessed a steady growth in IPO activity over the past decade, driven by economic diversification, regulatory reforms, and increased investor appetite. The number of IPOs, total proceeds, and post-IPO performance have all shown a positive trends, indicating the growing maturity and attractiveness of the MENA IPO market. The diversification of sectors beyond the traditional financial dominance suggests that the region is successfully leveraging its economic potential and offering investors a more diverse investment landscape. Going forward, continued regulatory improvements, the emergence of new sectors, and the potential for cross-border offerings could further enhance the IPO landscape in the MENA region, solidifying its position as an attractive destination for global capital.

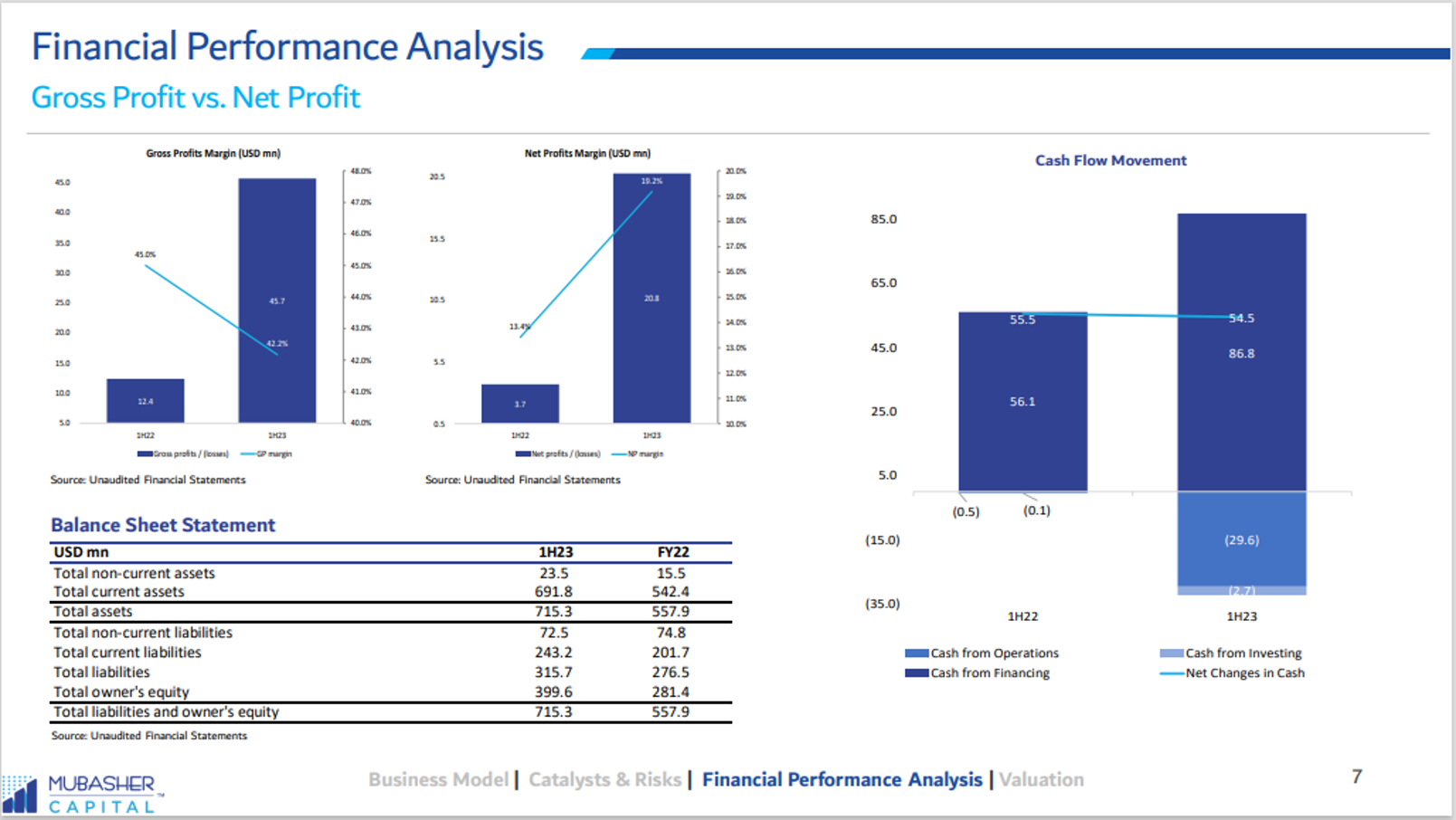

With 140 of the 259 offerings from 2014 to June 2024, KSA confirmed its dominance in the IPO market:

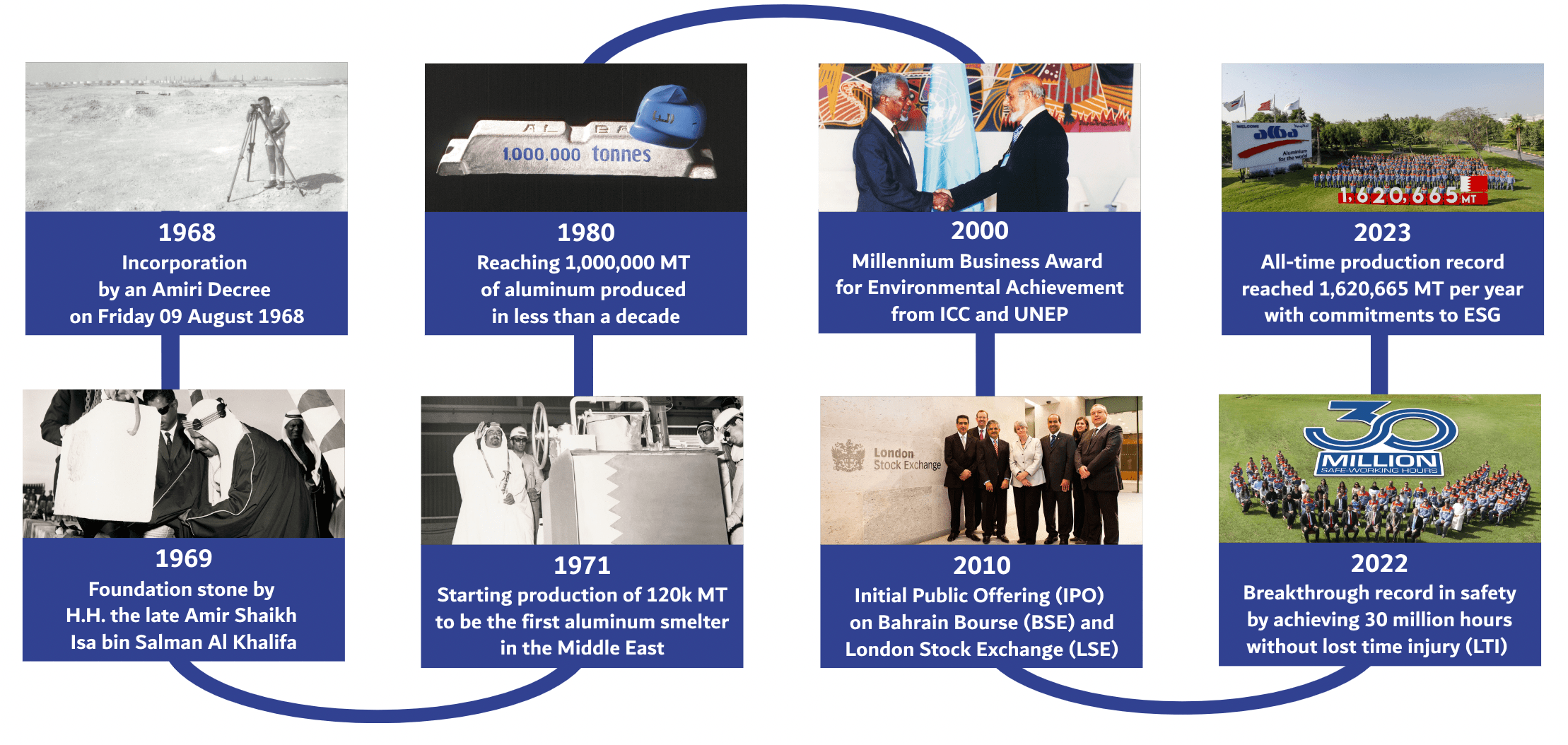

1- The MENA region has experienced a significant surge in initial public offering (IPO) activities over the past decade, with Saudi Arabia emerging as the dominant player in the market.

2- The top sectors attracting IPO activities in the MENA region during this period were Financials, Real Estate, and Energy. Saudi Arabia’s IPO market saw a strong focus on the Petrochemicals, Banking, and Retail sectors, reflecting the country’s economic diversification efforts.

3- Some of the notable large-scale IPOs in the MENA region include the USD29.4bn listing of Saudi Aramco in 2019, the USD6.1bn IPO of Dubai-based DP World in 2021, and the USD3.8bn offering of Abu Dhabi National Oil Company’s (ADNOC) drilling unit in 2021.

4- The IPO boom in the MENA region, led by Saudi Arabia, is closely tied to the countries’ efforts to diversify their economies away from a heavy reliance on oil and gas revenues. IPOs have provided an avenue for these countries to raise capital, privatize state-owned enterprises, and attract foreign investment.

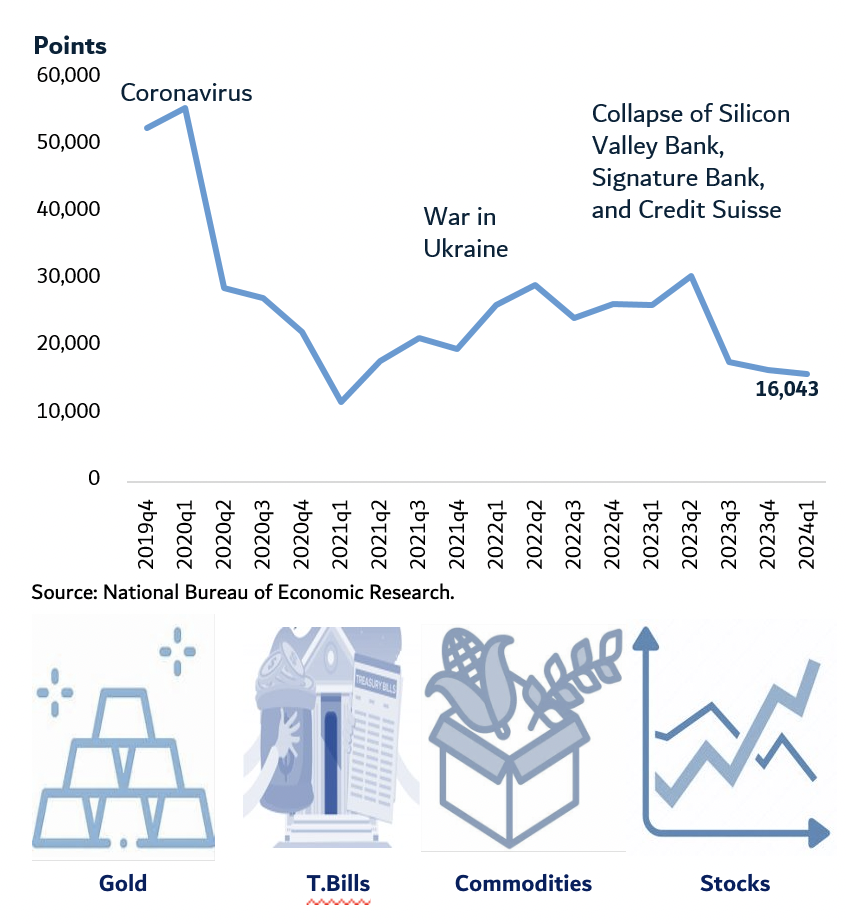

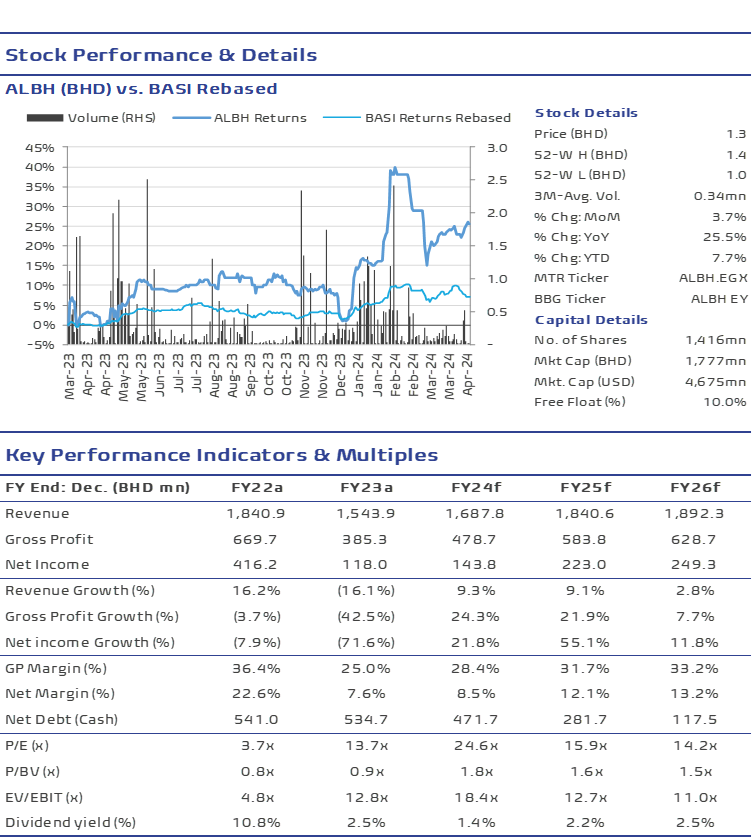

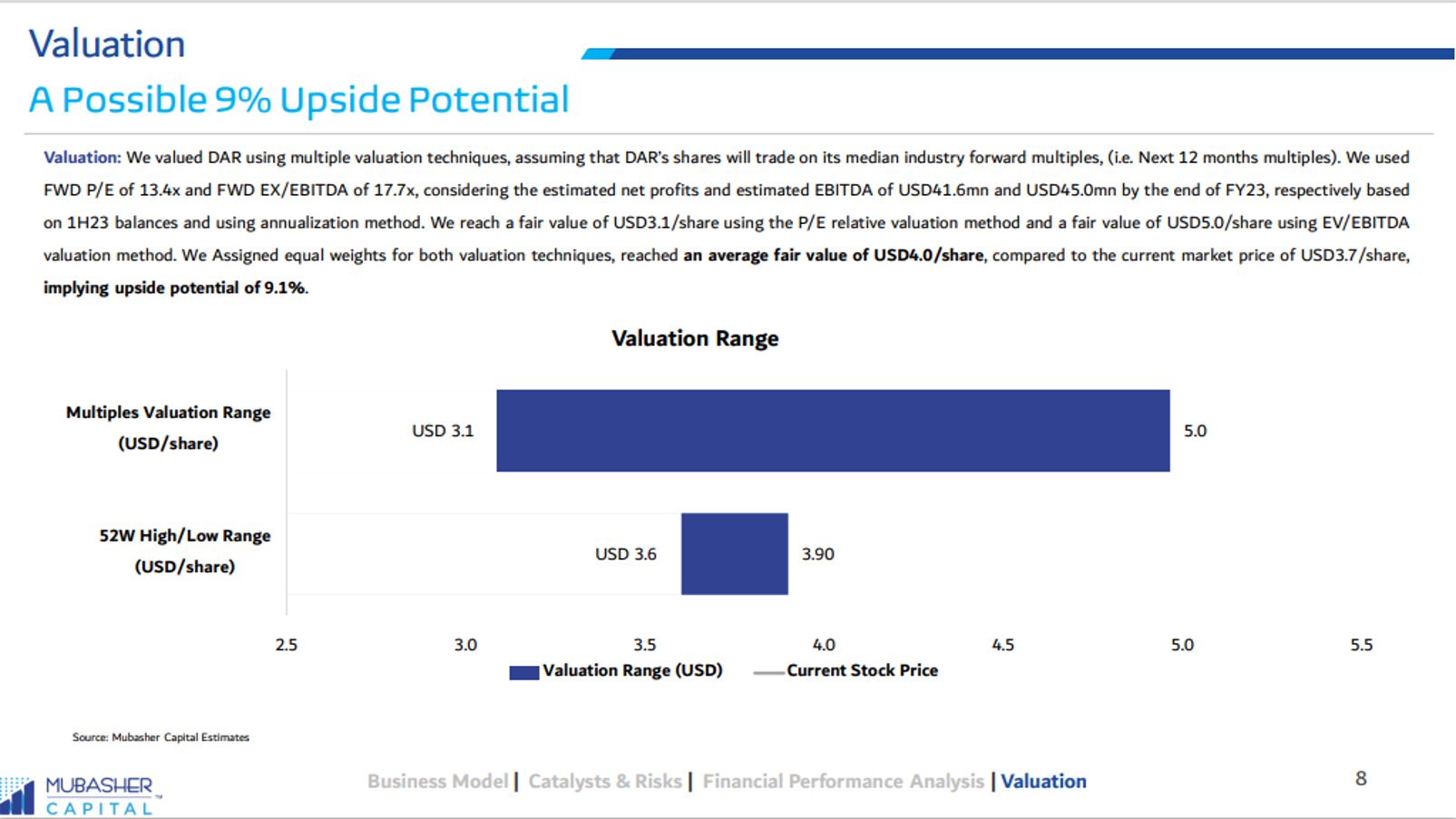

5- The MENA region has witnessed a gradual increase in the number of IPOs, from 26 in 2018 to 48 in 2023, representing a compound annual growth rate (CAGR) of 13%.

6- The total IPO proceeds in the MENA region have grown from USD2.9bn in 2018 to USD10.7bn in 2023, representing a CAGR of 29%, indicating a greater appetite for larger-scale offerings.

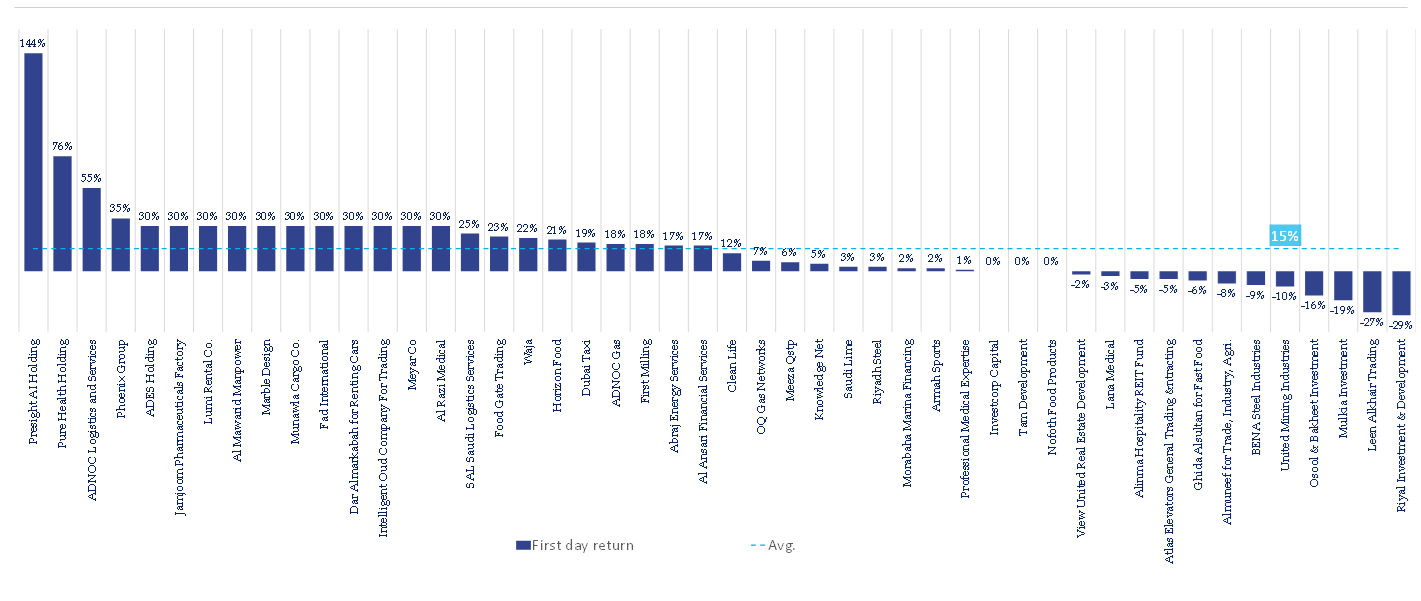

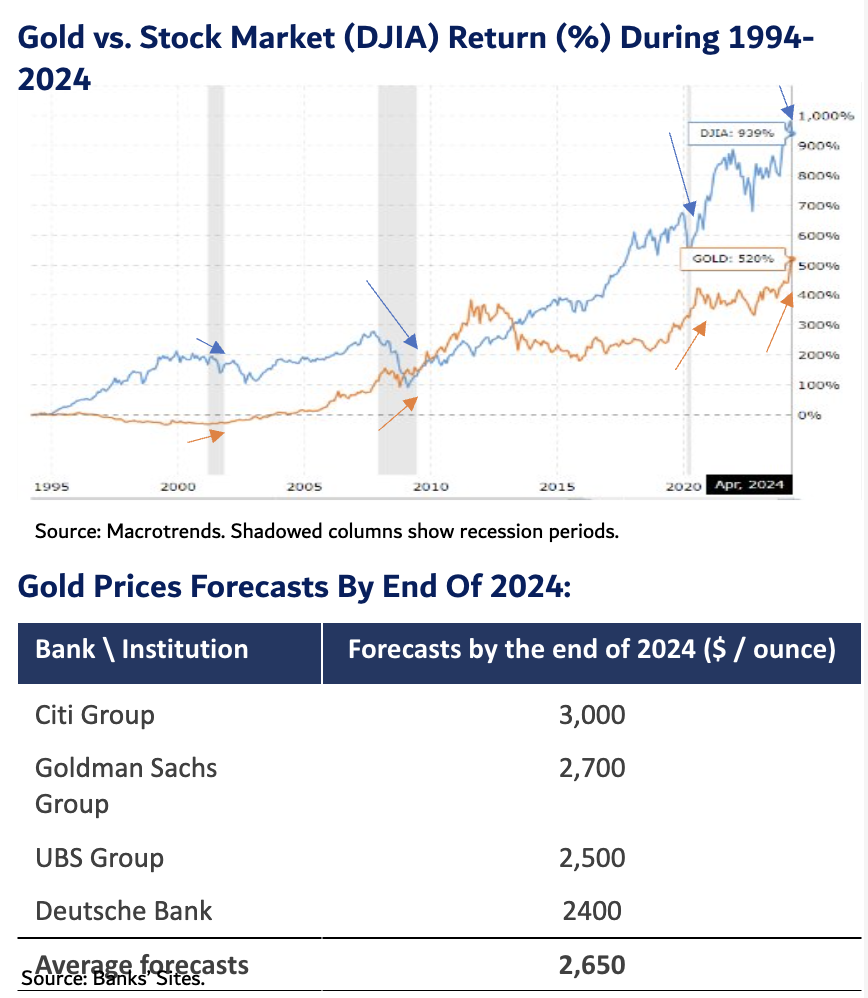

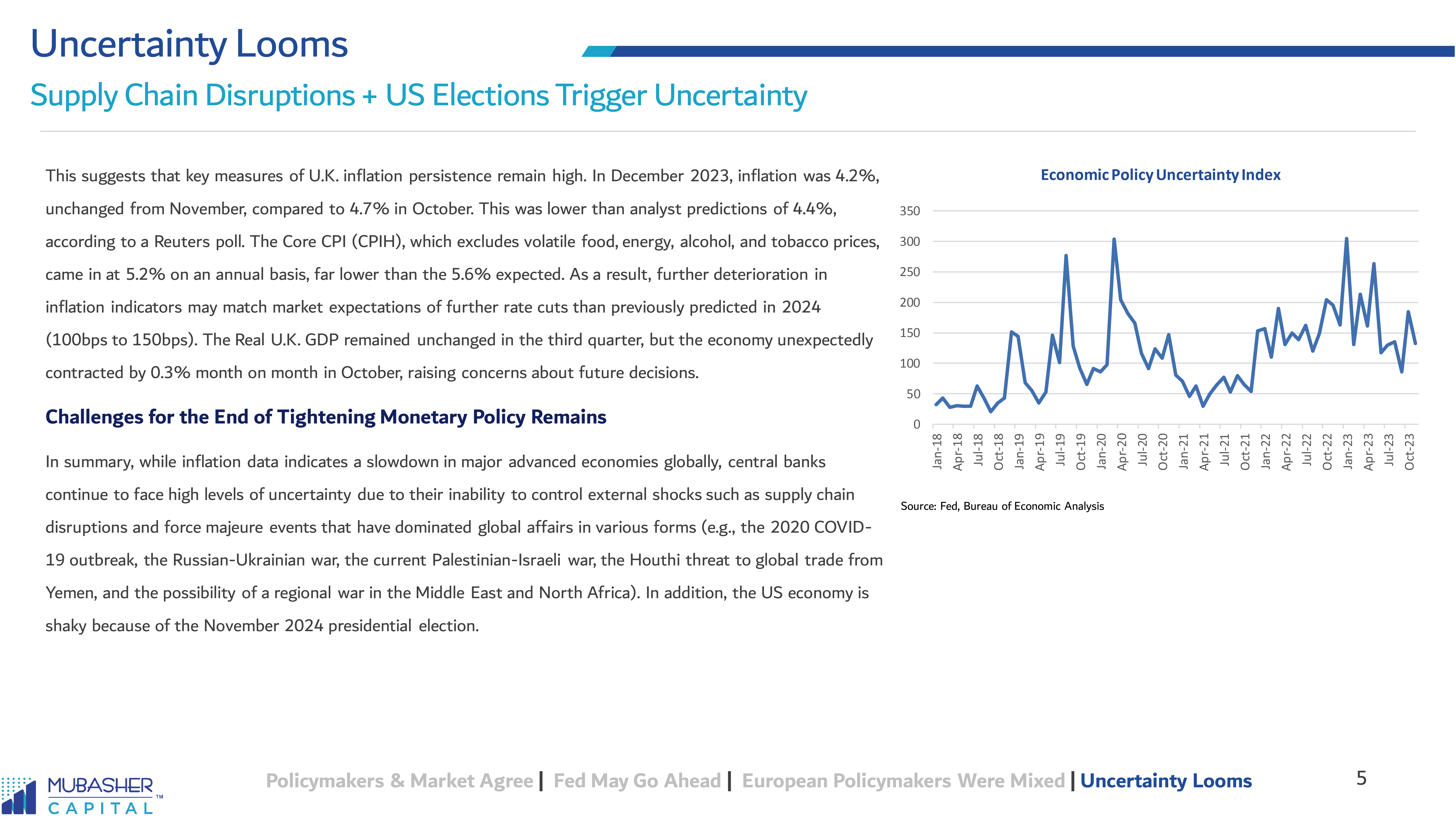

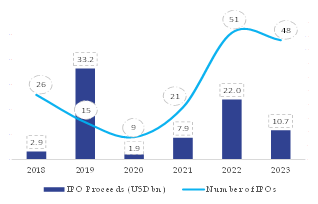

7- The average first-day return for MENA IPOs has increased significantly over the past decade, from 8.2% in 2014 to 19.5% in 2023.

8- Saudi Arabia has consistently reported the highest first-day returns in the region, averaging 22.3% over the 2014-2023 period.

9- The UAE, comprising Dubai and Abu Dhabi, has also seen strong first-day performance, with average returns of 16.7% and 15.4%, respectively during 2014-2023.

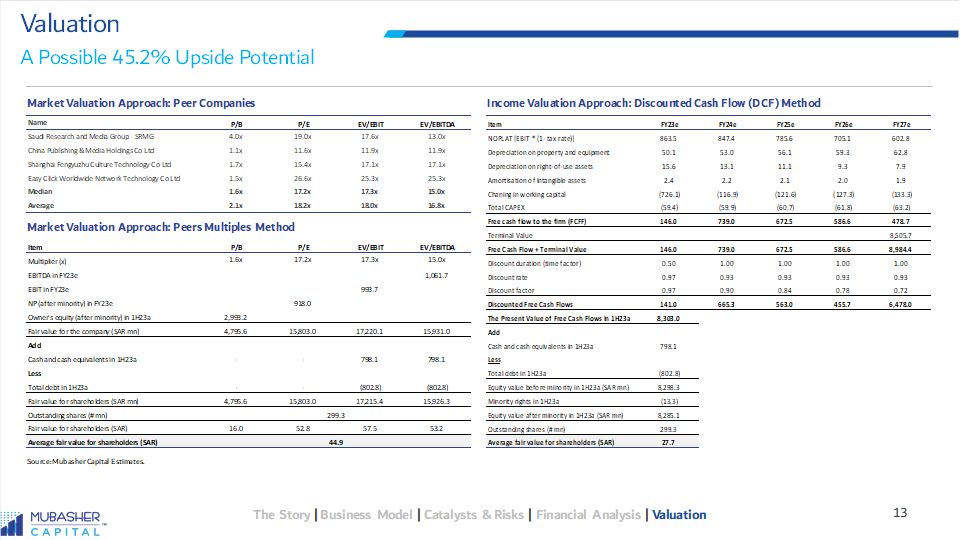

Number of IPOs in MENA region (2014- June 2024)

MENA IPO activity (2018 – 2023)

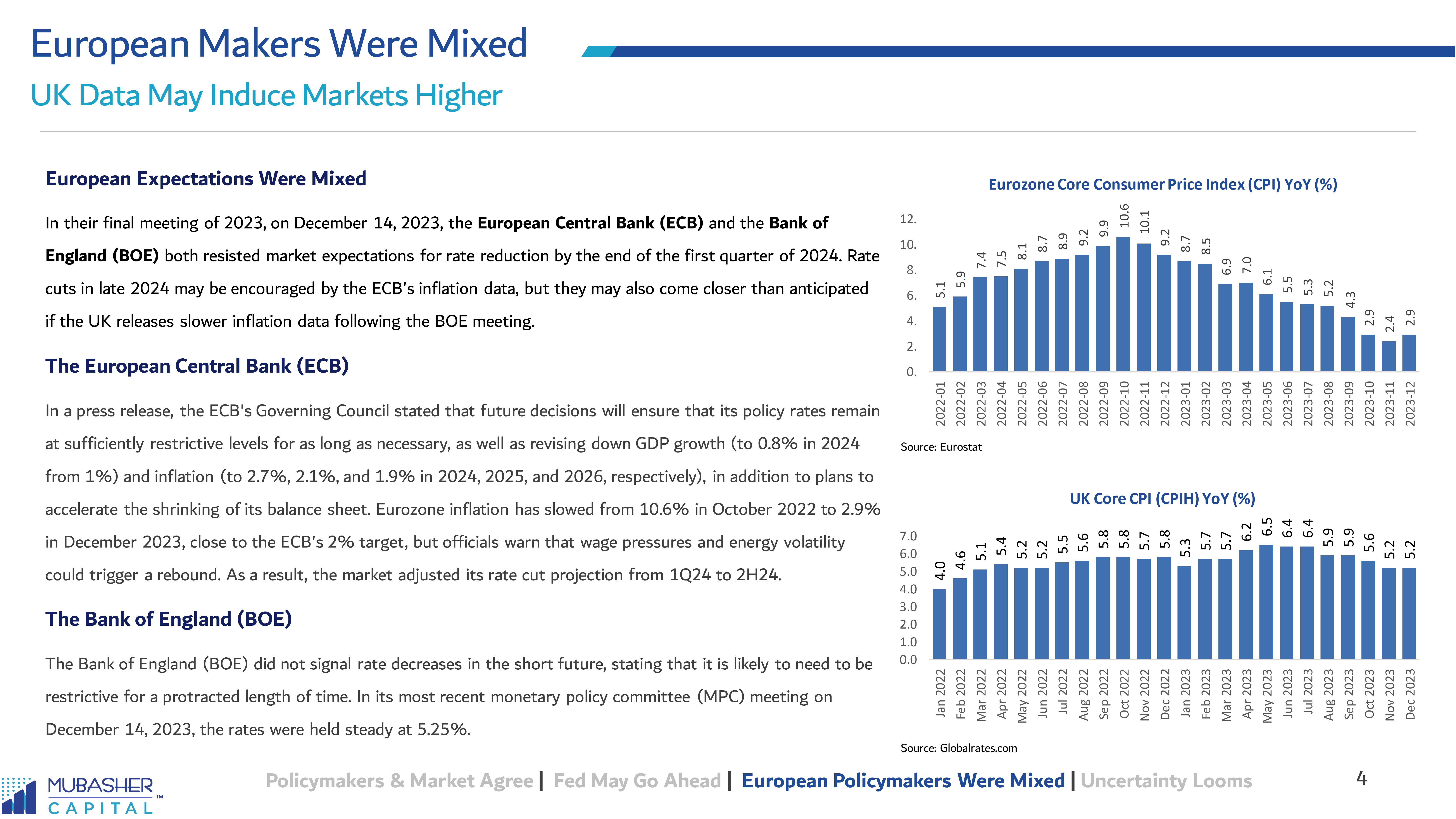

MENA IPO Activity in 2023

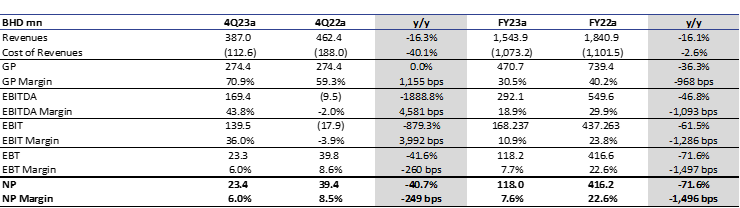

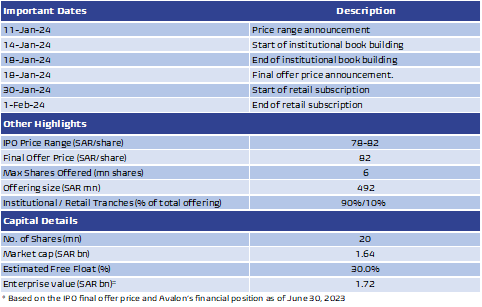

KSA confirmed its supremacy in the IPO market once more in FY23

Saudi Arabia Captures Lion’s Share of IPOs in MENA Region in 2023:

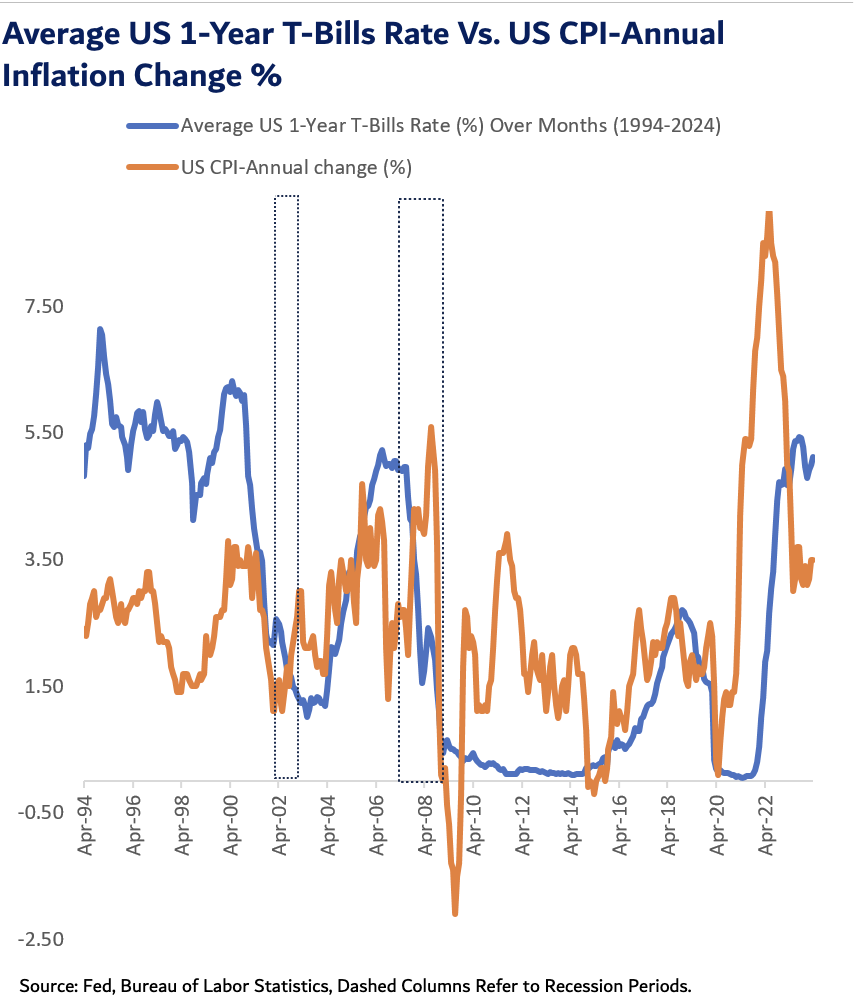

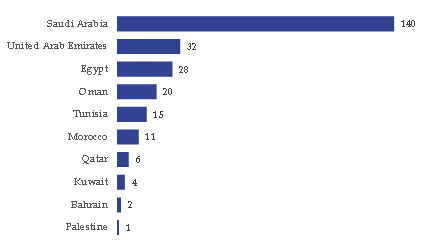

- The MENA region recorded a total of 48 IPOs in 2023, with the total IPO proceeds raised amounting to USD10.7bn.

- In 2023, the Saudi Arabian capital markets have emerged as the dominant force in the MENA region’s IPO (Initial Public Offering) landscape. Saudi companies have captured the lion’s share in terms of the number of IPOs completed during this period.

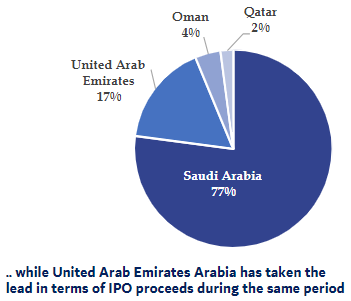

- Saudi Arabia recorded a total of 37 IPOs in 2023, accounting for over 77% of the total IPO activity in the MENA region. This impressive performance solidifies the Kingdom’s position as the regional leader in terms of new listings.

- The IPOs in Saudi Arabia covered a wide range of sectors, including technology, healthcare, consumer goods, and financial services. This diversity reflects the growing maturity and depth of the Saudi capital markets.

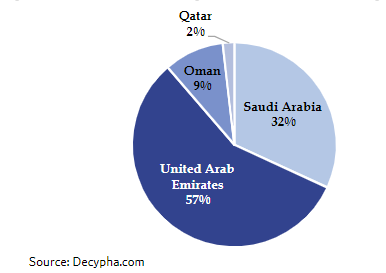

- While Saudi Arabia dominated in terms of the number of IPOs, the United Arab Emirates (UAE) took the lead in terms of total IPO proceeds. The UAE recorded IPO proceeds of USD6.1bn, accounting for 57% of the total IPO proceeds.

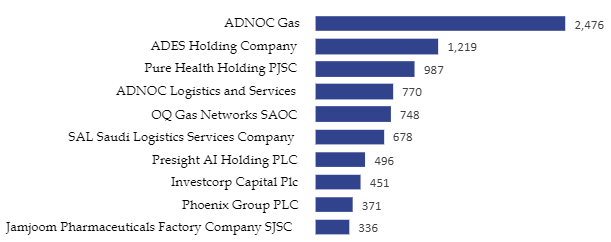

The ten largest IPOs in the MENA region in FY23 (USD mn)

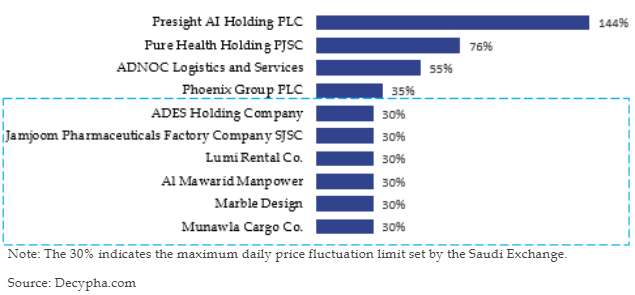

The ten best-performing IPOs in terms of first-day return

Saudi Arabia has captured the lion share in terms of the number of IPOs in the MENA region in 2023 ..

MENA IPO First Day Return

An Average Return 15% in IPOs 1st day