The IPO story

One of the Fastest Growing Pharmaceutical Manufacturers in KSA

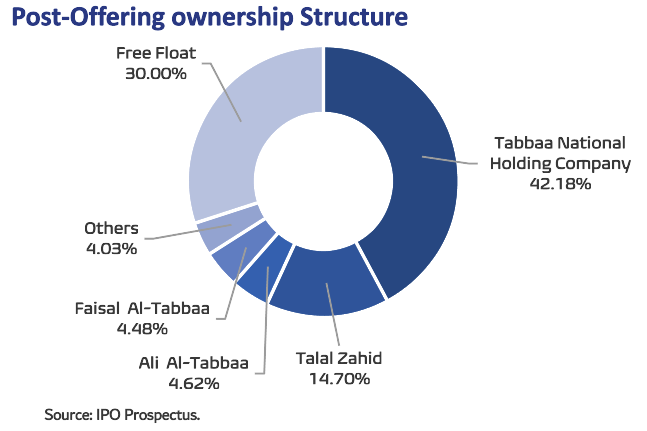

Middle East Pharmaceutical Industries Company, known as Avalon Pharma, is floating 30% of the company’s total issued share capital on the Saudi Exchange’s Main Market. The final offer price implying a market capitalization of SAR1.64bn. We valued Avalon at SAR108.66/share (+32.5% upside to the IPO final price), using both the DCF and multiples valuation techniques.

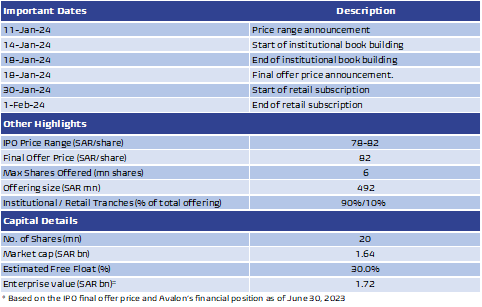

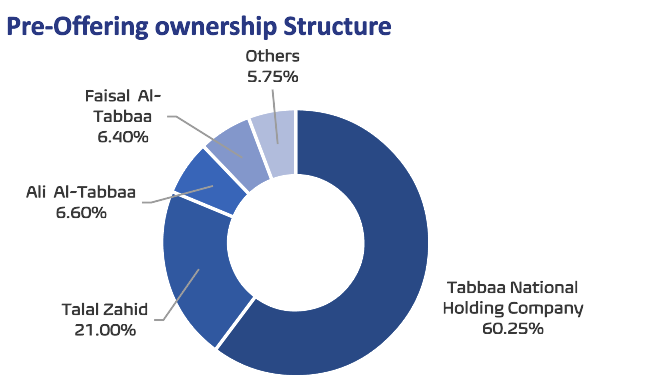

IPO highlights: Avalon Pharma is floating up to 6mn shares on the Tadawul stock exchange, representing 30% of the company’s issued share capital of 20mn shares. The final offer price for the offering has been set at SAR82 per share, at the top of its range of SAR78-82 per share, implying a market capitalization of SAR1.64bn at listing. All major shareholders, in addition to minorities, are selling parts of their stakes in the offer. The largest seller is Tabbaa National Holding Company owning 60.25% of the company, followed by Talal Yousuf Mahmoud Zahid (21%), Ali Shaher Ahmad Al-Tabbaa (6.6%), Faisal Shaher Ahmad Al-Tabbaa (6.4%), and other minorities (5.75%).

The IPO will take place as follows: 1) 100% of the offered shares (6mn shares) will be offered to institutional investors, subject to 10% claw-back if individual investors subscribe to all of the offering shares allocated to them, 2) In the event that individual investors subscribe to all of the offering shares allocated to them, the number of shares allocated to institutional investors would be reduced to 5.4mn shares as a minimum, representing 90% of the total offer shares, and 3) The final allocation will take place after the end of the Individual Investors’ subscription period.

Lock-up period: The current shareholders are subject to a lock-up period of six months, which will begin from commencement of trading of the shares on the Saudi Exchange.

The IPO proceeds: The net proceeds generated by the offering (after deducting the offering expenses ) will be distributed to the selling shareholder according to the number of shares owned by each selling shareholder of the offered shares.

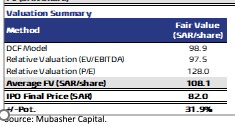

Our fair value is SAR108.1/share: To value Avalon, we used both the discounted cash flow (DCF) and multiples valuation models. We reached an average fair value of SAR108.1/ share, which implies an upside potential of 31.9% versus the final offer price of SAR82 / share.

Investment attractiveness: 1) Defensive industry and favorable regulatory framework, 2) A sizable and growing market share with Avalon Factory (2) to begin commercial production during 2Q24, 3) Optimal business model with a diversified list of suppliers and customers, mitigating supply chain risks, and 4) The company’s plans to expand globally.

Key risks: 1) High competition, and 2) The company must adhere to the pricing rules approved by the Food and Drug Authority that may affect the company’s profit margin.

Offering Details:

Summary KPIs

| FY End: December (SAR mn) | FY19a | FY20a | FY21a | FY22a |

| Revenue | 232 | 302 | 287 | 303 |

| Gross profit | 152 | 181 | 179 | 188 |

| EBITDA | 71 | 90 | 84 | 81 |

| Net Income | 54 | 73 | 66 | 59 |

| Revenue Growth (%) | NA | 30% | -5% | 5% |

| GP Growth (%) | NA | 19% | -1% | 5% |

| EBITDA Growth (%) | NA | 27% | -7% | -4% |

| Net Income Growth (%) | NA | 35% | -9% | -10% |

| GP Margin (%) | 65% | 60% | 62% | 62% |

| EBITDA Margin (%) | 31% | 30% | 29% | 27% |

| NP Margin (%) | 23% | 24% | 23% | 20% |

| Net Debt (Cash) (SAR mn) | 4.7 | 59.6 | 84.6 | 82.3 |

| PER (x) | 30.3x | 22.5x | 24.7x | 27.6x |

| PBV (x) | 7.5x | 6.5x | 6.1x | 5.9x |

| ROE (%) | 25% | 29% | 25% | 21% |

Company Profile

The Leading Provider of Dermatological and Skin Care Products

Saudi-based Avalon Pharma, began operations in 1998. The company develops, manufactures, markets, and distributes a wide range of generic medicines and pharmaceuticals in the Kingdom of Saudi Arabia and abroad through a diversified, high-quality product portfolio covering several therapeutic categories.

The company’s products include the following:

- Medicines and preparations used to treat skin diseases, skin creams and skin care products.

- Respiratory system medications.

- Nervous system medications.

- Digestive system medications.

- Musculoskeletal system medications.

- A variety of medicines and preparations within other therapeutic categories, including sexual system medicines, diabetes, cardiovascular medicines, anti-infective medicines, anti-parasitic medicines, pain relievers, antiseptics, and women’s and men’s health medicines.

Avalon currently has three factories in the city of Riyadh, Avalon Factory (1), Avalon Factory (2), and Avalon Factory (3), which are equipped with production and manufacturing lines for creams, cosmetics, liquid and solid medicines, and disinfectants. The Company has completed the establishment of the Avalon Factory (2) In FY22, with a production capacity of 21.76mn tubes of creams, 16.32mn boxes of liquid pharmaceuticals, and 27.2mn stripes of sold pharmaceuticals.

Since its incorporation, Avalon has focused on increasing the production capacity of factories in tandem with the increase in the volume of demand for its products, as it increased production capacity in several time periods during the years 2007, 2010, 2013, 2015, and 2020, the last of which was in 2022 as follows:

- Creams production lines: The creams production lines had an annual production capacity of 6.1mn tubes in 2003. This figure rose by 12.9mn tubes in 2010, and surged by 21.76mn tubes in 2022.

- Skin and cosmetics production lines: Avalon has maintained an annual production capacity of 3.4mn tubes in its skin and cosmetics production lines since they started production in 2020.

- Liquid pharmaceutical production lines: The liquid pharmaceutical production lines had an annual production capacity of 4mn box when the company was established. This figure rose by 9.2mn box in 2007, and surged by 16.32mn box in 2022.

- Solid pharmaceutical production lines: The solid pharmaceutical production lines started production in 2013 with an annual production capacity of 8.1mn strips. This capacity rose by 27.2mn strips in 2022.

- Disinfectant production lines: The disinfectants production lines had an annual production capacity of 3.5mn box when the company was established. This figure rose by 8.25mn box in 2015 and increased by 2.9376mn box in 2022.

Company Profile (Cont.’d)

A major Expansion is Expected to Start Production During 2Q24

Key Milestone

- In 1998, Middle East Pharmaceutical Industries Company was established.

- In 2003, the construction of the Avalon Factory (1) has been completed, with production lines for creams, liquid medicines and disinfectants.

- In 2004, Avalon began export and distribution operations outside the Kingdom in the Middle East.

- In 2007, the production capacity of the liquid medicine production lines at Avalon Factory (1) has been increased to reach 9,200,000 packages annually.

- In 2010, The company’s export sales extended to the UAE, Bahrain, Iraq, Jordan, Kuwait, Oman, Sudan and Yemen.

- In 2010, the production capacity of the cream production lines at Avalon Factory (1) has been increased to 12,900,000 tubes annually.

- In 2013, solid pharmaceutical production lines were added at Avalon Plant (1) with a production capacity of 8,100,000 strips annually.

- In 2015, the construction of Avalon Factory (3) with disinfectant production lines has been completed, in addition to Avalon Warehouse (2).

- In 2019, The Company entered into its first supply and licensing agreement with the Greek Company Elpin Pharmaceutical Inc., through which Avalon supplies and distributes the Greek Company’s products in the Kingdom of Saudi Arabia.

- In 2019, Avalon has established its UK subsidiary Avalon Pharma UK Holdings Limited.

- In 2020, skin and cosmetics production lines were added at Avalon Factory (1) with a production capacity of 3,400,000 tubes annually.

- In 2020, the production capacity of the disinfectants production lines at Avalon Factory (3) has been increased to 2,937,600 Boxes annually.

- In 2021, Avalon acquired 0.02% stake in the American-listed company Columbia Care Inc., which is listed on the NEO stock market in Canada and operates in the field of manufacturing medical pharmaceuticals and health solutions.

- In 2022, Avalon Pharma built a new main warehouse Avalon Warehouse (4), and Avalon Warehouse (2) was converted into a new factory and established with production lines for creams, liquid medicines and solid medicines, as it is expected to begin commercial production during 2Q24.

Avalone’s annual production capacity

| Avalone Production Lines | Avalon Factory (1) | Avalon Factory (2) | Avalon Factory (3) | Total Capacity |

| Creams production lines | 19mn tubes | 21.76mn tubes | - | 40.76mn tubes |

| Skin and cosmetics production lines | 3.4mn tubes | - | - | 3.4mn tubes |

| Liquid pharmaceutical production lines | 13.2mn box | 16.32mn box | - | 29.52mn box |

| Solid pharmaceutical production lines | 8.1mn stripes | 27.2mn stripes | - | 35.3 stripes |

| Disinfectants production lines | - | - | 14.6876 box | 14.6876mn box |

Actual Production and Utilization Rates

| | FY2020 | FY2021 | FY2022 |

| Creams | | | |

| Total Production Capacity (mn tube) | 19.0 | 19.0 | 19.0 |

| Actual Production (mn tube) | 13.7 | 13.1 | 14.3 |

| Utilization Rates (%) | 72.1% | 68.8% | 75.0% |

| Skin and cosmetic products | | | |

| Total Production Capacity (mn tube) | 3.4 | 3.4 | 3.4 |

| Actual Production (mn tube) | 0.9 | 1.2 | 2.0 |

| Utilization Rates (%) | 25.1% | 34.7% | 58.7% |

| Liquid medications | | | |

| Total Production Capacity (mn box) | 13.2 | 13.2 | 13.2 |

| Actual Production (mn box) | 8.2 | 8.8 | 12.7 |

| Utilization Rates (%) | 62.2% | 66.5% | 96.0% |

| Solid medications | | | |

| Total Production Capacity (mn stripe) | 8.1 | 8.1 | 8.1 |

| Actual Production (mn stripe) | 4.9 | 6.7 | 5.6 |

| Utilization Rates (%) | 60.3% | 82.2% | 68.7% |

| Disinfectants | | | |

| Total Production Capacity (mn box) | 14.7 | 14.7 | 14.7 |

| Actual Production (mn box) | 11.4 | 6.4 | 6.7 |

| Utilization Rates (%) | 77.5% | 43.5% | 45.5% |

Business Model

A Sizable and Growing Market Share Ahead, with Plans to Expand Globally

Avalon Pharma develops, manufactures, markets, and distributes a wide range of generic medicines and pharmaceuticals in the Kingdom of Saudi Arabia and abroad through a diversified, high-quality product portfolio covering several therapeutic categories. The company produces more than 250 products, falling under more than 70 brands. Avalon has three factories in the city of Riyadh, Avalon Factory (1), Avalon Factory (2), and Avalon Factory (3), which are equipped with machines, devices, and production lines for manufacturing creams, skin and cosmetic products, liquid and solid medicines, and disinfectants. Avalon factories have advanced and modern production lines for manufacturing creams, skin and cosmetic products, liquid and solid medicines, and disinfectants. They are also equipped with laboratories and quality control departments that work with an integrated and connected approach to manage production processes and monitor all stages of manufacturing to ensure accuracy and speed of production and high quality of the final products.

Avalon is currently working to register 19 new products with the Food and Drug Administration, including 4 skin medicines, 4 respiratory medicines, 1 digestive system medicine, 1 musculoskeletal medicine, and 9 various medicines within the company’s other therapeutic categories. The registration period generally ranges between 12 to 18 months.

Among the most important products of Avalon are dermatology medicines that carry the brand Avogain (a topical solution that stimulates hair growth and prevents hair loss) and Alpha Plus (a cream to lighten pigmentation and unify skin tone), and respiratory medicines that bear the trademark Salinose (saline solution to moisturize and clean the nose) and Avocom (a water nasal spray used to treat the symptoms of seasonal allergic rhinitis and perennial rhinitis), in addition to the brand of sterilizer products EZ Clean , which witnessed an unusual jump in sales during 2020 and 2021 due to the Corona virus pandemic at the time.

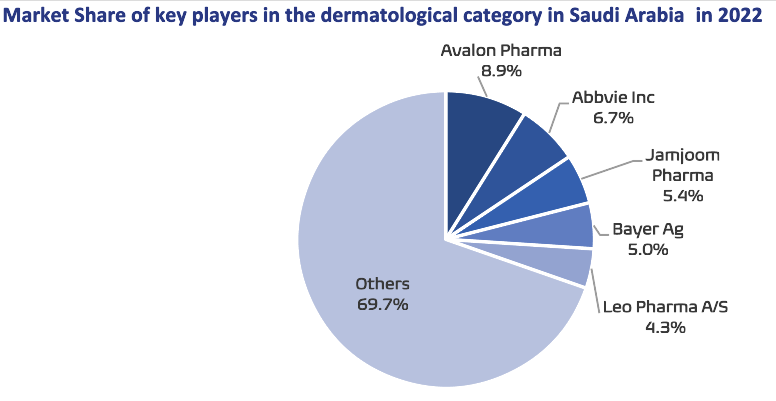

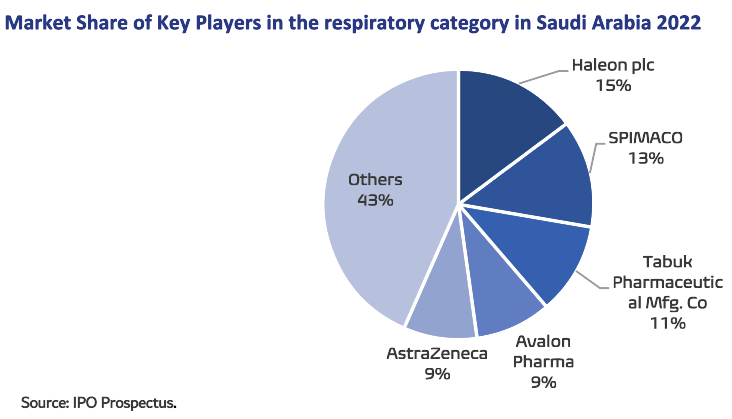

Avalon is the market leader in the market of dermatological products, medicines and skin care products, a fast-growing category in Saudi Arabia, with an 8.9% market share. Additionally, the company is one of the top four manufacturers in respiratory therapeutic category, with a 9.1% market share.

The Company’s business extends to many markets in the countries of the GCC region, Middle East and Africa, including Kuwait, UAE, Jordan, Iraq, Yemen, Bahrain, Lebanon, Egypt, Sudan and Libya.

Business Model (Cont.’d)

Dermatological and Skin Care Products Represent 50% of Total Revenue.

Pricing policy of pharmaceutical products: The pricing process for pharmaceutical and pharmaceutical preparations is subject to the pricing rules approved by the Board of Directors of the Food and Drug Authority. According to these rules, Avalon must always adhere to the pricing regulations for pharmaceutical products, which imposes negotiating pressure on it with its major clients in the government and private sectors. Additionally, the current pricing rules may be subject to future modifications that may affect its profit margins, which the company cannot predict.

Raw Materials: Avalon obtains raw materials from various sources in the Kingdom of Saudi Arabia, European countries, the United States of America, China, and others. Among the most important raw materials that the company imports are the active ingredients that are used in the pharmaceutical industry, such as the active ingredients Avogain and Minoxidil used in Avogain products, the active ingredient Pump Shenzhen bona used in Rhinaze and Avocom products, and other materials such as Ethanol used in sterilizers, Cetostearyl used in cream products, Propylene Glycol used in a large number of health products and medicines, and others. As for packaging supplies, boxes, packages, etc., Avalon obtains most of them from local companies and merchants in the Kingdom.

During production operations, Avalon factories depend on the availability of water, diesel, and electricity, as their annual need is as follows: 1) The company’s factories consume around 35,000-40,000 cubic liters of water annually, which the company obtains from the National Water Co. 2) The company’s factories need around 700,000-800,000 liters of diesel annually, which the company obtains from local sources. 3) The company’s factories consume around 6-7mn kilowatt-hours of electricity annually, which the company obtains from Saudi Electricity Co.

Avalon has a subsidiary in the United Kingdom and 14 branches; additionally, the company owns:

- 0.2% stake in the American-listed company Columbia Care Inc., which is listed on the NEO stock market in Canada and operates in the field of manufacturing medical pharmaceuticals and health solutions.

- 15% stake in Nuha Consultancy Company, which operates in the retail sale of cosmetics and beauty tools in specialized stores.

- 15% stake in Emulsion Cosmetics Limited, which operates in the retail sale of cosmetics and beauty tools in specialized stores.

Revenues by product categories (SAR mn)

| Revenues by product categories (SARmn) | FY2020 | FY2021 | FY2022 |

| Dermatological, and skin care products revenue | 105.7 | 143.0 | 150.3 |

| Y/Y Growth (%) | NA | 35.3% | 5.0% |

| Respiratory medications revenue | 35.4 | 49.5 | 72.0 |

| Y/Y Growth (%) | NA | 40.0% | 45.3% |

| Nervous system medications revenue | 22.4 | 27.5 | 26.0 |

| Y/Y Growth (%) | NA | 22.8% | -5.3% |

| Digestive system medications revenue | 6.8 | 11.3 | 13.5 |

| Y/Y Growth (%) | NA | 65.6% | 19.1% |

| Musculoskeletal system medications revenue | 10.8 | 14.2 | 11.6 |

| Y/Y Growth (%) | NA | 31.7% | -18.1% |

| Other medications in various therapeutic classes revenue | 120.6 | 41.7 | 29.3 |

| Y/Y Growth (%) | NA | -65.4% | -29.7% |

| Total revenue | 301.7 | 287.2 | 302.7 |

Revenues by business sector (SARmn)

| | FY2019 | FY2020 | FY2021 | FY2022 |

| Revenue from retail customers | 158.4 | 190.9 | 194.1 | 208.0 |

| As % of total revenue | 68.2% | 63.3% | 67.6% | 68.7% |

| Revenues from government sector clients | 52.6 | 88.2 | 65.6 | 68.6 |

| As % of total revenue | 22.6% | 29.2% | 22.9% | 22.7% |

| Revenue from export clients | 21.1 | 22.6 | 27.4 | 26.1 |

| As % of total revenue | 9.1% | 7.5% | 9.6% | 8.6% |

| Total revenue | 232.1 | 301.7 | 287.2 | 302.7 |

COGS Breakdown (SAR mn)

| | FY2019 | FY2020 | FY2021 | FY2022 |

| Cost of raw materials | 21.5 | 45.3 | 33.7 | 39.1 |

| As % of total cost | 25.3% | 36.2% | 29.9% | 33.0% |

| Cost of packaging materials | 26.4 | 39.1 | 34.7 | 44.7 |

| As % of total cost | 31.0% | 31.2% | 30.8% | 37.8% |

| Labor cost | 18.4 | 20.0 | 22.0 | 24.4 |

| As % of total cost | 21.7% | 16.0% | 19.5% | 20.6% |

| Depreciation & amortization | 4.5 | 4.3 | 4.2 | 4.0 |

| As % of total cost | 5.3% | 3.4% | 3.7% | 3.4% |

| Others | 14.1 | 16.6 | 18.0 | 6.2 |

| As % of total cost | 16.6% | 13.3% | 16.0% | 5.2% |

| Total COGS | 85.0 | 125.3 | 112.6 | 118.4 |

Industry in a Nutshell

Favorable Market Dynamic

The public healthcare system in Saudi Arabia is managed and financed by the government through the Ministry of Health provides comprehensive healthcare for all its residents via an integrated network of healthcare services across all regions of the Kingdom.

In 2022, Saudi Arabia allocated SAR138bn on healthcare and social development, or 14.4% of its budget. Additionally, under Vision 2030, the Saudi Arabian government plans to invest approximately SAR295bn towards the development of the nation’s healthcare infrastructure. In addition to public spending to improve and advance the healthcare sector, the government also aims to boost private sector participation in the sector by encouraging investments.

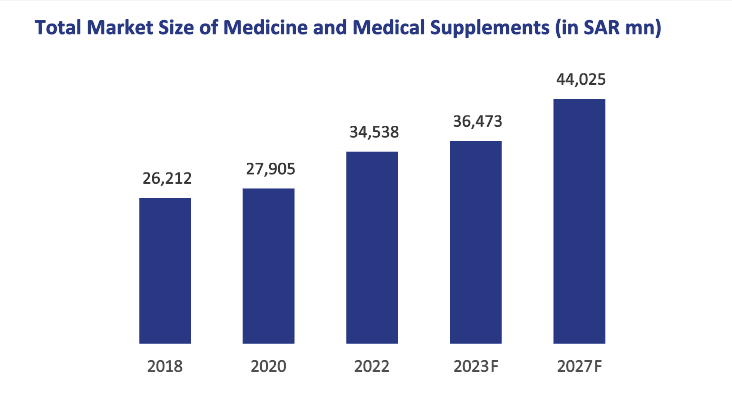

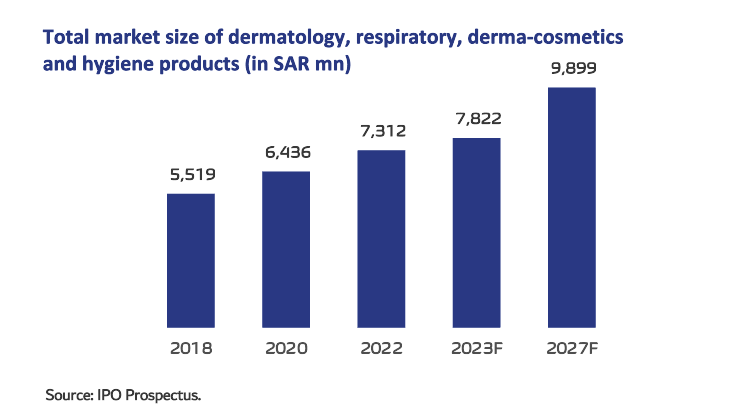

In 2022, the total medicine and medical supplements industry was valued at SAR34.5bn and grew at a CAGR of 7.1% from 2018 to 2022. This includes dermatology, respiratory, derma-cosmetics and hygiene products (hand sanitizers) and oral care– which grew by 7.3% during 2018-2022 to reach SAR7.3bn by 2022. These categories contributed 21.2% of the overall medicine and medicinal supplements sector sized at SAR34.5bn as of 2022.

Due to Saudi Arabia’s reliance on imported medicines and medicinal supplements to meet their healthcare demand, the majority of medicine and medical supplements sales to consumers in the country are conducted through large national distributors such as Tamer Group and Al Naghi Brothers.

The total market for dermatological increased by CAGR of 8.9% between 2018 and 2022, reaching SAR2.5bn in 2022, primarily due to factors such as increased disposable income, which allowed for increased spending on pharmaceutical products, skin products, general skin health, all-weather skin care, and skin disease awareness (including early detection of skin cancer).

The total market for dermo-cosmetics increased by CAGR of 2.2% between 2018 and 2022, reaching SAR237mn in 2022, with facial care accounts for the largest market size.

The total market for Hygiene products (hand sanitizers) and oral care (as defined in this study) increased by CAGR of 11.4% between 2018 and 2022, reaching SAR1.4bn in the latter year . The demand for hygiene products (hand sanitizers) and essentials (oral care) during 2018-22 was largely influenced by during the Covid-19 pandemic. In addition to the encouragement from the Saudi government’s educational activities to raise awareness on the importance of maintaining good hygiene practices.

The total market for respiratory category increased by CAGR of 4.9% between 2018 and 2022, reaching SAR3.1bn in 2022. This was primarily attributed to factors such as rising air pollution, intense dusty weather, continued high prevalence of smoking among younger age groups, growing awareness of respiratory diseases such as asthma and Chronic Obstructive Pulmonary Disease (COPD), and the ageing of the population.

Valuation

Avg. Fair Values is SAR108.1 / share

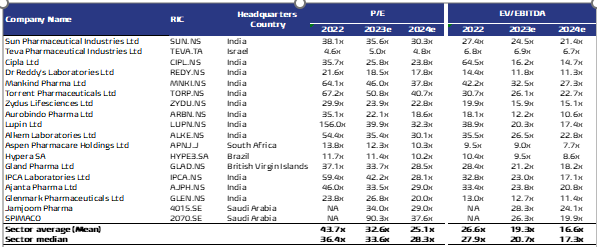

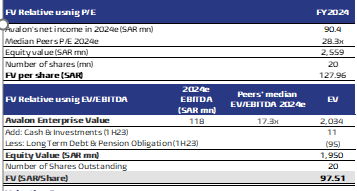

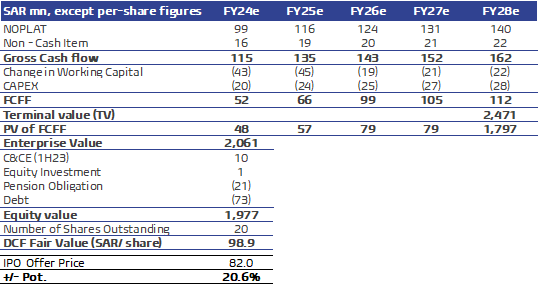

Our average Fair Value stands at SAR108.1 / Share: In addition to our discounted cash flow (DCF) model which yielded a fair value of SAR98.9/ share as depicted in the right table, we also conducted a relative valuation using the median P/E and EV/EBITDA multiples for FY24 for Avalon’s peers. We used emerging markets peers’ median P/E and EV/EBITDA FY24 multiples and applied them to Avalon’s expected earnings and EBITDA in FY24 to arrive at a fair value for the stock. We assign equal weights to each valuation technique, reaching an average fair value of SAR108.1/share, which is 31.9% higher than the IPO final offer price of SAR82 per share.

DCF – fair value SAR98.9/ share: We discounted Avalon’s free cash Flow to the firm over the coming five years (2024-2028) (FCFF) based on the following assumptions:

- Revenues to grow at a 6Y CAGR of 11.1% to SAR568mn by 2028, on the back of growing market share as the company has completed the establishment of the Avalon Factory (2) in FY22, which is expected to begin commercial production during 2Q24.

- EBITDA to grow at a 6Y CAGR of 12.6% to SAR165.6mn by 2028, with EBITDA margin to stand at 29% in the forecasted period, in line the Avalon’s historical average.

- Cumulative Capex of SAR124mn, averaging 5% of revenues during the forecast period.

- Working capital assumptions are based on historical averages cash conversion cycle (CCC).

- Cost of Equity (COE) is 8.2%, calculated as follows: SKA implied risk-free rate of 3.1% on average during forecasted period (based on US risk free rate and inflation differential between KSA vs. USA), KSA’s Equity Risk Premium (ERP) of 6.3% (based on a US market ERP of 5.94% and a relative standard deviation of 1.06 between US and KSA equity markets returns), and a Beta of 0.8.

- After tax cost of debt 2.5% on average.

- Capital structure of 95% equity and 5% debt, based on the market value of Avalon’s equity of SAR 1.64bn (based on the IPO final price).

- Hence, we used a WACC of 8.3% in 2024e, which eventually declines to 7.7% by 2028e, with terminal year growth rate of 3%.

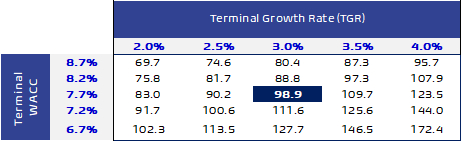

Sensitivity analysis: Our DCF fair value is highly sensitive to the changes in both WACC and growth rate in the terminal year. Therefore, we conducted a sensitivity analysis for any changes in both WACC and growth rate in the terminal year which resulted in fair values ranged from SAR69.7 to SAR172.4 / share.

DCF Valuation

FV sensitivity to TGR and WACC

Valuation (Cont.’d)

A Possible 31.9% Upside Potential

Multiples valuation: We used emerging markets peers’ median P/E and EV/EBITDA FY24 multiples and applied them to Avalon’s expected earnings and EBITDA in FY24 to arrive at a fair value for the stock as follows:

- P/E: Using peers’ median FY24 P/E of 28.3x and our forecasted net income for FY24, we arrived at a fair value of SAR127.96/ share.

- EV/EBITDA: By applying peers’ median FY24 EV/EBITDA of 17.3x to our forecasted FY24 EBITDA, we arrived at a fair value of SAR97.51/ share.

- Our FV is SAR108.1 / share based on equal weights: We assign equal weights to both valuation techniques, reaching a fair value of SAR108.1/ share, which represents 31.9% higher than the IPO final price of SAR82 per share.

Investment rationale:

- One of the fastest growing home-grown pharmaceutical manufacturing companies in the Kingdom of Saudi Arabia.

- Defensive industry and favorable regulatory framework.

- Optimal business model with a diversified list of suppliers and customers, mitigating supply chain risks.

-

- A sizable and growing market share ahead as the company has recently completed a major expansion by doubling its manufacturing capacity, which is expected to start production by the second quarter of 2024.

- Avalon Pharma is the market leader in the market of dermatological products, medicines and skin care products, a fast-growing category in Saudi Arabia, with an 8.9% market share.

- Avalon Pharma is one of the top four manufacturers in Respiratory therapeutic category, with a 9.1% market share.

- The company’s plans to expand its export market, a fast-growing channel for Avalon, including the introduction of new sub-distribution partnerships in key countries.

Key Risks:

- Avalon must always adhere to the pricing rules approved by the Food and Drug Authority that may affect the company’s profit margin.

- Fierce competition.

- The company is exposed to the risk of withdrawing its products from the market.