The Story

Global Presence Contributes to The Aluminum Industry

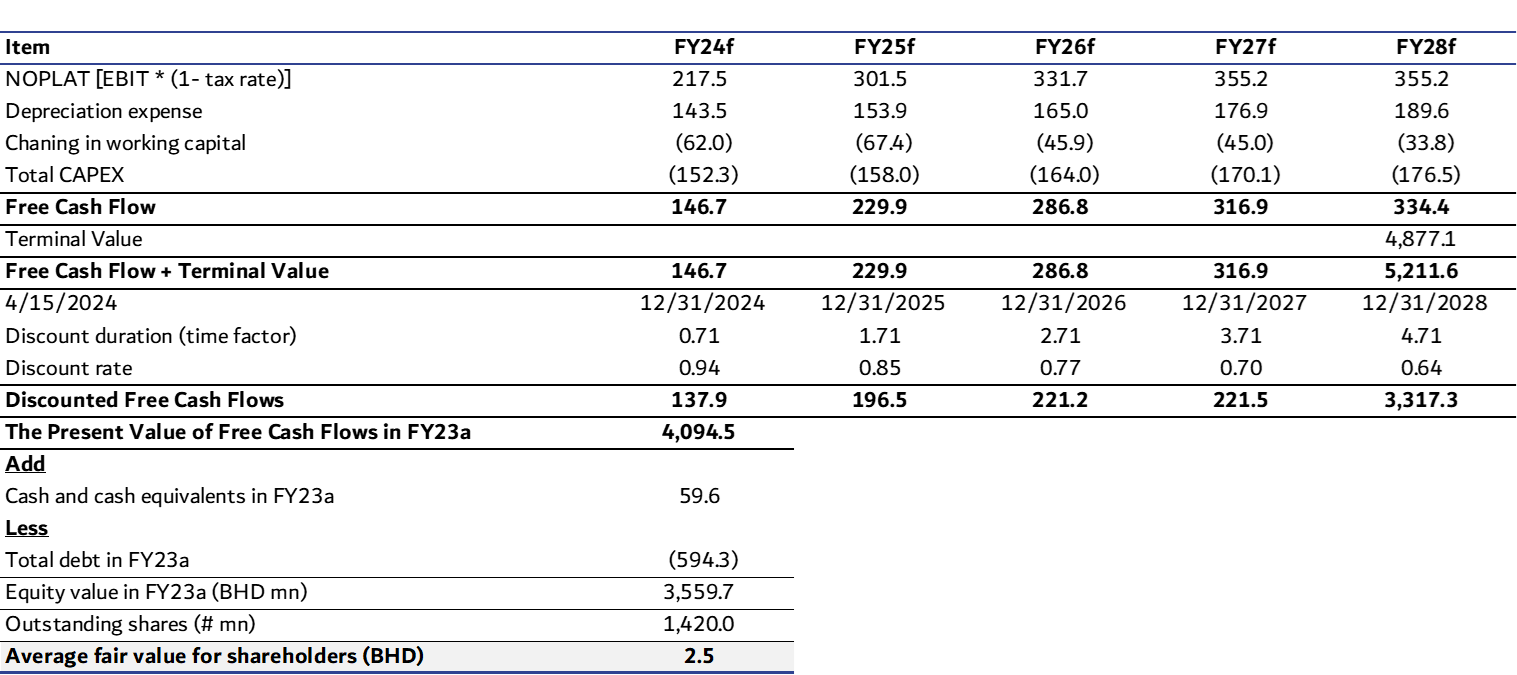

Aluminium Bahrain – “alba” (ALBH) is the first primary aluminum smelter in the Middle East with +50 years of legacy, a significant contributor with a capacity of +1.62 MTPA of a wide range of aluminum products to serve +270 customers worldwide in global markets, with strategically situated and abundant natural gas resources in Bahrain. We valued the company at BHD2.5/share using DCF approach with a possible 99.2% upside potential.

The background: 2024 is a milestone year for the thriving aluminum industry around the globe generally and in the MENA region, particularly. Therefore, Aluminium Bahrain (ALBH) Valuation Call Note has some potential catalysts this year, as follows:

(1) Growing up from a dual-listing company to a multiple-listing company: The sovereign wealth fund of Bahrain (Mumtalakat) studies listing a stake of ALBH on Saudi Exchange (Tadawul) by 2024 end after an IPO on Bahrain Bourse (BSE) and London Stock Exchange (LSE) more than a decade ago. Tadawul is one of the most active markets in the MENA, since allowing foreigners to buy stocks directly in 2015, the market has attracted some of the largest global investors.

(2) Cooperation with Egypt to produce the raw material instead of importing: ALBH, in cooperation with Egypt Aluminum (EGAL), Metallurgical Industries Holding Co. (MIH), and Ministry of Public Business Sector (MPBS), seeks to establish a bauxite production factory, the main component for producing alumina, which is the raw material to produce primary aluminum metal, in order to cover the needs of Bahrain and Egypt instead of importing from China, Russia, and India.

(3) Technology services partnership agreement with Emirates Global Aluminum (EGA): Both ALBH and Emirates Global Aluminum (EGA) signed a technology services partnership agreement that includes technical support services, performance monitoring services, and operational consultation on operational aspects for ALBH’s Reduction Line number 6.

(4) EU sanctions against Russia spark competition for the Middle East’s aluminum: The European Union (EU) imposed a new package of sanctions on Russian aluminum, forcing European and American buyers to buy aluminum from the Middle East, including the United Arab Emirates and Bahrain, which is similar to what happened in 2018, when the EU banned Russian aluminum supplied by UC RUSAL, sparking significant price increases.

The Business Model

Significant Milestone for The Region’s Industrial Development

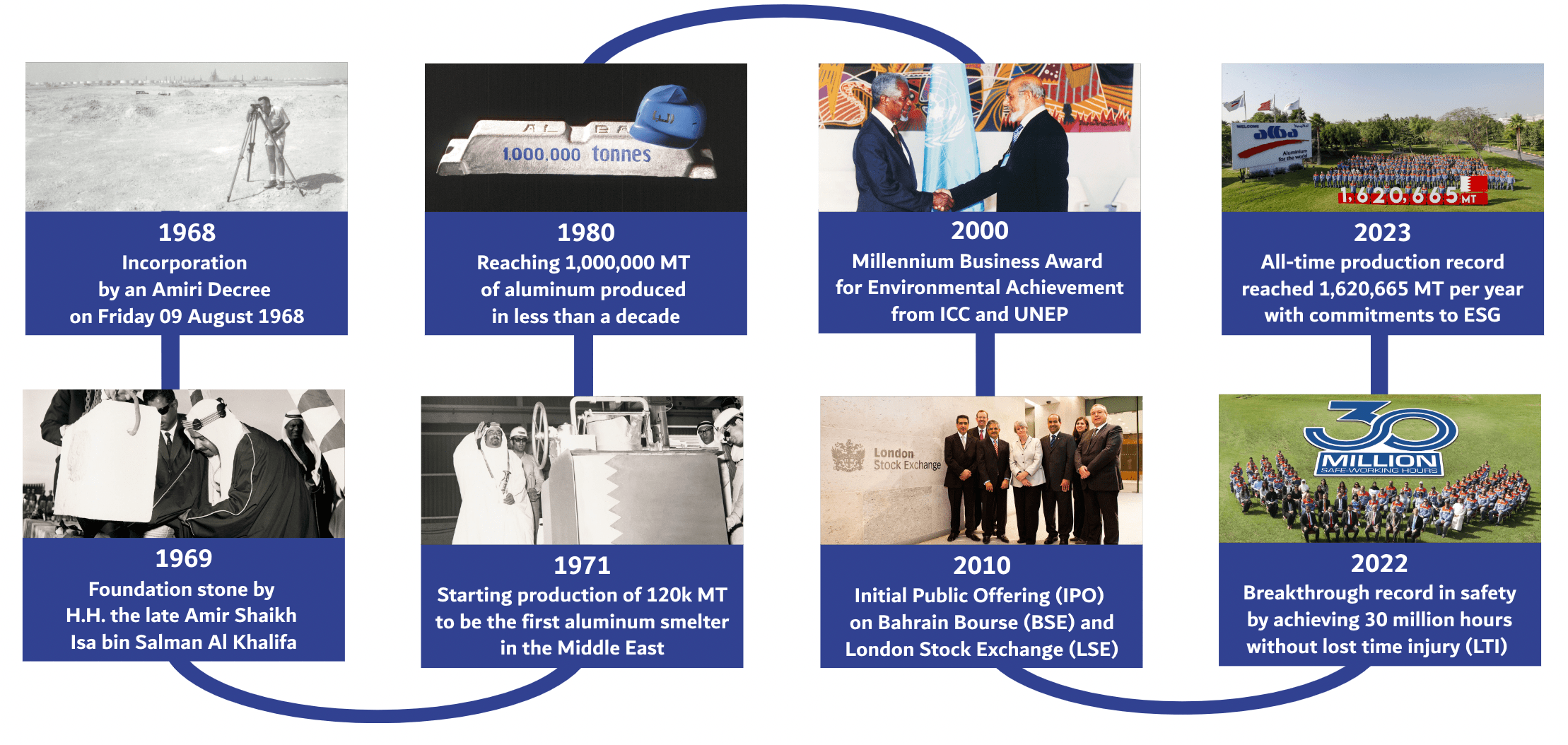

Business Brief: ALBH is one of the top aluminum producers in the world. It’s been manufacturing and distributing aluminum and related products around the globe for over 50 years, becoming the first aluminum smelter in the Middle East and the first non-oil industry established in the Kingdom of Bahrain.

Business Products: Key Aluminum products include:

1-Billets (Extrusion Ingots),

2- Slabs (Rolling Ingots),

3- Foundry (Foundry Alloy Ingots),

4- Liquid Metal, and

5-Primary Ingots.

As well as other products, including:

1- Calcined Coke,

2- Anode,

3- Power,

4- Water.

Business Ownership: Aluminium Bahrain (ALBH) is owned by Bahrain Mumtalakat Holding Company (69.38%), SABIC Industrial Investments Company (SIIC) (20.62%), and free float (10%).

Key facts about the business model:

1- Global aluminum smelter with a global presence contribute to the aluminum industry’s growth, driven by a production of more than 1.62 million metric tones per annum (MTPA) of aluminum as of 2023.

2- The blue-chip asset of the Kingdom of Bahrain, representing approximately 12% of the Kingdom’s GDP and employing 86% of Bahrain nationals in 2023.

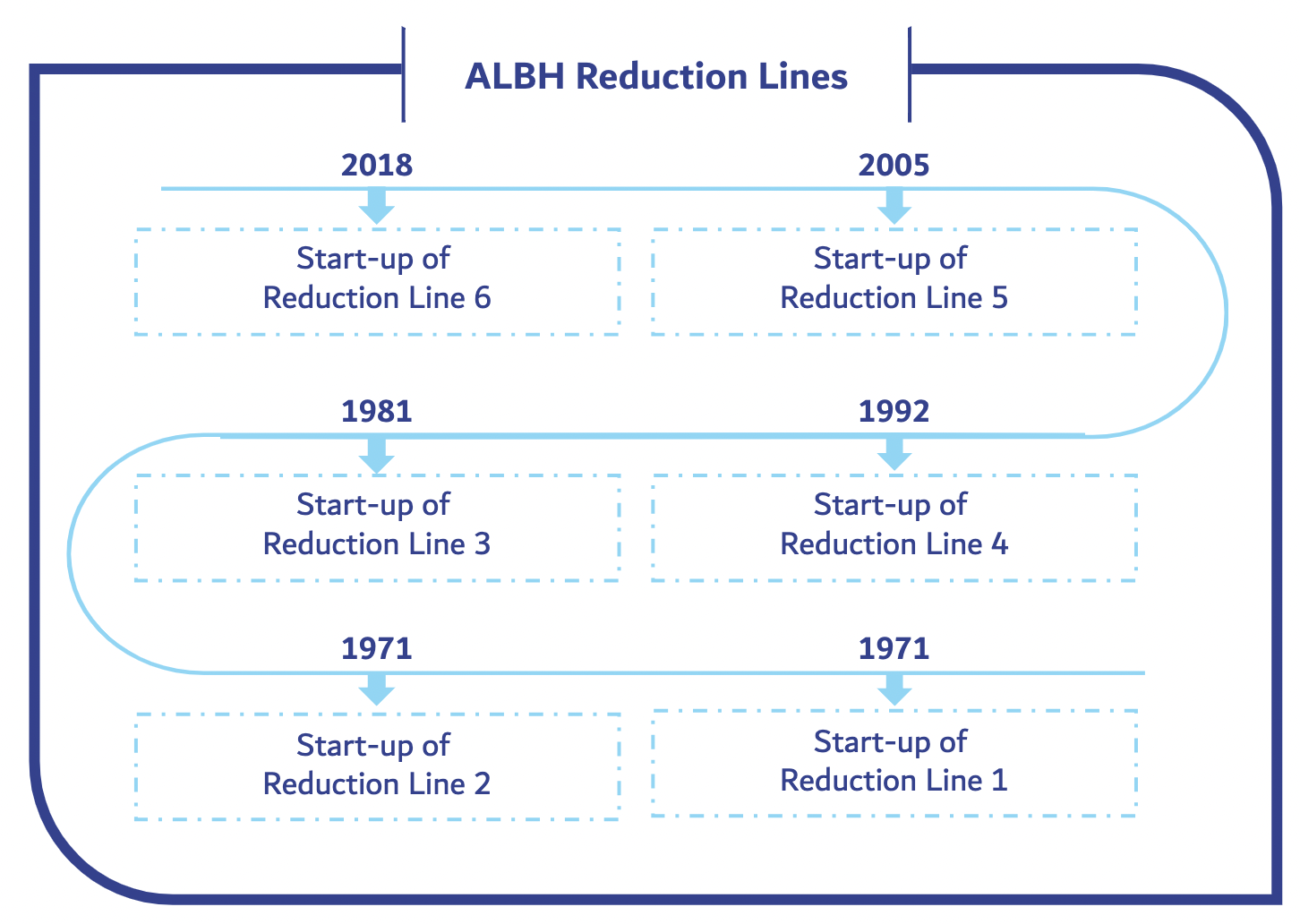

3- ALBH Campus comprises six reduction lines, three power stations, four greenhouses, four carbon plants, and other ancillary facilities.

4- ALBH maintains an impressive safety record, with 30 million safe-working hours without a lost time injury (LTI).

Business History: Aluminium Bahrain (ALBH) has an ambitious history of growth and expansion over five decades, deep down into the early days of Alba and up to today, as follows:

1- 1960s – 1970s: The Early Days of Alba.

2- 1980s: The Era of Growth.

3- 1990s: The Power of Unity.

4- 2010s & Beyond: Made in Bahrain Branching-out to the World.

ALBH Reduction Lines

The Business Model (Cont’d)

+50 Years of Excellence

High Quality Product Portfolio

Aluminium Products

Billets (Extrusion Ingots)

The extruded aluminum comes out as an elongated piece with the same profile as the die opening. Alba produce more than 600,000 MT/year of high-quality extrusion ingots (Billets).

Some Applications:

1- Anodizing and Powder Coating.

2- Architectural Applications.

3- Engineering and Transport Applications.

4- Automotive Applications.

5- Precision Tubing, and Forging Applications.

Slabs (Rolling Ingots)

The slabs are supplied to a specific standard based on dimensional tolerance, surface finish requirements, and metallurgical characteristics. The built-in production capacity stands at 400,000 MT/year.

Some Applications:

1- Ultra-Light Gauge Foils.

2- Cookware Foils.

3- Packaging Applications.

4- Transport and Aviation Industries.

5- Lithographic Industry.

6- Construction.

7-General Engineering Applications.

Foundry (Foundry Alloy Ingots)

Foundry alloys are produced using state-of-the-art casting and metal treatment systems that exceed the most stringent quality requirements. Foundry Alloys give an enhanced cosmetic appearance to cars wheels. Aluminium Bahrain (ALBH) currently produce more than 90,000 MT/year of high-quality foundry alloys in Properzi ingot form.

Some Applications:

1- High Quality Automotive Wheels.

2- Truck Hubs.

3- Gas Pump Nozzles.

Liquid Metal

Producing 1.6 MTPA with high-quality molten aluminum with an average purity exceeding 99.85%. Since it takes around 5 hours for the liquid metal to solidify, Alba is only able to transfer it in crucibles to nearby downstream customers, allowing them to cast their products directly, thus saving time and operational costs.

Some applications produced by local clients:

1- Aluminium Powder.

2- Aluminium Pellets.

3- Curved Line and Solid Conductors.

4- Wheels of Cars and Trucks.

5- Aluminium wires for electrical & mechanical use.

5- Aluminium clad steel (ACS) wires for transmission lines.

Primary Ingots

Higher-grade LME sows conform to London Metal Exchange standards and are used in many re-melting and casting applications, including fabrication into various end-products such as pressure cookers and the facades of skyscrapers. Alba’s built-in production capacity is c. 150,000 MT/year.

Some Applications:

1- Construction Industry.

2- Transportation.

3- Electrical Goods.

4- Household Appliances.

5- Facades of Skyscraper.

Other Products

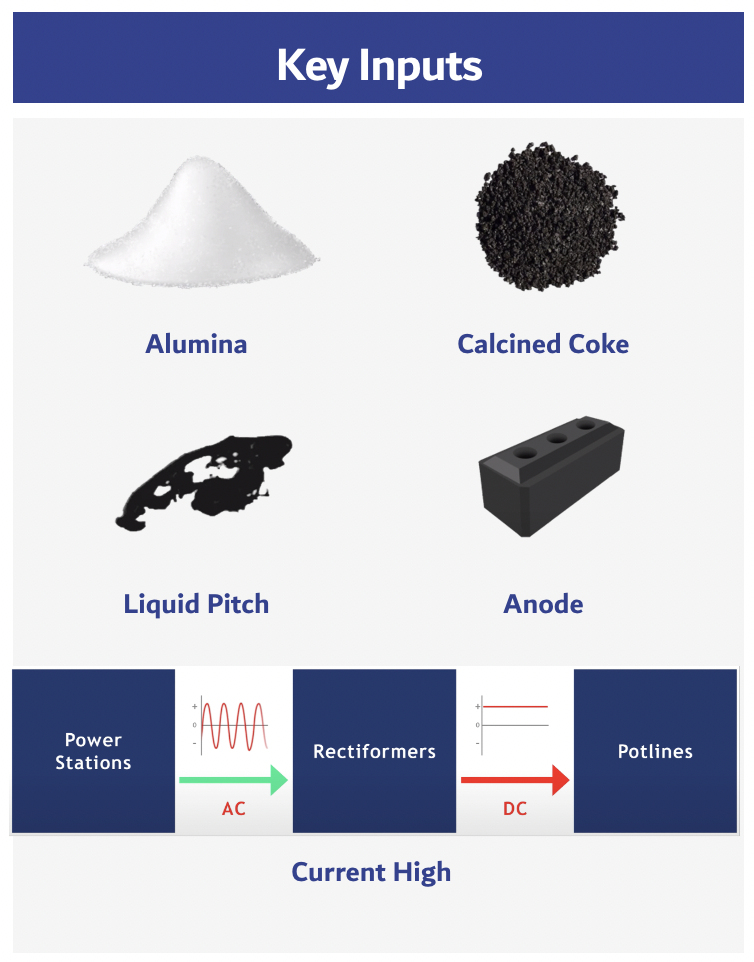

Calcined Coke

Production Capacity: 550,000 MT

Calcined Petroleum Coke (CPC) is the major raw material used to produce carbon anodes for the aluminum smelting process, while the raw coke, Green Petroleum Coke (GPC), is the product of the cooker unit in a crude oil refinery and must possess a sufficiently low metal content in order to be used as anode material.

Anode

Production Capacity: 550,000 MT

Anodes are carbon blocks used to conduct electrical energy during the process of producing primary aluminum. We have four computerized carbon plants that produce about 550,000 MT/year of anodes to ensure a continuous and uninterrupted supply of high-quality replacement anodes.

Power

Production Capacity: 3,665 MW ISO

The aluminum smelting process is power-intensive due to the electrolysis process. Alba is able to ensure self-sufficiency in meeting its extensive energy requirements through our three environmentally friendly power stations with a total combined power generating capacity of 3,665 MW ISO, which is equivalent to the average power consumed in the Kingdom of Bahrain as a whole.

Water

Production Capacity: 13 Million CM

Most of the potable water in the Gulf region is produced through seawater desalination. This process utilizes a vast amount of energy and plays a major role in contributing to the region’s carbon footprint.

Production Process

Competitive Landscape

Catalysts & Risks

ALBH’s SWOT Analysis

Strengths

1- Product Portfolio: manufacturing and distributing a wide range of aluminum products, including molten aluminum, standard ingots, rolling slabs, foundry alloy ingots, extrusion billets, T-ingots, and liquid metal.

2- Technical Support Services: providing technical support services, including extrusion workshops

for purchasing logs, billets, and alloy development.

3- Global Reach: exporting to various regions, including MENA, Europe, Asia and Americas

Weaknesses

1- Operating Expenses: Increasing operating expenses remain a cause for concern.

2- Financial Leverage: Despite improving financial leverage, it still needs to manage this aspect effectively.

Threats

1- Growth Initiatives: exploring growth opportunities through strategic initiatives.

2-Expansion Projects: The line 6 expansion project and PS5 block 4 expansion offer avenues for growth.

Threats

1- Market Competition: facing competition from other aluminum manufacturers.

2- Economic Factors: global economic crises, pricing fluctuations and aluminum market dynamics can impact ALBH’s performance.

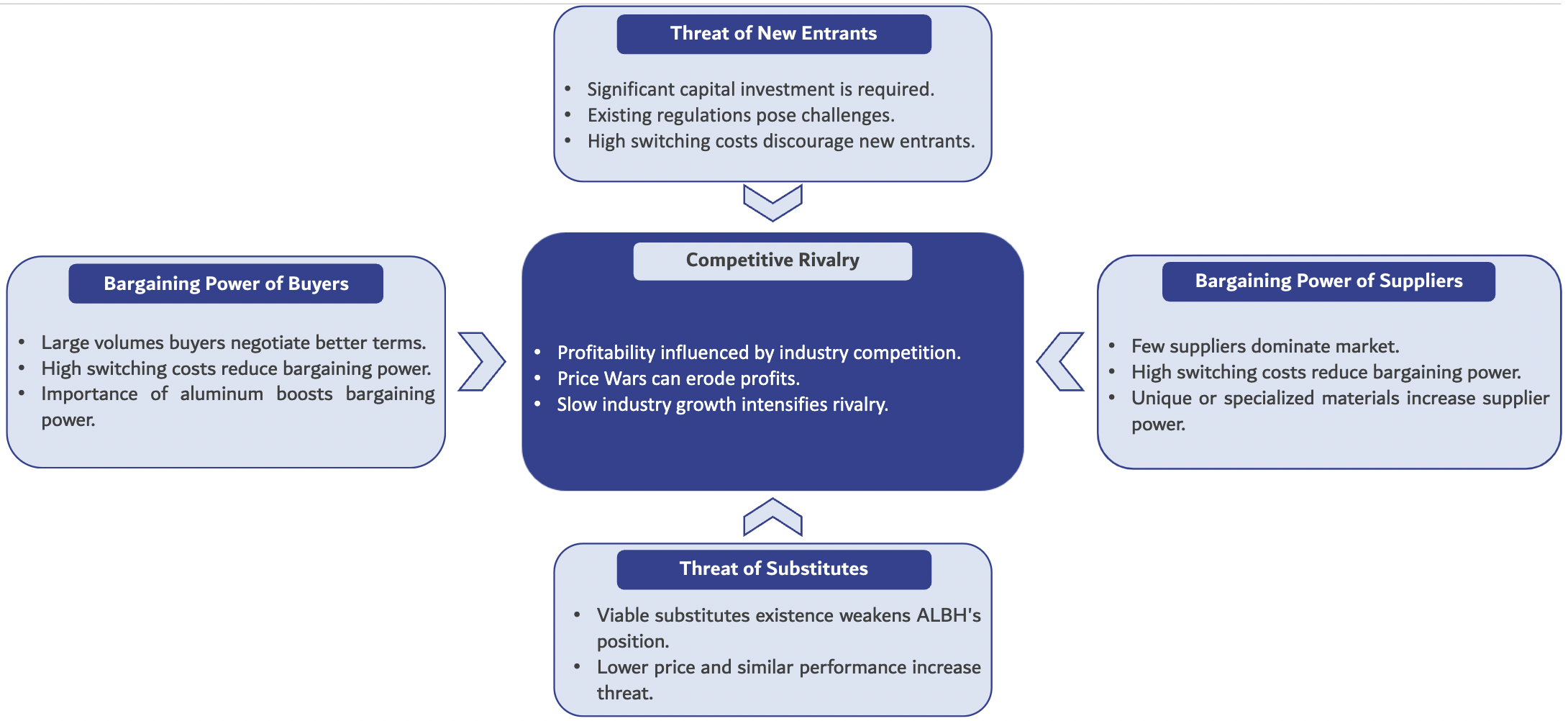

Industry: Porter’s Five Forces Analysis

Country: PEST Analysis

Political

1- Government Policies: operating in Bahrain leads to benefiting from government policies related to trade, taxation, and regulations.

2- Stability and Political Climate: Political stability benefits business continuity and investment decisions.

Economic

1- Economic Growth: ALBH’s growth prospects are tied to Bahrain’s economic performance.

2- Exchange Rates: global currency exchange rates affect export revenues and costs.

3- Interest Rates: Interest rate changes impact borrowing costs and investment decisions.

Social

1- Labor Force: Availability of skilled labor and workforce demographics affect ALBH’s operations.

2- Social Trends: Consumer preferences and social changes impact aluminum demand.

Technological

1- Innovation: ALBH’s ability to adopt new technologies affects efficiency and competitiveness.

2- Automation: Technological advancements in production processes impact cost and productivity.

Financial Analysis

Financial Results Commentary

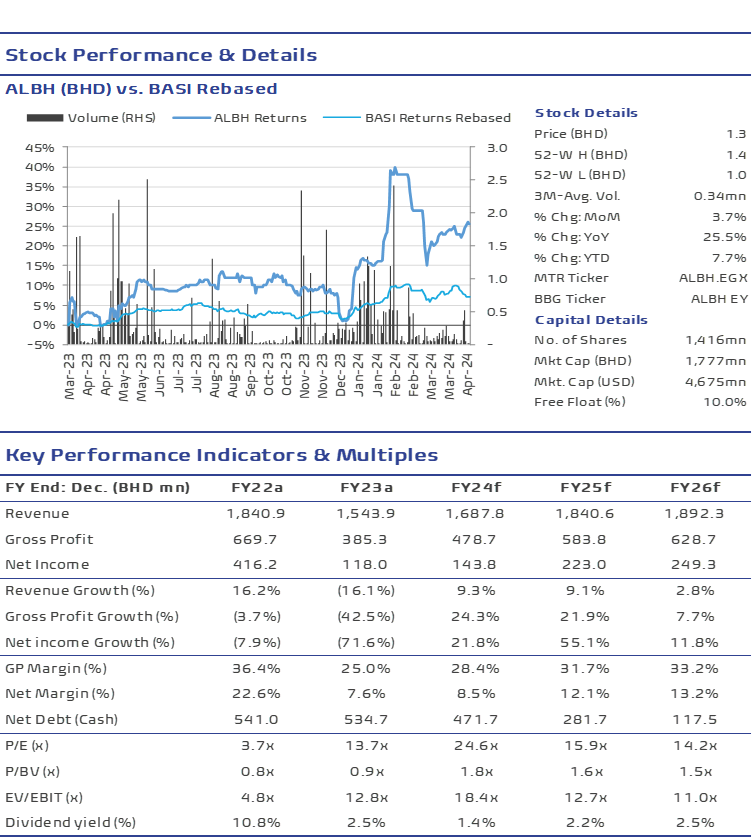

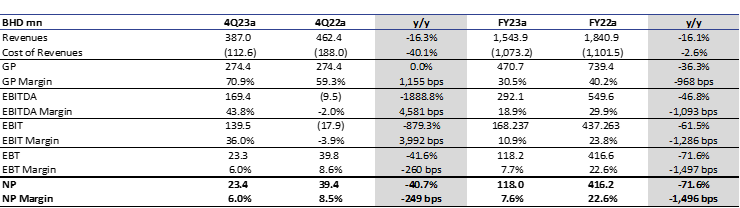

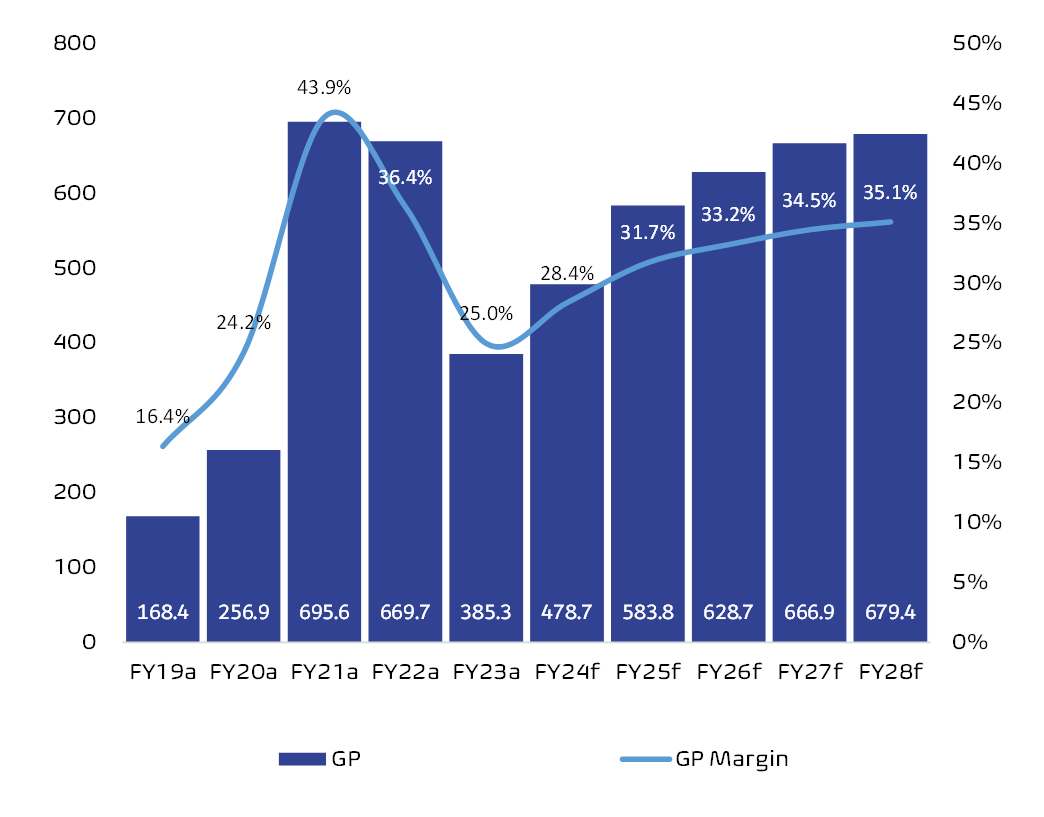

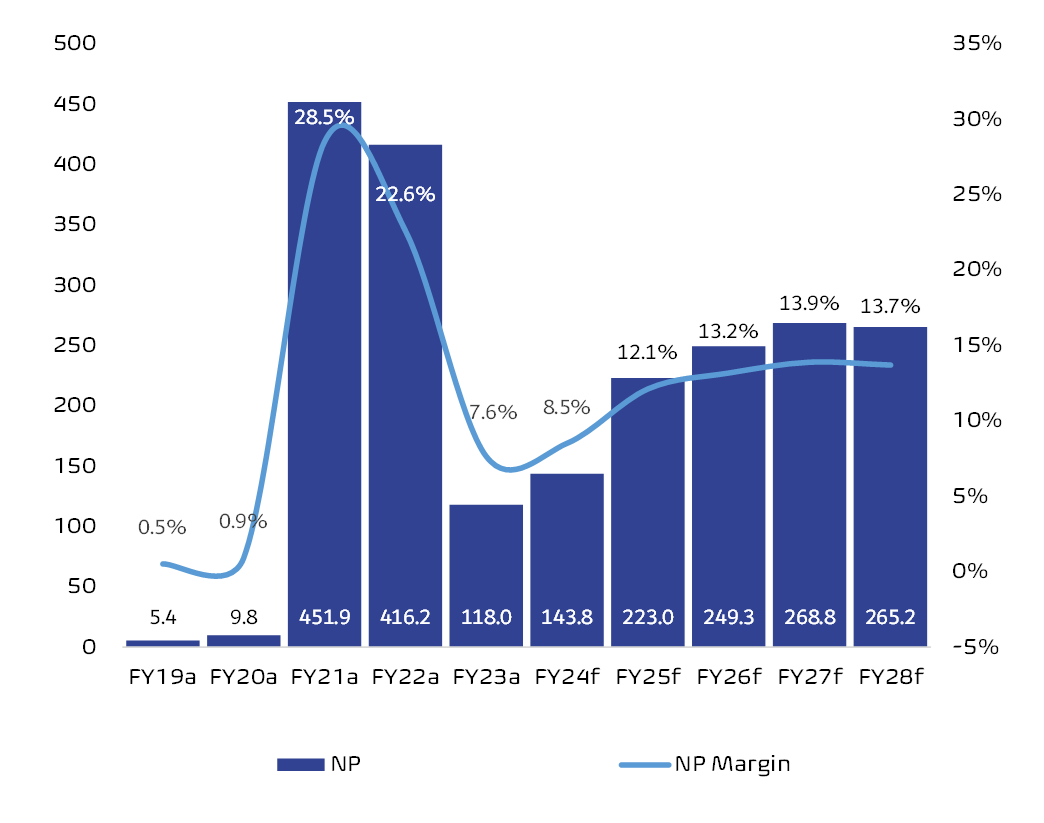

Profitability: ALBH recorded a 71.6% y/y increase in net profit, reaching BHD 118.0mn in FY23a, reflecting a net profit margin after minority of 7.6%. Revenue decreased by 16.1% y/y to BHD 1.5bn in FY23a.

The decrease in ALBH’s revenue in FY23a was mainly attributed to:

(1) volatile LME prices, recording a 16.8% y/year decrease, and (2) fluctuating premiums, recording a 35.3% y/year in premiums.

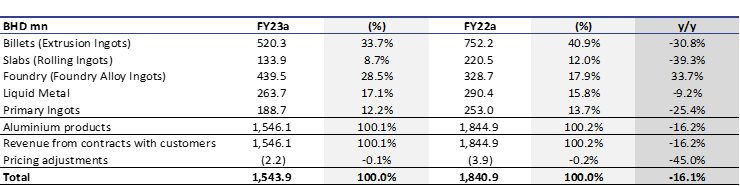

Revenues breakdown (by products):

1- Billets revenues decreased by 30.8% y/y, recording BHD 520.3mn in FY23a, contributing 33.7% of total revenues in FY23a.

2- Slabs revenues decreased by 39.3% y/y, recording BHD 133.9mn in FY23a, contributing 8.7% of total revenues in FY23a.

3- Foundry revenues increased by 33.7% y/y, recording BHD 439.5mn in FY23a, contributing 28.5% of total revenues in FY23a.

4- Liquid Metal revenues decreased by 9.2% y/y, recording BHD 263.7mn in FY23a, contributing 17.1% of total revenues in FY23a.

5- Primary Ingots revenues decreased by 25.4% y/y, recording BHD 188.7mn in FY23a, contributing 12.2% of total revenues in FY23a.

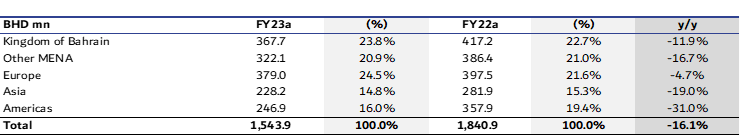

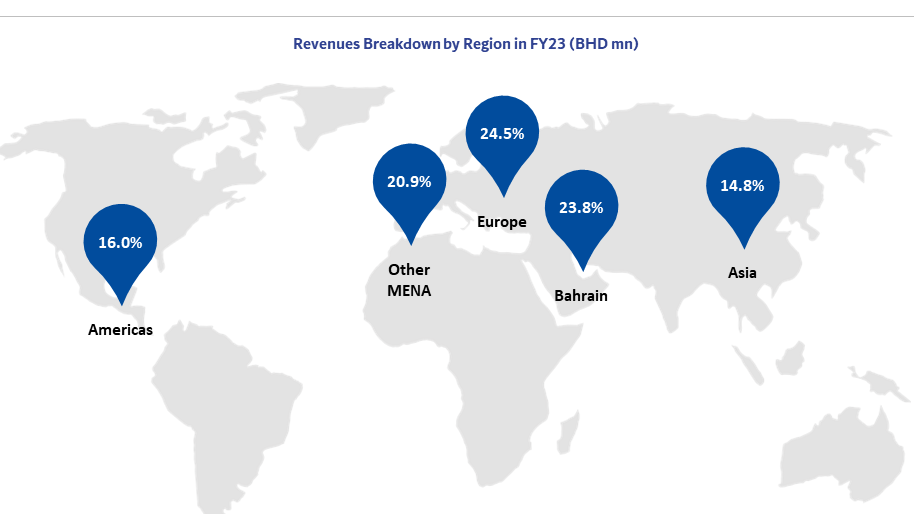

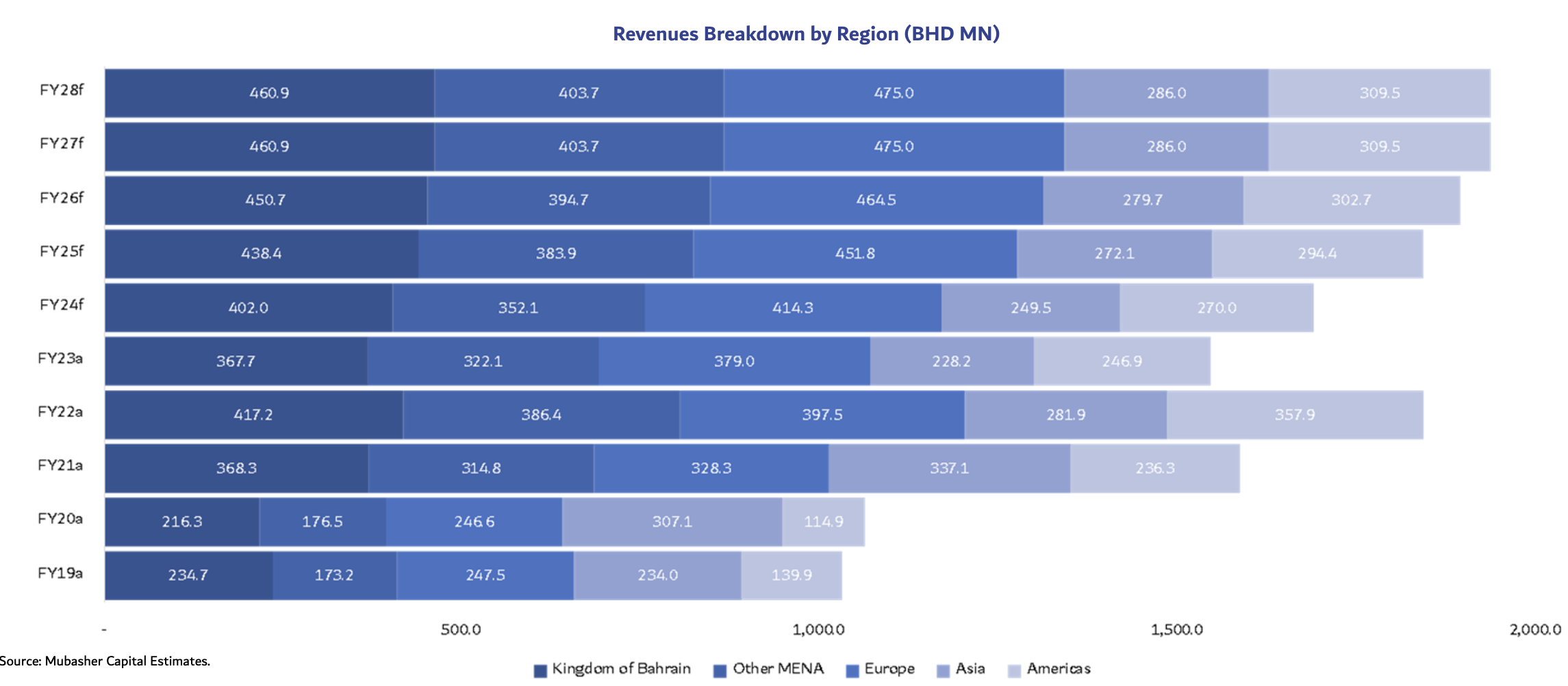

Revenues breakdown (by region):

1- Kingdom of Bahrain revenues decreased by 11.9% y/y, recording BHD 367.7mn in FY23a, contributing 23.8% of total revenues in FY23a.

2- Other MENA revenues decreased by 16.7% y/y, recording BHD 322.1mn in FY23a, contributing 20.9% of total revenues in FY23a.

3- Europe revenues decreased by 4.7% y/y, recording BHD 379.0mn in FY23a, contributing 24.5% of total revenues in FY23a.

4- Asia revenues decreased by 19.0% y/y, recording BHD 228.2mn in FY23a, contributing 14.8% of total revenues in FY23a.

5- Americas revenues decreased by 31.0% y/y, recording BHD 246.9mn in FY23a, contributing 16.0% of total revenues in FY23a.

Liquidity position:

Aluminium Bahrain (ALBH) recorded a 36.3% y/y increase in cash & cash equivalent balance, reporting BHD 59.6mn by the end of FY23a compared to BHD 93.6mn by the end of FY22a.

Financial leverage:

Aluminium Bahrain (ALBH) reported a net debt/equity ratio of 33.2% in FY23a versus 34.8% by the end of FY22a, driven by net debt balance of BHD 534.7mn by the end of FY23a.

Financial Analysis

Financial Results Commentary

Key Financials: Income Statement

Revenues Breakdown (by Products)

Revenues Breakdown (by Region)

Key Financials: Balance Sheet Statement

Source: Financial Statements

Geographic Revenue Distribution

Valuation

Key Basis and Assumptions

Revenue

Cost Of Revenue

Forecasted Financial Statements

Income Statement

Balance Sheet Statement

Gross Profit vs. Net Profit

Gross Profit (BHD mn)

Net Profit (BHD mn)

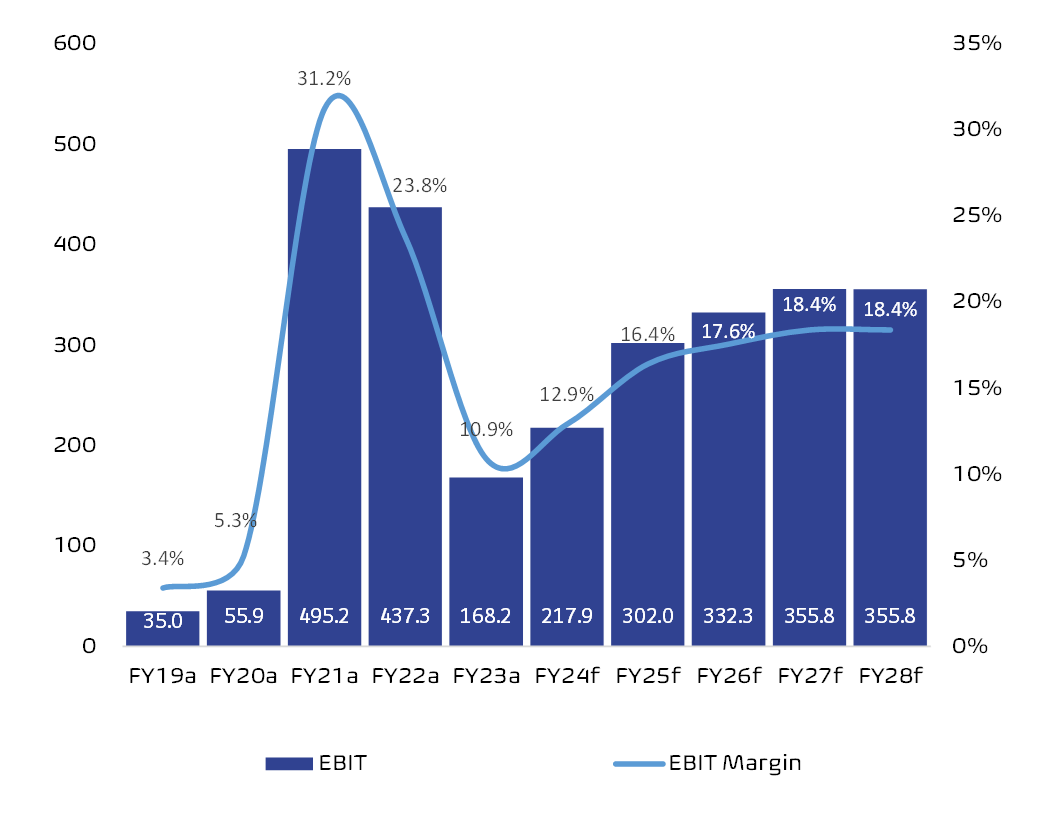

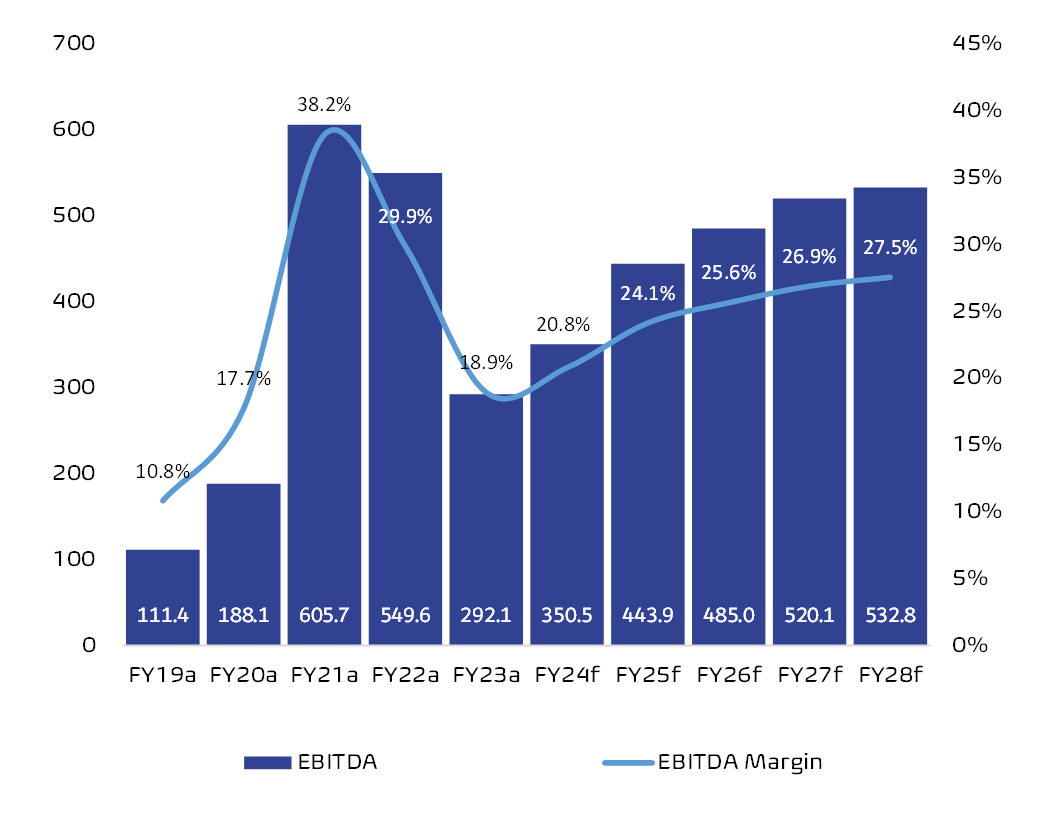

EBIT vs. EBITDA

EBIT (BHD mn)

EBITDA (BHD mn)

Revenue Breakdown Streams

A Possible 99.2% Upside Potential

Discounted Cash Flow (DCF) Valuation

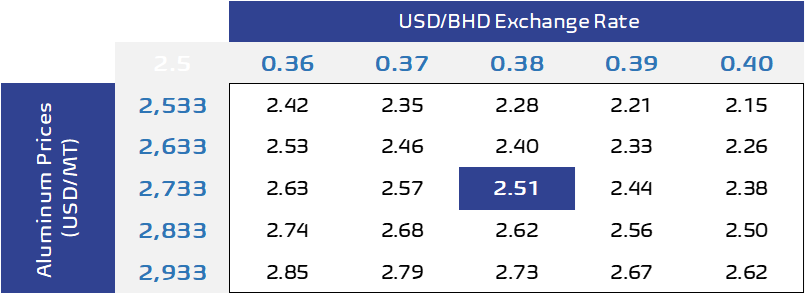

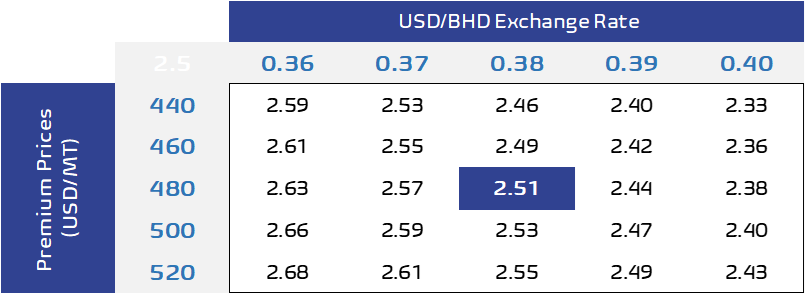

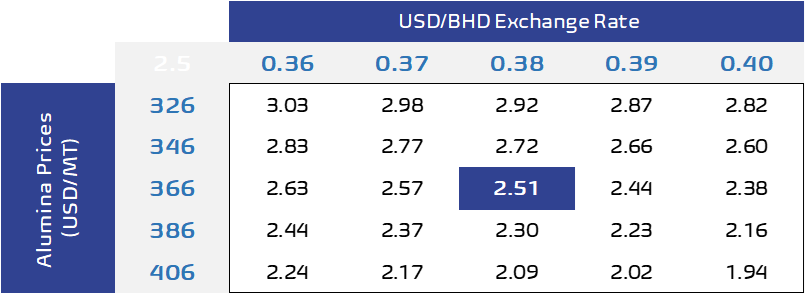

Sensitivity Analysis