Derivatives are financial contracts that derive their value from an underlying asset or security. They have become increasingly popular in today’s financial markets due to their potential for high returns.

However, with that potential comes a level of risk and complexity that can be daunting for even experienced traders. That’s where understanding the secrets of the most popular derivatives traded today comes in.

Whether you’re a seasoned investor or just starting out, gaining a solid understanding of these instruments can be the key to unlocking profitable investment opportunities.

In this article, we’ll explore the most popular derivatives traded today, including futures, options, and swaps, and take a deep dive into their inner workings. So, buckle up and get ready to unlock the secrets of the derivatives market.

Understanding the Different Types of Derivatives – Futures, Options, Swaps

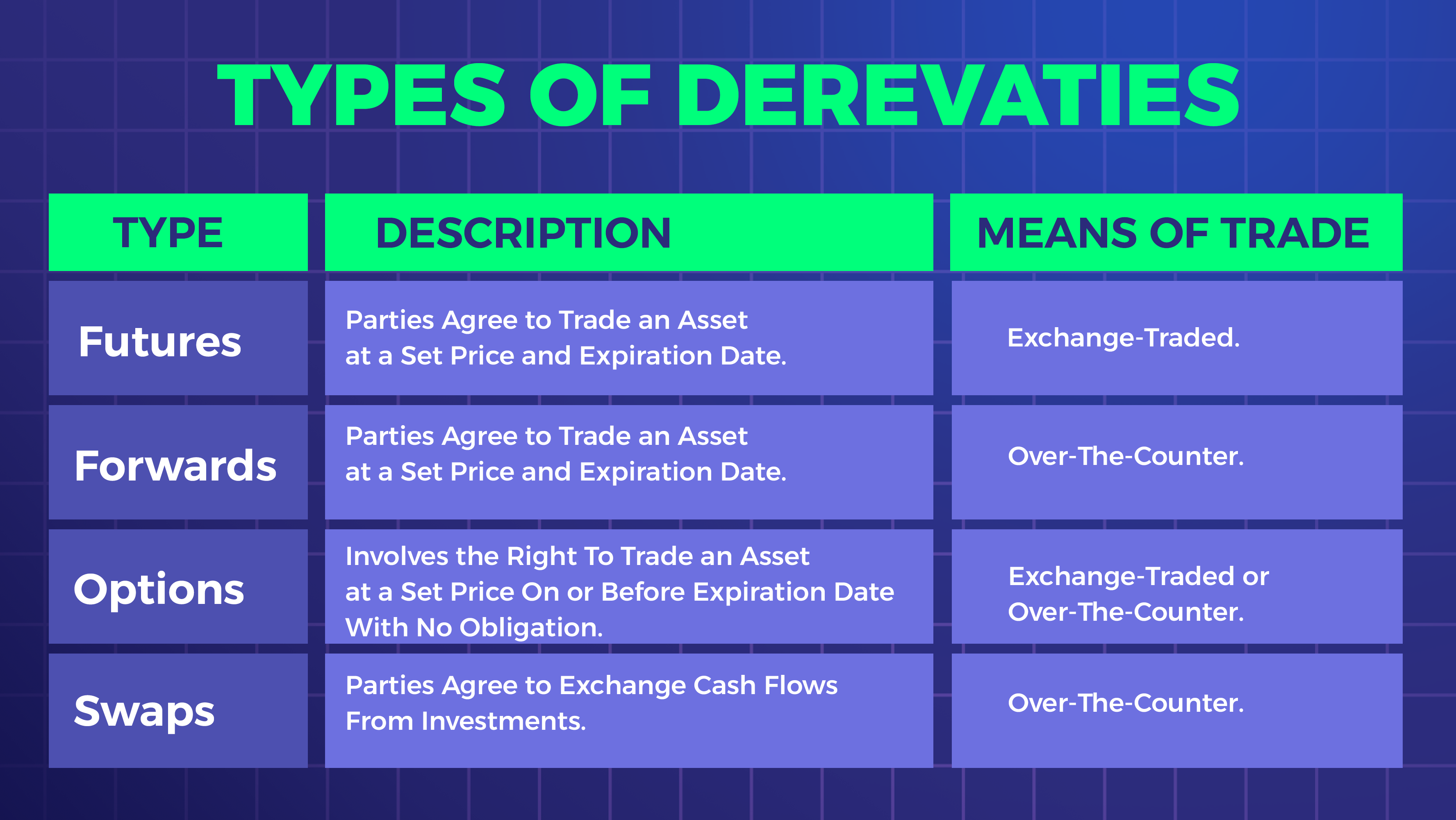

Futures, options, and swaps are the most common types of derivatives traded in financial markets today. Each of these instruments has unique characteristics that make them attractive to traders.

Futures contracts are agreements to buy or sell an underlying asset at a predetermined price and date in the future. Futures are traded on exchanges and are standardized in terms of the underlying asset, quantity, and delivery date. Futures can be used to hedge against price fluctuations or to speculate on the future price of an asset.

Options contracts give the buyer the right but not the obligation to buy or sell an underlying asset at a predetermined price and date in the future. Options can be used to hedge against price fluctuations or to speculate on the future price of an asset. Options traded on exchanges are standardized, while over-the-counter options can be customized to meet specific needs.

Swaps are agreements between two parties to exchange cash flows based on a predetermined set of conditions. Swaps are used to manage risks associated with interest rates, currencies, and other financial variables. Swaps can be customized to meet specific needs and are traded over-the-counter.

Understanding the differences between futures, options, and swaps is essential for effective derivatives trading. Each of these instruments has unique characteristics that make them suitable for different trading strategies.

Benefits of Derivatives Trading

Derivatives trading offers several advantages over traditional investment instruments. These include:

Leverage: Derivatives trading allows traders to control a large amount of underlying assets with a relatively small investment. This leverage can amplify profits but also increases risk.

Hedging: Derivatives can be used to hedge against price fluctuations, providing a level of protection against market volatility.

Diversification: Derivatives trading allows traders to diversify their portfolios, spreading risk across different asset classes and markets.

Liquidity: Derivatives are traded on exchanges, making them highly liquid and easy to buy and sell.

Derivatives trading offers several benefits, but it’s essential to understand the risks associated with these instruments.

Common Derivatives Trading Strategies

Derivatives trading strategies can be broadly categorized into two types: hedging and speculation.

Hedging is a strategy used to manage risk associated with price fluctuations. Futures and options can be used to hedge against adverse price movements, providing a level of protection against market volatility.

Speculation is a strategy used to profit from price movements. Futures and options can be used to speculate on the price of an underlying asset, allowing traders to profit from both upward and downward price movements.

There are several other derivatives trading strategies, including spread trading, pairs trading, and delta-neutral trading. Each of these strategies has its own unique characteristics and can be used to achieve different trading objectives.

Risks Associated with Derivatives Trading

Derivatives trading comes with a level of risk, and traders should be aware of the potential downsides before investing. Some of the risks associated with derivatives trading include:

Leverage: Derivatives trading allows traders to control a large amount of underlying assets with a relatively small investment. While this can amplify profits, it also increases risk.

Market risk: Derivatives are sensitive to price movements in the underlying asset, and market volatility can result in significant losses.

Counterparty risk: Derivatives are traded over-the-counter, which means that traders are exposed to counterparty risk. If the counterparty defaults on the agreement, the trader may incur losses.

Liquidity risk: Derivatives can be highly liquid, but in times of market stress, liquidity can dry up, making it difficult to buy or sell contracts.

Traders should carefully consider the risks associated with derivatives trading and develop a comprehensive risk management strategy to minimize potential losses.

Key Market Players in Derivatives Trading

The derivatives market is composed of a diverse group of market players, including institutional investors, hedge funds, proprietary trading firms, and individual traders.

Institutional investors are among the largest players in the derivatives market, using these instruments to hedge against risks associated with their investment portfolios.

Hedge funds and proprietary trading firms use derivatives to generate profits from price movements in the market.

Individual traders can also participate in derivatives trading, using online platforms and brokers to trade futures, options, and swaps.

The derivatives market is highly competitive, and traders should be aware of the risks associated with trading against institutional investors and other large players.

Derivatives Trading Platforms and Tools

Derivatives trading requires specialized platforms and tools to execute trades effectively. Online trading platforms offer access to a range of derivatives contracts, allowing traders to buy and sell contracts from their desktop or mobile devices.

In addition to trading platforms, derivatives traders use a range of analytical tools to identify trading opportunities and manage risk. These tools include technical analysis, fundamental analysis, and quantitative analysis, among others.

Most Popular Derivatives Traded Today – Stock Index Futures, Currency Options, Interest Rate Swaps

The derivatives market is composed of a range of contracts, but some derivatives are more popular than others. Some of the most popular derivatives traded today include:

Stock index futures: Futures contracts based on the performance of a stock index, such as the S&P 500 or the Nasdaq 100.

Currency options: Options contracts based on the exchange rate between two currencies, such as the US dollar and the euro.

Interest rate swaps: Swaps contracts based on the interest rate differential between two currencies, such as the US dollar and the Japanese yen.

Understanding the characteristics of these popular derivatives is essential for effective trading.

Unlocking the Secrets of Successful Derivatives Trading – Tips and Tricks

Derivatives trading can be lucrative, but success requires a comprehensive understanding of the market and effective risk management strategies. Some tips and tricks for successful derivatives trading include:

Develop a trading plan: A trading plan should include trading strategies, risk management guidelines, and a clear set of rules for entering and exiting trades.

Stay up-to-date: The derivatives market is constantly evolving, and traders should stay up-to-date on market trends, news, and developments.

Manage risk effectively: Derivatives trading comes with a level of risk, and traders should develop a comprehensive risk management strategy to minimize potential losses.

Use analytical tools: Analytical tools can help traders identify trading opportunities and manage risk effectively.

Conclusion and Final Thoughts

Derivatives trading offers significant opportunities for profitable investments, but it also comes with a level of risk and complexity.

Understanding the different types of derivatives, trading strategies, and risks associated with these instruments is essential for successful trading.By staying up-to-date on market trends, developing a comprehensive risk management strategy, and using effective analytical tools, traders can unlock the secrets of successful derivatives trading.