From Bull to Bear: Understanding the Ups and Downs of Stock Trading

Stock trading can be a rollercoaster ride that takes you from the heights of bull markets to the lows of bear markets. While it may seem like a game of chance, understanding the underlying factors that drive market movements can help you make informed decisions and stay ahead of the curve.

From the latest economic indicators to global political events, there are countless factors that can impact stock prices. As an investor, it’s important to stay informed and keep your finger on the pulse of the market. In this article, we’ll explore the ups and downs of stock trading, demystify some of the jargon, and provide insights into how you can navigate this exciting and ever-changing landscape. Whether you’re a seasoned investor or just starting out, understanding the market’s movements can help you make informed decisions and achieve your financial goals.

So, buckle up and get ready to ride the waves of the stock market!

Bull and bear markets – what do they mean?

A bull market refers to a market where prices are rising, and investors are optimistic about the future. In a bull market, there is high demand for stocks, and investors feel confident about buying them. This leads to an increase in stock prices.

A bear market, on the other hand, refers to a market where prices are falling, and investors are pessimistic about the future. In a bear market, there is low demand for stocks, and investors are cautious about buying them. This leads to a decrease in stock prices.

Bull and bear markets are not permanent states. They are cyclical, and they can switch from one to the other. The economy, political events, and investor sentiments can all impact market movements. Understanding these factors is crucial to making informed decisions in the stock market.

Causes and indicators of a bull market

A bull market is typically characterized by rising stock prices, low unemployment rates, and a growing economy. When the economy is doing well, investors feel confident about buying stocks, and this leads to higher demand and prices.

Some of the key indicators of a bull market include high volumes of trading activity, improving corporate earnings, and low interest rates.

In a bull market, investors tend to focus on growth stocks, which are companies that are expected to grow rapidly in the future. These stocks typically have high price-to-earnings ratios and may not be profitable yet.

Examples of growth stocks include Amazon, Facebook, and Tesla. Investing in growth stocks can be risky, but it can also lead to significant gains if the company performs well.

Strategies for trading in a bull market

Trading in a bull market can be exciting, but it’s important to have a strategy in place to manage risk. One approach is to invest in index funds, which are funds that track the performance of a particular index, such as the S&P 500. This approach allows you to diversify your portfolio and minimize risk.

Another strategy is to invest in dividend-paying stocks. These are stocks that pay a portion of their profits to shareholders in the form of dividends. Dividend-paying stocks tend to be less volatile than growth stocks and can provide a steady stream of income. Examples of dividend-paying stocks include Coca-Cola, Procter & Gamble, and Johnson & Johnson.

Causes and indicators of a bear market

A bear market is typically characterized by falling stock prices, high unemployment rates, and a weak economy. When the economy is struggling, investors become cautious about buying stocks, and this leads to lower demand and prices. Some of the key indicators of a bear market include low volumes of trading activity, declining corporate earnings, and high interest rates.

In a bear market, investors tend to focus on defensive stocks, which are companies that are less sensitive to economic cycles. These stocks typically have low price-to-earnings ratios and are considered to be more stable. Examples of defensive stocks include utilities, consumer staples, and healthcare companies.

Strategies for trading in a bear market

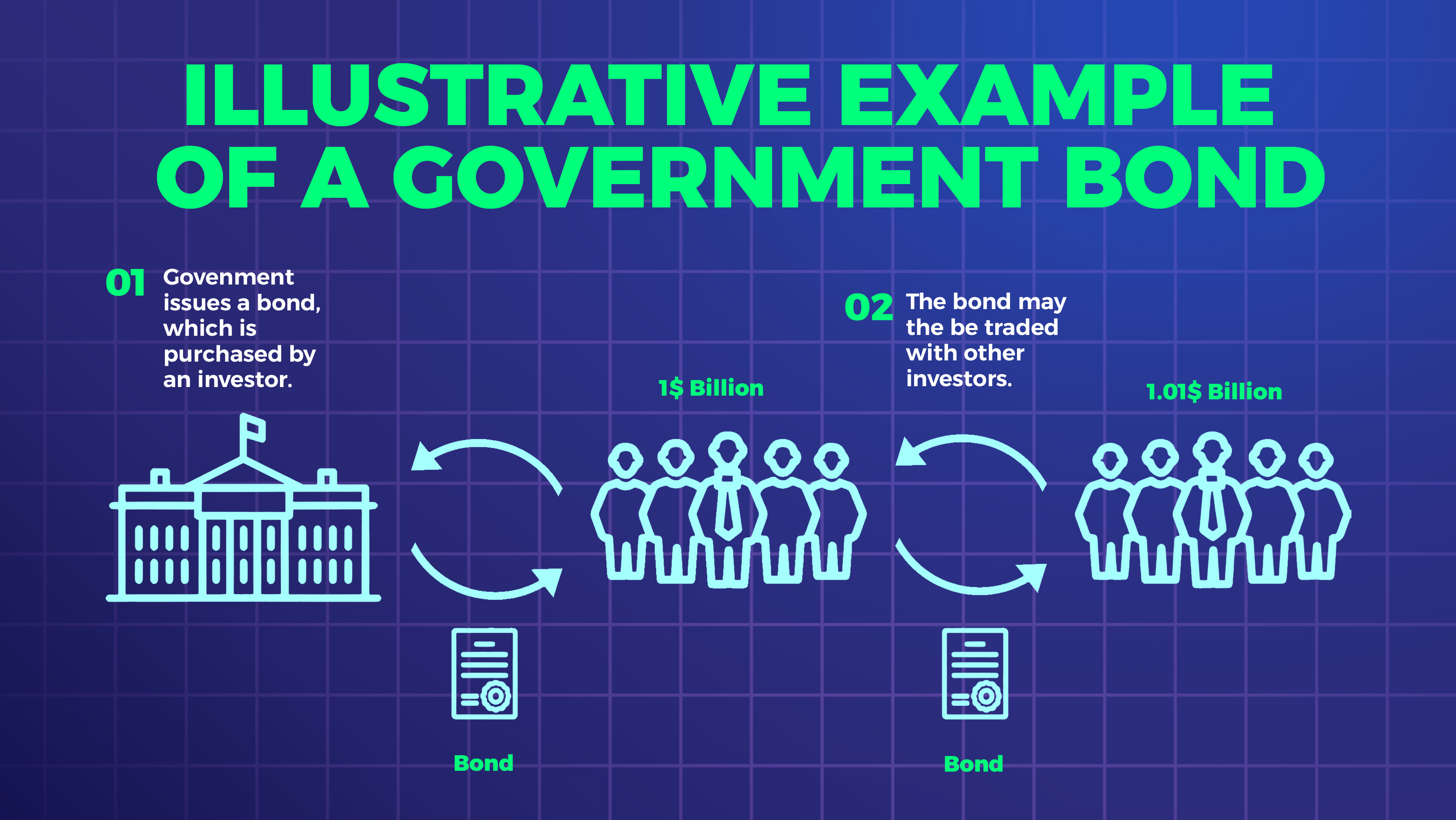

Trading in a bear market can be challenging, but there are strategies you can use to manage risk and take advantage of opportunities. One approach is to invest in bonds, which are debt securities issued by companies or governments. Bonds provide a fixed income stream and can help protect your portfolio from the volatility of the stock market.

Another strategy is to invest in value stocks, which are companies that are trading at a discount to their intrinsic value. Value stocks tend to be less affected by market downturns and can provide a good long-term investment opportunity. Examples of value stocks include Berkshire Hathaway, JP Morgan, and Intel.

Understanding market cycles

Market cycles are an inevitable part of the stock market. They can be difficult to predict, but understanding them can help you make informed decisions and stay ahead of the curve. Market cycles typically follow a pattern of expansion, peak, contraction, and trough. During the expansion phase, stock prices are rising, and investors are optimistic.

During the peak phase, stock prices have reached their highest point, and investors become cautious. During the contraction phase, stock prices are falling, and investors are pessimistic. During the trough phase, stock prices have hit their lowest point, and investors start to become optimistic again.

Understanding market cycles can help you make informed decisions about when to buy and sell stocks. It’s important to remember that market cycles are not always predictable, and there is always a risk involved in investing in the stock market.

Common mistakes to avoid in stock trading

There are several common mistakes that investors make when trading in the stock market. One of the most common mistakes is trying to time the market. Trying to predict when the market will go up or down is extremely difficult, and it can lead to missed opportunities and losses.

Another mistake is not diversifying your portfolio. Investing in a single stock or sector can be risky, as a downturn in that particular stock or sector can have a significant impact on your portfolio. Diversifying your portfolio across different stocks, sectors, and asset classes can help minimize risk.

Managing risk in stock trading

Risk management is a crucial part of stock trading. It’s important to have a strategy in place to manage risk and minimize losses. One approach is to set stop-loss orders, which are orders to sell a stock when it reaches a certain price. This can help limit losses in the event of a sudden downturn in the market.

Another approach is to use options, which are contracts that give you the right to buy or sell a stock at a certain price. Options can be used to hedge against losses and provide protection for your portfolio.

Conclusion: Long-term success in stock trading

Stock trading can be a challenging and rewarding pursuit. Understanding the ups and downs of the stock market is crucial to making informed decisions and achieving long-term success. Whether you’re trading in a bull market or a bear market, it’s important to have a strategy in place to manage risk and take advantage of opportunities. Remember to diversify your portfolio, avoid common mistakes, and stay informed about market cycles and trends. With patience, discipline, and a long-term perspective, you can achieve your financial goals in the exciting world of stock trading.

In conclusion, the world of stock trading can be complex and challenging, but it can also be an exciting and rewarding pursuit. Understanding the underlying factors that drive market movements is crucial to making informed decisions and achieving long-term success. Whether you’re trading in a bull market or a bear market, it’s important to have a strategy in place to manage risk and take advantage of opportunities. Remember to diversify your portfolio, avoid common mistakes, and stay informed about market cycles and trends. With patience, discipline, and a long-term perspective, you can achieve your financial goals in the exciting world of stock trading.