Diversifying Safe-Havens

Gold Is Not The Only Safe-Havens King

In times of market volatility, investors need safe-haven investments to provide stability. Gold is still a common option because it is a traditional store of value. Gold ETFs, mining stocks, and actual gold are options available to investors. Furthermore, Treasury Bills (T-Bills) provide reliable, low-risk returns, particularly during periods of high inflation.

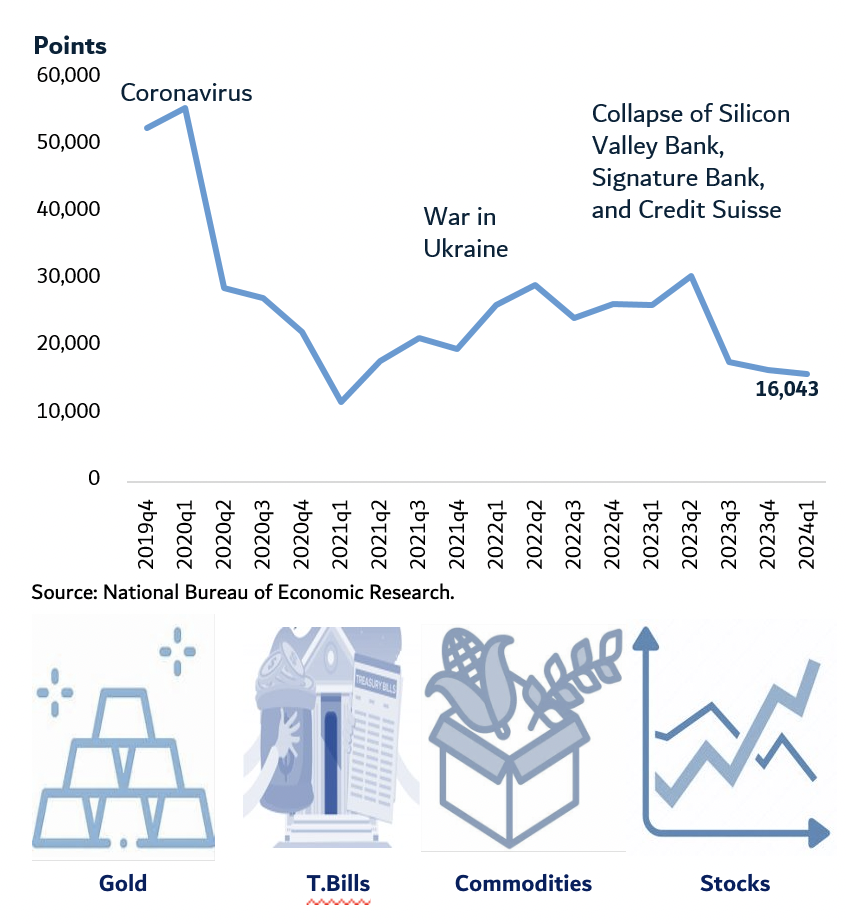

There are other commodities that can serve as safe havens. Because consumers always need necessities, defensive stocks are less vulnerable to fluctuations in the economy and continue to be appealing. Even if the World Uncertainty Index has been below 17,000 points for the previous three quarters(see below chart ), geopolitical concerns originating from the Middle East and other parts of the world are contributing to the rise in global uncertainty.

We also still have to deal with the effects of the Russia-Ukraine war on the global economy.

Safe-Haven Assets Are Not Limited To Gold

A safe-haven asset is an underlying investment that is anticipated to maintain or grow in value (Positive returns) in periods of market volatility brought on by dangers of any kind, whether they be geopolitical, economic, or otherwise. When markets decline, investors look for safe havens to reduce their exposure to losses. Treasury Bills and gold are the two most popular safe-haven assets that yield lucrative returns during crises (particularly those of resilient economies).

Although safe havens can vary depending on the particulars of a market slump, some riskier assets, such as defensive stocks and commodities, gain positive returns. Major safe havens that encourage portfolio diversification during difficult times are as follows:

1- Gold.

2- Treasury Bills.

3- Other Commodities.

4- Defensive Stocks.

World Uncertainty Index (Q4 2019 to Q1 2024)

Gold Is Shining

Major Forecasts Geopolitical Risks Induce Gold Higher

The Precious Metal Is The Store Of Value:

Gold, often known as the precious metal, has long been valued as a store of wealth. Gold cannot be created at will, unlike fiat money, and changes in interest rates made by the government have no direct effect on the value of gold. As a type of insurance during bad economic times or protracted market turbulence, investors frequently turn to gold.

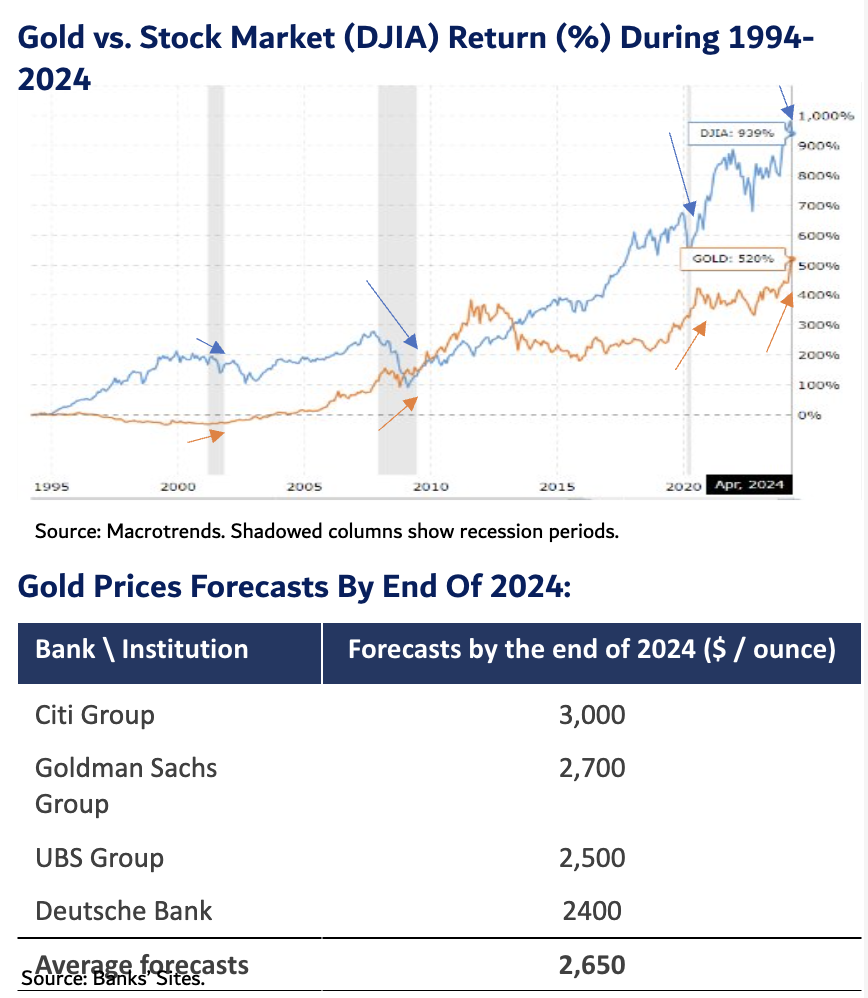

According to the chart, bullion prices returned positively during US economic downturns, in contrast to the stock market’s (represented by the Dow Jones Industrial Average DJIA) negative returns.

1- Gold is often considered a safe-haven asset, especially during times of economic uncertainty.

2-Historically, gold has maintained its value over time and tends to perform well when inflation is on the rise.

3- Investors can consider physical gold, gold ETFs, or gold mining stocks as part of their portfolio to hedge against inflation.

4- Prices (represented by DJIA) touched an all-time high in April 2024, due to recent Middle East tensions (Iran -Israel).

Gold Prices Forecasts Seen Going Higher:

In April 2024, Deutsche Bank increased their prediction for the price of gold to $2,400 per ounce by year’s end and $2,600 by 2025 end. Bullion is set to reach $3,000 an ounce over the next six to 18 months on increasing investor inflows, driven by wars in the Middle East and Ukraine, buying by central banks and consumer demand in China, according to Citi Group. Goldman Sachs Group says the precious metal is in an “unshakable bull market,” and has raised its year-end forecast to $2,700. UBS Group AG sees $2,500 by the year-end.

Another Safe-Havens Two Pillars

T-Bills: A Safe-Haven in Volatile Markets. Commodities: A Hedge Against Inflation

Treasury Bills (T-Bills), Low-Risk offer a Stable Returns amid volatile markets:

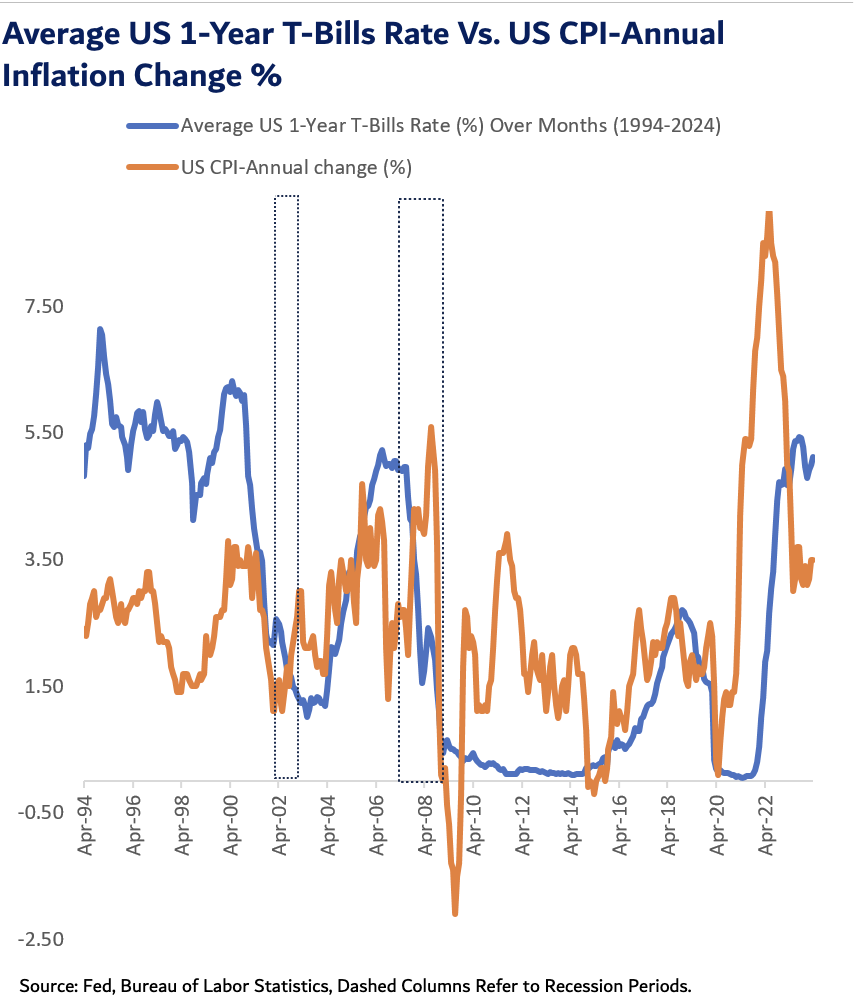

Securities of government debt with maturities ranging from a few days to a year are known as T-Bills. Despite their modest yields, T-Bills are regarded as low-risk investments. Because of their more consistent yields, T-Bills may be preferred by investors during inflationary times, particularly those denominated in the currencies of robust economies.

The most widely used are the T-Bills, which are fully guaranteed by the US government. Even in turbulent economic times, they are regarded as safe havens and risk-free. Investors often rush to T-bills during times of perceived economic instability.

The figure on the right-hand chart illustrates that US 1-Year T-Bills provided positive returns at larger rates than inflation during recessions (such as the Dot Com Bubble of 2001–2002 and the Global Financial Crisis of 2009), which used to decline as the recession subsided.

Other Commodities, Supply & Demand-Driven Based on Special Issues:

Beyond gold, other commodities can also act as inflation hedges, other commodities like silver, platinum, palladium, and base metals copper (such as copper), sugar, corn, and livestock are negatively correlated with stocks and bonds.

These commodities can also serve as safe havens for investors during market volatility. they are influenced by supply and demand dynamics and special issues induce some higher.

When global economic activity picks up, demand for these commodities tends to rise, potentially leading to price increases.

Defensive Stocks: The 4th Choice

Less Sensitive To Economic Cycles

Defensive Stocks-Less Sensitive To Economic Cycles:

Consumers still buy necessities including food, health care products, utilities, and basic household supplies regardless of the situation of the market. Due to their less cyclical performance, companies in these industries are regarded as defensive investments.

They can therefore serve as safe havens amid downturns in the markets. These stocks give greater stability to any investment portfolio because they are less erratic. Dividend-paying stocks can also be considered defensive, as they offer regular income regardless of market conditions.

Every crisis or recession is unique, active investing and portfolio diversification are the main solutions to gain positive / real returns or to mitigate risks.