The Advantages and Disadvantages of Trading Derivatives: What You Need to Know

Investors are always on the hunt for a stable and reliable investment that can help them grow their wealth over the long-term. While there are many options available, one investment class that has stood the test of time is bonds. Bonds are essentially loans made to corporations or governments, and they provide a fixed rate of return over a predetermined period of time. Bonds are considered a safe and stable investment because they are less volatile than stocks and provide a steady stream of income. In this article, we’ll explore why bonds are a smart addition to your investment portfolio and how they can help you achieve your financial goals while minimizing risk. Whether you’re a seasoned investor or just starting out, understanding the benefits of bonds can help you make informed investment decisions and build a more secure financial future.

Advantages of Trading Derivatives

1. Leverage

One of the most significant advantages of trading derivatives is the ability to use leverage. Leverage allows traders to control a more significant amount of the underlying asset than they could with just their own capital. For example, instead of purchasing 100 shares of a stock, a trader could buy 10 options contracts that give them the right to purchase 1000 shares. This means that a trader can potentially make more significant profits with a smaller investment.

2. Diversification

Derivatives trading also gives investors the ability to diversify their portfolio. By trading derivatives, investors can gain exposure to a variety of underlying assets, including stocks, bonds, currencies, commodities, and more. This helps to spread the risk and reduce the impact of any one specific asset on the portfolio.

3. Hedging

Another advantage of trading derivatives is that they can be used as a hedging tool. Hedging is a risk management strategy that involves taking an offsetting position to an existing investment. By using derivatives to hedge, investors can protect their portfolio from potential losses due to market volatility or unexpected events.

Disadvantages of Trading Derivatives

1. Complexity

One of the biggest disadvantages of trading derivatives is their complexity. Derivatives contracts can be difficult to understand, and the terminology used can be confusing. This makes it challenging for investors who are new to derivatives trading to get started.

2. High Risk

Derivatives trading is also associated with high risk. Because derivatives are leveraged instruments, traders can potentially lose more money than they have invested. Additionally, the value of derivatives contracts is often highly dependent on market conditions, which can be unpredictable and volatile.

3. Counterparty Risk

Another disadvantage of trading derivatives is counterparty risk. This is the risk that the other party to a derivatives contract will not fulfill their obligations under the contract. This can be particularly concerning in the case of over-the-counter (OTC) derivatives, where the contract is negotiated and agreed upon directly between the two parties involved.

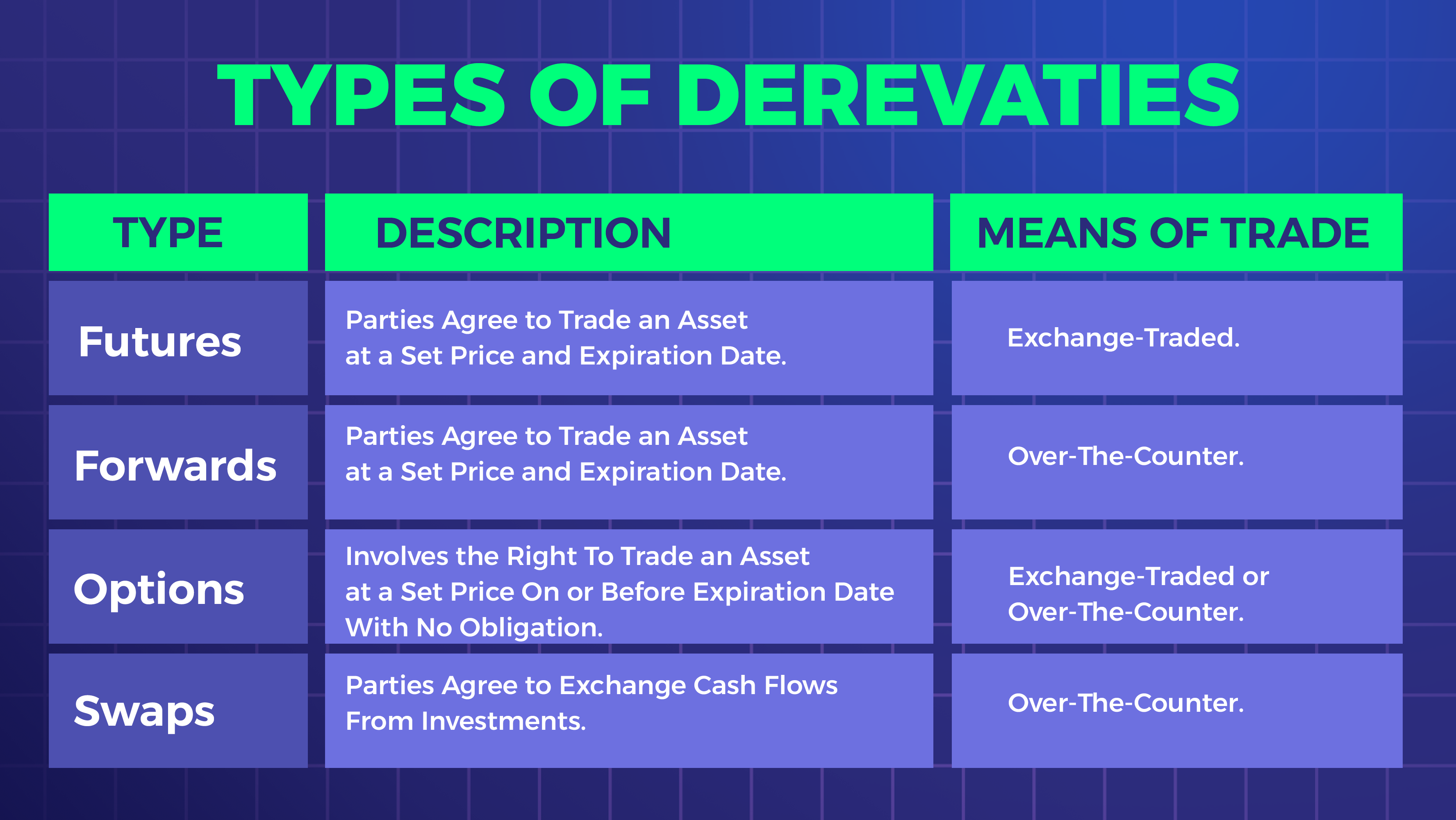

Types of Derivatives trading Futures, Options, Swaps

There are three main types of derivatives: futures, options, and swaps.

1. Futures

Futures contracts are agreements to buy or sell an underlying asset at a predetermined price and date in the future. Futures contracts are standardized and traded on exchanges, which means that they are highly liquid and can be easily bought and sold.

2. Options

Options contracts give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date in the future. Options contracts can be used to hedge against potential losses or to speculate on the movement of an underlying asset.

3. Swaps

Swaps are agreements between two parties to exchange cash flows based on an underlying asset. Swaps can be used to hedge against interest rate or currency risk, or to speculate on the movement of an underlying asset.

Risks Associated with Derivatives Trading

1. Market Risk

Market risk is the risk that the value of a derivatives contract will change due to fluctuations in the market. This risk is particularly high for leveraged derivatives, where a small change in the underlying asset can have a significant impact on the value of the contract.

2. Credit Risk

Credit risk is the risk that the other party to a derivatives contract will default on their obligations. This risk can be particularly concerning in the case of OTC derivatives, where there is no exchange to guarantee the fulfillment of the contract.

3. Liquidity Risk

Liquidity risk is the risk that a derivatives contract cannot be easily bought or sold on the market. This can be particularly problematic for traders who need to exit a position quickly.

Strategies to Mitigate Risks in Derivatives Trading

1. Diversification

One of the best ways to mitigate risks in derivatives trading is to diversify your portfolio. By trading a variety of derivatives contracts, investors can spread their risk and reduce their exposure to any one specific asset.

2. Risk Management

Another strategy for mitigating risks in derivatives trading is to implement a risk management plan. This can involve setting stop-loss orders to limit potential losses, or using options contracts to hedge against potential market volatility.

3. Education

Finally, one of the most effective strategies for mitigating risks in derivatives trading is education. By understanding the ins and outs of derivatives contracts and the risks associated with trading them, investors can make more informed decisions and minimize their exposure to risk.

Key Considerations Before Derivatives trading

Before trading derivatives, there are several key considerations that investors should keep in mind.

1. Risk Tolerance

Investors should be aware of their risk tolerance before trading derivatives. Due to their high risk, derivatives contracts may not be suitable for all investors.

2. Education

As mentioned earlier, education is critical when it comes to trading derivatives. Investors should take the time to learn about the different types of derivatives, the risks associated with trading them, and the strategies for mitigating those risks.

3. Brokerage Account

Investors will also need a brokerage account that allows them to trade derivatives. It’s important to choose a reputable broker with experience in derivatives trading.

Derivatives Trading Platforms

There are several online trading platforms that offer derivatives trading. These platforms allow investors to trade a variety of derivatives contracts, including futures, options, and swaps. Some popular derivatives trading platforms include E-Trade, TD Ameritrade, and Interactive Brokers.

Regulations on Derivatives Trading

Derivatives trading is regulated by the Commodity Futures Trading Commission (CFTC) in the United States. The CFTC is responsible for ensuring that derivatives trading is conducted in a fair and transparent manner and that investors are protected from fraud and manipulation.

Conclusion

Trading derivatives can be a useful tool for investors looking to maximize their profits, but it also comes with its fair share of risks. Understanding the advantages and disadvantages of derivatives trading, as well as the risks associated with it, is critical for making informed investment decisions. By following the strategies outlined in this article and keeping key considerations in mind, investors can minimize their exposure to risk and potentially achieve significant returns through derivatives trading.