Are you interested in learning about world of derivatives trading? Derivatives are financial instruments that derive their value from an underlying asset.

They have become increasingly popular in recent years, with the global derivatives market estimated to be worth trillions of dollars. But what exactly are derivatives, and how do they work?

In this comprehensive guide, we’ll explore the world of derivatives trading, from the basics of what they are and how they’re traded, to the different types of derivatives and the risks and rewards associated with them.

Whether you’re a beginner looking to dip your toes into the world of trading, or an experienced investor looking to expand your knowledge, this guide will provide you with a solid understanding of the fascinating world of derivatives trading.

So let’s dive in and discover the exciting opportunities that await in this dynamic and ever-evolving market.

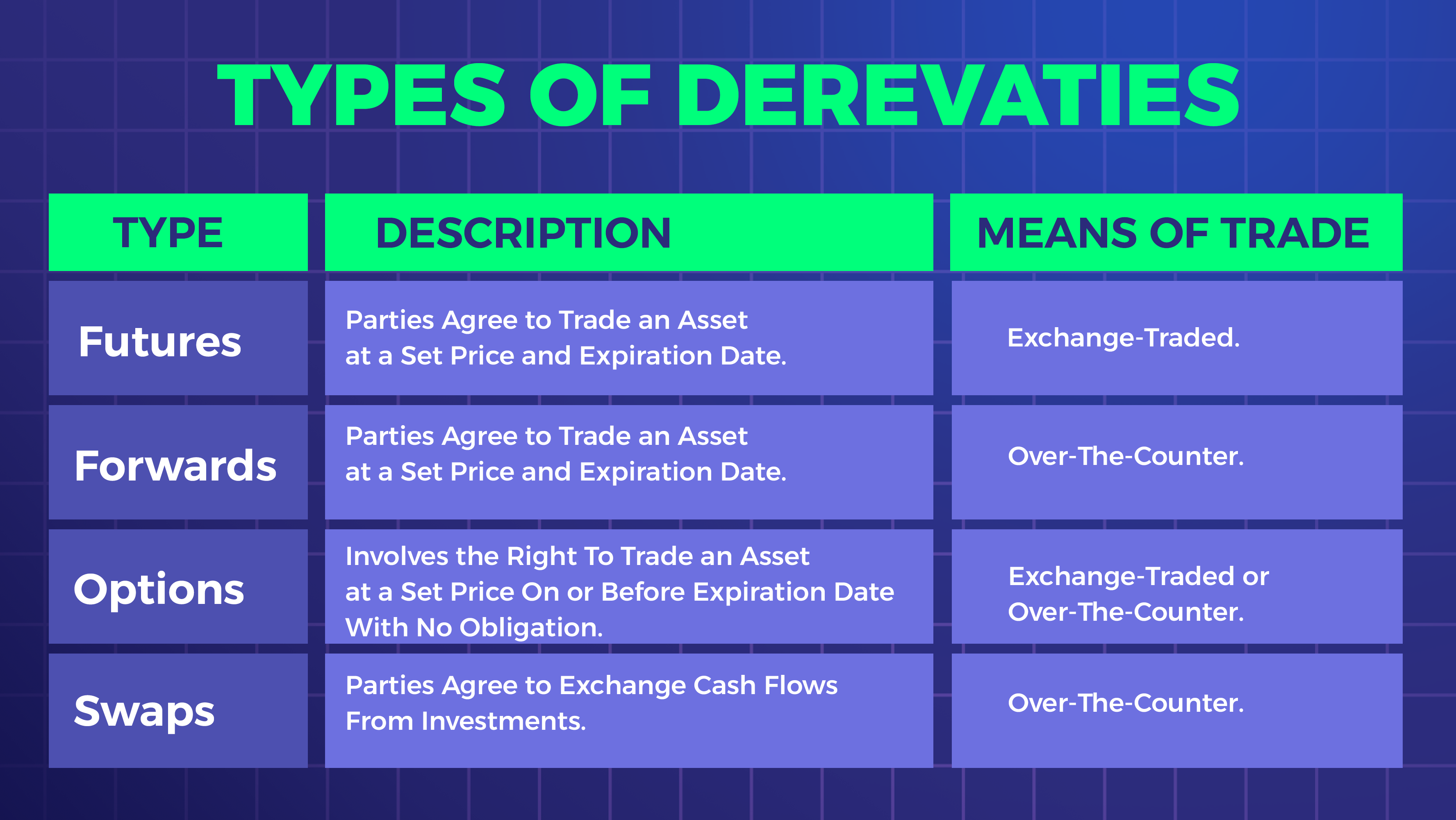

Types of Derivatives – Futures, Options, Swaps

Derivatives trading come in many different forms, but the most common types are futures, options, and swaps. Futures are contracts that require the buyer to purchase an asset at a specific price and time in the future. Options give the buyer the right, but not the obligation, to purchase or sell an asset at a specific price and time in the future. Swaps are agreements between two parties to exchange cash flows based on a specific set of conditions.

Futures are popular with traders who want to lock in a price for a commodity or financial instrument in the future. For example, a farmer might use futures contracts to lock in the price of their crops before they are harvested. Options are popular with traders who want the flexibility to buy or sell an asset at a specific price in the future, but don’t want to be obligated to do so. Swaps are popular with traders who want to hedge against changes in interest rates or other market conditions.

Overall, derivatives can be a powerful tool for managing risk and generating profits in a variety of market conditions. However, it’s important to understand the risks involved before diving in.

Advantages of Derivatives Trading

One of the biggest advantages of derivatives trading is the ability to manage risk. By using futures, options, and other derivatives, traders can hedge against price fluctuations and other market conditions that could impact their investments. This can help to protect their portfolio and minimize losses.

Another advantage of derivatives trading is the potential for higher returns. Because derivatives allow traders to speculate on the price movements of an underlying asset without actually owning it, they can make profits even in bearish markets. This can be especially useful for traders who are looking to diversify their portfolio and generate additional income.

Finally, derivatives trading can be more flexible than traditional trading. By using options and other derivatives, traders can customize their investments to meet their specific needs and risk tolerance. This can be particularly useful for traders who are looking to take advantage of specific market conditions or who want to invest in a particular asset class.

Risks Involved in Derivatives Trading

While derivatives trading can be a powerful tool for managing risk and generating profits, it’s important to understand the risks involved. One of the biggest risks is the potential for losses. Because derivatives are leveraged products, even small price movements can result in significant losses. This can be especially true for traders who are using high levels of leverage.

Another risk of derivatives trading is the potential for counterparty risk. Because derivatives are agreements between two parties, there is always the risk that the counterparty will default on their obligations. This can result in significant losses for the trader.

Finally, derivatives trading can be complex and difficult to understand. Traders need to have a solid understanding of the underlying assets, market conditions, and technical analysis in order to be successful. This can be a steep learning curve for beginners, and even experienced traders can struggle to navigate the complexities of the derivatives market.

Derivatives Trading Strategies

There are many different strategies that traders can use when trading derivatives. One of the most common is hedging, which involves using derivatives to offset the risk of other investments. For example, a trader might use futures to hedge against price fluctuations in a commodity that they hold in their portfolio.

Another common strategy is speculation, which involves using derivatives to profit from price movements in the market. This can be risky, as it requires the trader to accurately predict the direction of the market.

Other strategies include arbitrage, which involves taking advantage of price discrepancies between different markets, and spread trading, which involves trading multiple derivatives at once in order to profit from the price differences between them.

Technical Analysis in Derivatives Trading

Technical analysis is a key tool for traders who are looking to profit from derivatives trading. This involves studying price charts and other market data in order to identify trends and patterns that can be used to predict future price movements.

There are many different technical indicators that traders can use, including moving averages, trendlines, and oscillators. By using these indicators, traders can identify key support and resistance levels, as well as potential entry and exit points for their trades.

While technical analysis can be a powerful tool for traders, it’s important to remember that it’s not foolproof. Market conditions can change quickly, and traders need to be prepared to adapt their strategies accordingly.

Fundamental Analysis in Derivatives Trading

Fundamental analysis is another important tool for traders who are looking to profit from derivatives trading. This involves studying the underlying assets that the derivatives are based on, as well as economic and political factors that could impact their value.

For example, a trader might use fundamental analysis to study the supply and demand dynamics of a commodity, or the financial health of a company that they hold options on. By understanding these factors, traders can make more informed decisions about when to enter and exit their trades.

Derivatives Trading Platforms and Tools

There are many different platforms and tools available for traders who are looking to trade derivatives. Some of the most popular include MetaTrader 4, NinjaTrader, and TradingView.

These platforms allow traders to access real-time market data, track their trades, and execute orders quickly and efficiently. They also offer a variety of technical indicators and charting tools that can be used for technical analysis.

In addition to trading platforms, traders can also use a variety of other tools and resources to help them succeed in the derivatives market. These include educational resources, trading communities, and research tools.

Choosing a Derivatives Broker

Choosing the right derivatives broker is an important part of success in the derivatives market. Some of the key factors to consider when choosing a broker include their reputation, commissions and fees, trading platforms and tools, and customer support.

It’s also important to consider the type of derivatives that the broker offers, as well as their trading conditions and margin requirements. Traders should take the time to research different brokers and compare their offerings before making a decision.

Conclusion – Is Derivatives Trading Right for You?

Derivatives trading can be a powerful tool for managing risk and generating profits in a variety of market conditions. However, it’s important to understand the risks involved and to have a solid understanding of the market before diving in.

Whether you’re a beginner looking to dip your toes into the world of trading, or an experienced investor looking to expand your knowledge, this guide has provided you with a solid understanding of the fascinating world of derivatives trading. So if you’re ready to explore the exciting opportunities that await in this dynamic and ever-evolving market, now is the time to start your journey.