Fixed income investment strategies are a crucial component of any well-rounded investment portfolio. As the name suggests, fixed income securities provide investors with a predictable stream of income, making them an excellent choice for risk-averse investors looking to generate steady returns over time.

There are several different types of fixed income securities, including investment grade bonds, Treasury bonds, corporate bonds, government bonds, municipal bonds, and high-yield bonds. Each type of bond has its unique characteristics and potential benefits, which we will explore in detail throughout this article.

Furthermore, bond market analysis is an essential tool for making informed investment decisions in the fixed income market. By carefully analyzing trends in the bond market, investors can identify opportunities for higher returns and minimize risk.

Key Takeaways:

1- Fixed income investments provide a predictable stream of income, making them an excellent choice for risk-averse investors.

2- There are several different types of fixed income securities, including investment grade bonds, Treasury bonds, corporate bonds, government bonds, municipal bonds, and high-yield bonds.

3- Bond market analysis is crucial for making informed investment decisions in the fixed income market.

Understanding Fixed Income Investments

Fixed income investments are a type of investment that offers a predictable and steady stream of income to investors. Bond investments are the most common type of fixed income investment, which are essentially loans made by the investor to a borrower in return for regular payments of interest and eventual repayment of the initial investment.

Unlike stocks or mutual funds, which can be highly volatile and subject to frequent market fluctuations, fixed income investments are generally considered to be less risky and more stable. However, this stability often comes at a cost of lower potential returns compared to other types of investments.

To build a diversified fixed-income portfolio, it is recommended to invest in a combination of various types of fixed income securities. This can include government bonds, corporate bonds, municipal bonds, and high-yield bonds. By diversifying one’s investment in different types of fixed income securities, investors can balance their risk and return.

Types of Fixed Income Securities

Fixed income securities are a popular investment option for those looking for steady streams of income and reduced volatility. Here, we’ll take a closer look at some of the most common types of fixed income securities available to investors.

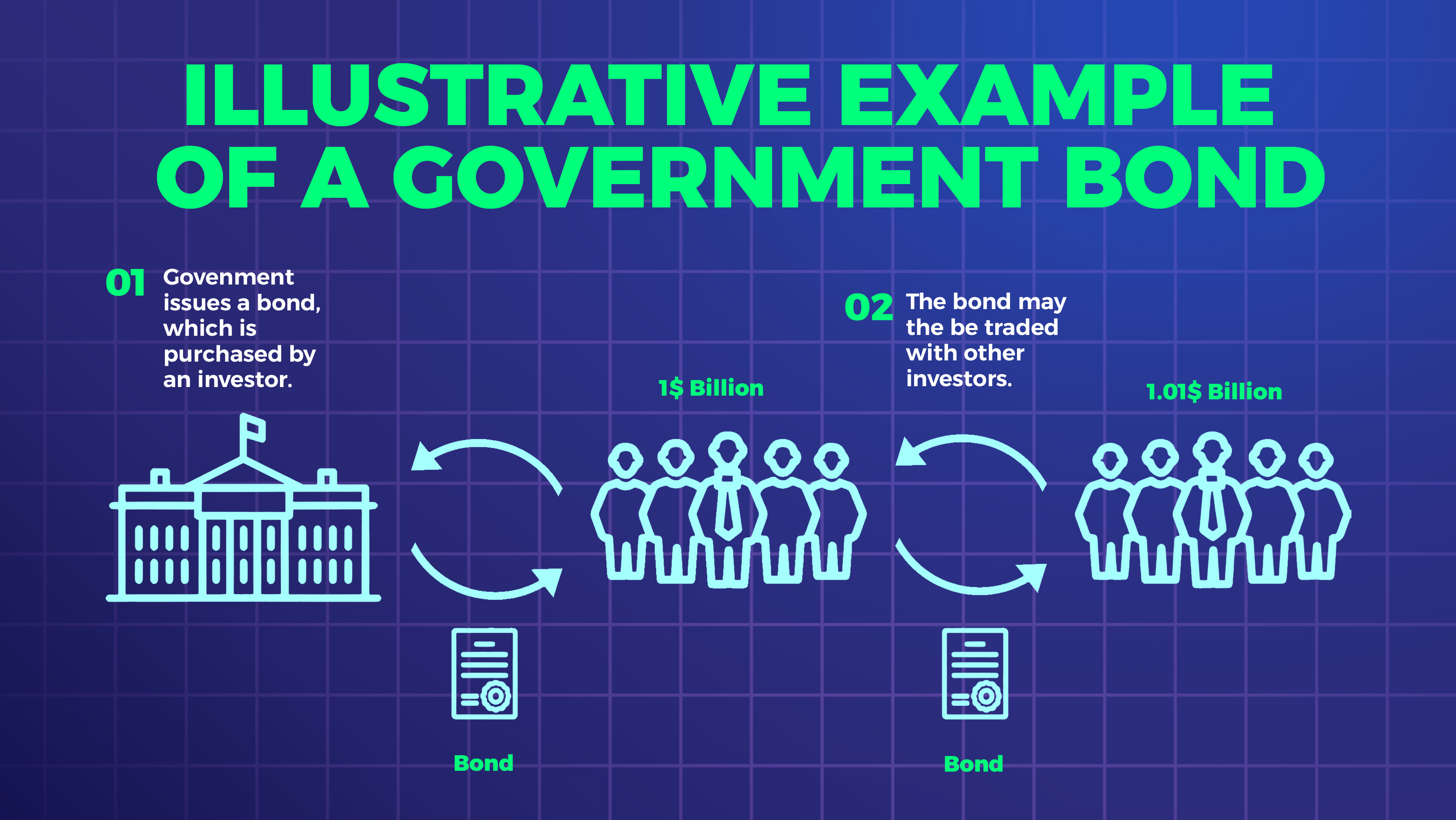

Government Bonds

Government bonds, also known as sovereign bonds, are issued by national governments and are generally considered to have the lowest credit risk since they are backed by the full faith and credit of the issuing government. These bonds come in various forms, including Treasury bonds, which are issued by the US government, and other government bonds issued by foreign governments. Government bonds typically offer lower yields compared to other types of fixed income securities, but they provide a safe haven for investors seeking a low-risk option.

Corporate Bonds

Corporate bonds are issued by corporations to raise funds for various purposes. These bonds offer higher yields compared to government bonds, but also come with greater credit risk since the financial strength of the issuing corporation affects the bond’s value.

Corporate bonds can be further classified into investment grade and high-yield bonds, with investment grade bonds being issued by companies with a higher credit rating and lower default risk, while high-yield bonds are issued by companies with a lower credit rating and higher default risk.

Municipal Bonds

Municipal bonds, also known as munis, are issued by state and local governments to fund public projects such as infrastructure development. These bonds offer tax advantages since the interest income earned from them is often exempt from federal and state taxes. Municipal bonds can be further classified into general obligation bonds, which are backed by the full faith and credit of the issuing municipality, and revenue bonds, which are backed by specific revenue-generating projects.

High-Yield Bonds

High-yield bonds, also known as junk bonds, are issued by companies with a lower credit rating and higher default risk. Despite their higher risk profile, these bonds offer higher yields compared to other types of bonds, making them attractive to investors seeking higher returns. However, investing in high-yield bonds requires careful analysis of the issuing company’s financial health.

Unlock Wealth: Sign Up Now for Smart Investing Success

Strategies for Maximizing Returns in Fixed Income Investments

Fixed income investments can offer a reliable stream of income, but maximizing returns requires strategic planning. Here are some strategies that investors can consider:

1. Invest in Investment Grade Bonds

Investing in investment grade bonds can help reduce default risk while still offering relatively high returns. These bonds are issued by companies or entities with a strong credit rating and are considered a safer investment than high-yield bonds.

2. Consider Treasury Bonds

Treasury bonds are issued by the US government and are considered the safest fixed income investment, as they are backed by the full faith and credit of the US government. While they typically offer lower returns than other types of bonds, they can be an attractive option for risk-averse investors.

3. Look at Corporate Bonds

Corporate bonds are issued by companies and offer higher yields than Treasury bonds, but at a slightly higher risk. Careful selection of corporate bonds can offer steady returns while minimizing default risk.

4. Explore Municipal Bonds

Municipal bonds are issued by states, cities, and other local government entities to fund public projects. They offer tax advantages and can be a good option for investors in higher tax brackets. However, investors should be aware of the specific risks associated with municipal bonds, such as potential changes in tax laws.

5. Conduct Bond Market Analysis

Conducting thorough bond market analysis can help identify opportunities for higher returns. This involves analyzing economic indicators, interest rates, credit ratings, and other factors that can impact bond prices and yields. By staying informed about market trends, investors can make more informed investment decisions.

Minimizing Risk in Fixed Income Investments

When it comes to fixed income investments, minimizing risk is essential to generate steady streams of income and protect one’s portfolio from potential losses. Here are some strategies that investors can use to minimize risk:

Invest in Investment Grade Bonds

Investment grade bonds are issued by companies with high credit ratings, indicating lower default risk. These bonds offer lower yields than high-yield bonds, but they are a safer investment option. By investing in investment grade bonds, investors can minimize risk and ensure a steady stream of income.

Invest in Government Bonds

Government bonds are considered to be the safest fixed income investments, as they are backed by the full faith and credit of the government. These bonds offer lower yields than corporate or high-yield bonds, but they provide a secure investment option for risk-averse investors.

Conduct Bond Market Analysis

Bond market analysis can help investors identify potential risks and opportunities in the fixed income market. By analyzing bond market trends and economic indicators, investors can make informed investment decisions and minimize risk. It’s important to conduct thorough research and analysis before investing in fixed income securities.

By implementing these strategies, investors can minimize risk and generate steady streams of income from their fixed income investments.

Conclusion

In conclusion, fixed income investment strategies provide a valuable opportunity to diversify investment portfolios, generate steady income, and balance risk and return. Investing in a range of fixed income securities, including government bonds, investment grade bonds, corporate bonds, municipal bonds, and high-yield bonds, can help to maximize returns, while conducting thorough bond market analysis is essential to identify potential risks and opportunities.

By implementing risk management strategies such as investing in lower default risk securities like government bonds and investment grade bonds, investors can minimize their exposure to potential losses. Through careful consideration and informed decision-making, investors can make the most of the fixed income market and achieve their financial goals.