Are you curious about the daily activities of a professional forex trader? Forex trading is a fast-paced and exciting career that involves buying, selling, and exchanging currencies in the financial market. As a forex trader, you play a vital role in the currency trading industry, and your decisions can have a significant impact on the market.

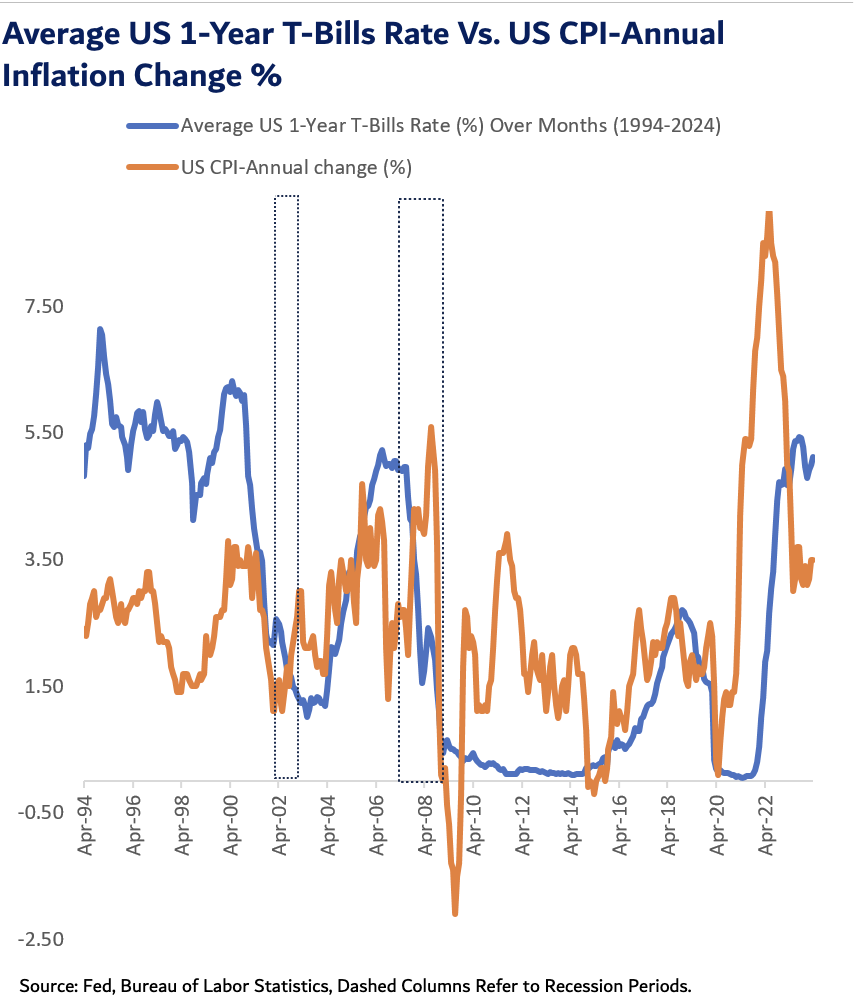

Typically, forex traders begin their days by analyzing market news and trends, researching and developing trading strategies, and monitoring currency exchange rates. They use technical analysis tools such as charts and graphs to identify patterns and make informed trading decisions. As the forex market is open 24 hours a day, traders may work long hours and adapt to different time zones.

Successful forex traders possess several skills, including discipline, risk management, and the ability to remain calm under pressure. They also understand the importance of continuous learning and constantly strive to improve their trading strategies.

Key Takeaways:

- Forex traders are responsible for buying, selling, and exchanging currencies in the financial market.

- Forex traders spend their days analyzing market trends, developing trading strategies, and monitoring exchange rates.

- Successful forex traders possess skills such as discipline, risk management, and continuous learning.

Skills Required for Successful Forex Trading

Being a successful forex trader requires a combination of skills that enable one to make informed trading decisions. These skills are not only limited to technical analysis but also include psychological and money management skills.

Technical Analysis: A forex trader needs to be able to analyze charts and identify trends that indicate possible market movements. This involves understanding technical indicators and integrating them into a workable trading strategy.

Forex Strategy: A successful forex trader has a well-defined strategy that they stick to, enabling them to make consistent profits. A trading strategy should encompass risk management, money management, and trading rules.

Forex Signals

Forex signals: are alerts that indicate when to buy, sell or hold a particular currency. These signals are provided by professional traders or automated trading systems, and they can be used to complement a trader’s strategy. Forex traders need to have a good understanding of how to read and interpret signals to make the right trading decisions.

Money Management: A forex trader needs to manage their funds effectively to limit losses and maximize profits. This involves determining an appropriate position size, setting stop-loss orders, and managing risk.

Forex Education

Forex Education: To be successful, a forex trader needs to stay informed about market trends, news, and events. This includes learning from experienced traders, attending trading seminars and webinars, and reading up-to-date trading literature.

By acquiring and mastering these skills, a forex trader can develop a successful trading strategy, minimize risk, and maximize profits.

Unlock Wealth: Sign Up Now for Smart Investing Success

Developing a Winning Forex Trading Strategy

Developing a winning forex trading strategy is essential for any forex trader looking to achieve success in the market. There are different types of trading strategies that forex traders can use to make informed decisions when trading currencies. These include technical analysis, fundamental analysis, and a combination of both.

Technical analysis involves using charts and historical data to identify patterns and trends in the market. On the other hand, fundamental analysis involves studying economic, financial, and geopolitical factors that can impact currency prices.

The most successful forex traders develop a strategy that combines both technical and fundamental analysis to make informed trading decisions.

“A good trading strategy should be clear, concise, and easy to follow.”

When developing a trading strategy, it’s essential to consider your trading style, risk tolerance, and financial goals. A good trading strategy should be clear, concise, and easy to follow. It should include entry and exit points, stop-loss orders, and risk management techniques to limit potential losses.

It’s also crucial to regularly review and adjust your trading strategy to adapt to the ever-changing forex market. This involves keeping up-to-date with market news and events that can impact currency prices and adjusting your strategy accordingly.

The Forex Market: An Ever-Changing Landscape

As a professional forex trader, it’s essential to understand that the forex market is constantly evolving and impacted by various economic, political, and social events. Keeping up with these changes is critical to making informed trading decisions.

One major factor that influences currency fluctuations is macroeconomic data, such as employment rates, inflation, and GDP. Traders must stay updated with economic news releases and reports to anticipate market reactions and potential currency movements.

Another critical aspect of forex trading is online trading platforms. A reliable trading platform can provide access to a wide range of financial instruments, real-time price data, and advanced trading tools.

| Factors to Consider When Choosing a Trading Platform: | Description: |

| Execution speed | How quickly and efficiently trades can be executed on the platform |

| Reliability | Stability of the platform and its ability to handle high trading volumes |

| User-friendly interface | Intuitive and easy-to-use interface for managing trades and monitoring market movements |

Finally, it’s important to note that the forex market is open 24/7, allowing traders to conduct transactions at any time. However, this can also cause traders to experience fatigue or burnout if they don’t manage their time effectively. We recommend setting clear trading goals, taking regular breaks, and maintaining a healthy work-life balance.

The Importance of Staying Updated with Market News and Events

Staying updated with the latest market news and events can be the difference between making a profit or a loss in forex trading. Traders must stay informed about global economic developments, political events, and other significant news that may impact currency markets.

“The market can stay irrational longer than you can stay solvent.” – John Maynard Keynes

As the quote above suggests, staying updated with market news and events is vital for traders to avoid making irrational decisions that could lead to significant losses.

Choosing the Right Forex Broker

One of the essential decisions a forex trader must make is selecting a reputable forex broker. With so many options available, it may be challenging to determine which one is best suited for individual trading needs. Therefore, before committing to a forex broker, it is crucial to consider the following factors:

| Factor | Importance |

| Regulation | In forex trading, it is imperative to work with a regulated broker to ensure the safety and security of funds. Always check if the broker is registered with a reputable regulatory body such as the Financial Conduct Authority (FCA) or the National Futures Association (NFA). |

| Trading Platform | Choose a broker with a trading platform that is user-friendly and fits your trading style. Additionally, ensure the platform has the tools and resources needed to carry out your trading strategy effectively. |

| Execution Speed | Choose a broker with a fast and reliable execution speed to ensure trades are executed promptly, minimizing the risk of slippage and delays. |

| Customer Support | It is essential to work with a broker that provides reliable and responsive customer support. Choose a broker with multiple options for contacting support, including email, phone, and live chat. |

By considering these factors and conducting thorough research, a forex trader can make an informed decision when selecting a forex broker. Additionally, it is crucial to regularly review the broker’s performance and adapt to changes in the market to ensure continued success.

Maintaining a Winning Mindset in Forex Trading

Forex trading is not just about strategies and analysis; it also requires a winning mindset. The psychological challenges faced by forex traders are significant, and it’s easy to become overwhelmed by emotions like greed, fear, and anxiety. A winning mindset is essential to overcome these challenges and maintain focus on trading objectives.

One of the crucial elements of a winning mindset is discipline. Forex traders must adhere to their trading plans and resist the temptation to make impulsive decisions.

To do this, it’s important to stick to predefined risk management and money management rules, as these will help mitigate losses and keep trading activities within a predetermined level of risk.

Another essential aspect of maintaining a winning mindset is managing emotions. Successful traders understand that they must stay level-headed and objective, even in highly pressured situations.

They avoid getting caught up in the excitement of winning trades and avoid making emotional decisions while experiencing losses.

Developing resilience is another critical component of maintaining a winning mindset. Forex trading can be stressful, and setbacks are inevitable. It’s essential to approach these setbacks as learning opportunities and to maintain a positive attitude.

With a resilient mindset, traders can quickly bounce back from setbacks and remain focused on their long-term goals.

Finally, it’s important not to forget the importance of taking a break. Forex trading can be all-consuming, and it’s easy to spend long hours glued to the screen. However, taking regular breaks is essential for maintaining focus and preventing burnout. Taking a break can also help traders gain valuable perspective and avoid getting caught up in the minutiae of daily trading.

Conclusion

Being a professional forex trader requires a combination of skills, knowledge, and a winning mindset. It’s a dynamic and ever-changing field that demands constant learning and adaptation.

Through this article, we’ve discussed the daily activities of a forex trader, the skills necessary for success, and how to develop a winning trading strategy. We’ve also explored the importance of staying updated with market news and events, choosing the right forex broker, and maintaining a positive mindset.

Remember…

Forex trading is not a get-rich-quick scheme. It requires discipline, hard work, and consistent effort to achieve success. However, with the right mindset and a commitment to learning, anyone can become a successful forex trader.

Thank you for taking the time to read this article. We hope you found it informative and helpful in your journey towards becoming a professional forex trader.

Unlock Wealth: Sign Up Now for Smart Investing Success

FAQ

Q: What is forex trading?

A: Forex trading refers to the buying and selling of currencies in the foreign exchange market. It involves speculating on the price movements of different currencies to profit from the fluctuations in their exchange rates.

Q: What does a professional forex trader do?

A: A professional forex trader is actively involved in analyzing market trends, executing trades, and managing risk in order to make profitable trading decisions. They constantly monitor the forex market and stay updated with economic and political news that can impact currency prices.

Q: What skills are necessary for successful forex trading?

A: Successful forex trading requires a solid trading strategy, the ability to interpret forex signals, and a good understanding of market dynamics. It is also important to have strong analytical skills, risk management abilities, and the discipline to stick to a trading plan.

Q: How can I develop a winning forex trading strategy?

A: Developing a winning forex trading strategy involves understanding different types of analysis, such as technical and fundamental analysis, and finding a strategy that aligns with your trading style. It is important to test and refine your strategy over time and adapt to changing market conditions.

Q: What factors influence the forex market?

A: The forex market is influenced by a variety of factors, including economic indicators, geopolitical events, central bank policies, and market sentiment. These factors can cause currency fluctuations and create trading opportunities for forex traders.

Q: How do I choose the right forex broker?

A: When choosing a forex broker, consider factors such as regulation, trading platform features, execution speed, customer support, and the range of instruments offered. It is important to select a reputable broker that meets your trading needs and provides a secure trading environment.

Q: How can I maintain a winning mindset in forex trading?

A: Maintaining a winning mindset in forex trading requires discipline, emotional control, and resilience. It is important to manage risk, stay focused on long-term goals, and learn from both successes and setbacks. Developing a positive attitude and keeping a balanced perspective is key to long-term success.