Avalon Pharma

Continues to Impress

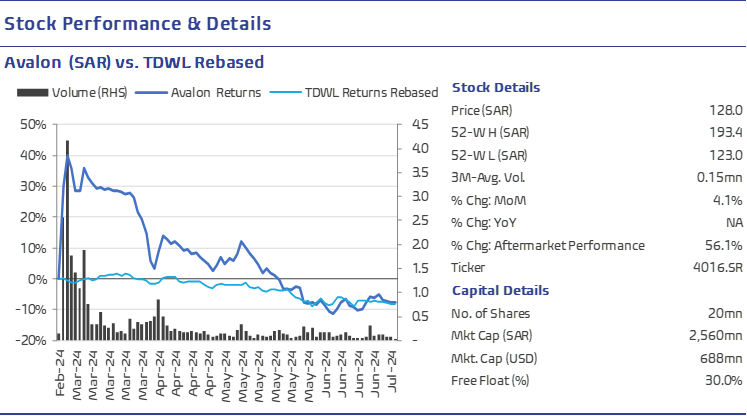

On February 5, 2024, we issued our pre-IPO note on Middle East Pharmaceutical Industries Company, also known as Avalon Pharma, with an initial fair value (FV) of SAR108.1 per share (+31.9% vs. IPO price). In less than six months, the Avalon share price surpassed our fair value on an impressive financial results. We upgraded our FV in light of the company’s recent regulatory approval and strong financial performance.

Avalon Pharma has received approval from the Saudi Food and Drug Authority (SFDA) for new production lines at its Avalon Factory (2) facilities. This expansion will double the production capacity, positioning Avalon to capitalize on growing pharma demand in the region. Moreover, Avalon delivered impressive financial results in 1Q 24, bolstering our confidence in the company’s outlook. Based on the above, we are raising our FV for Avalon by 46% to SAR 157.4 per share as We believe it is well-positioned for continued growth and remains an attractive investment opportunity in the regional healthcare sector. The strategic capacity expansion and its solid first quarter results, underscore the strength of Avalon’s operating model and future prospects.

Avalon started 2024 on a positive note with a remarkable 37% y/y increase in revenue: Avalon Pharma (4016.TDWL) achieved impressive results in 1Q24, with strong revenue growth of 37.3% y/y, reaching SAR75.8mn.

The expansion was driven by the successful introduction of new products and market expansion across all channels.

The retail sector experienced significant growth of 29.3% y/y, reaching SAR54.8mn, attributed to the acquisition of new customers and the introduction of key products like Avotrene, Copan, and Quenfil.

Gross profit also increased by 37.7% to SAR46.5mn, with a gross profit margin of 61.27%, slightly higher than 1Q23. Higher gross profit margin was primarily due to improved margins in the Public and Export sectors, while the change in Retail margins was influenced by the reclassification of Wasfaty sales.

EBITDA showed remarkable growth, surging by 168% y/y to SAR15.6mn, with an expanded EBITDA margin of 20.7% compared to 10.61% in 1Q23, driven by enhanced operational efficiency.

Avalon Pharma experienced a significant turnaround in net profit, soaring to SAR9.4mn from a loss of SAR0.50mn in 1Q23.

Avalon Pharma has received approval from the Saudi Food and Drug Authority (SFDA) for new production lines at its Avalon Factory (2) in Riyadh. The approved lines encompass capsules, tablets, as well as semi-solids such as creams, ointments, and gels. Once fully operational, these registered lines will have a production capacity of 270 million tablets and capsules per year, along with 22 million units of semi-solids per year. Commercial production on these new lines will commence after obtaining the necessary approvals from the SFDA for the targeted products. This expansion allows Avalon Pharma to meet increasing demand and offer a wider range of pharmaceutical products to healthcare providers and patients in the market.

| FY End: December (SAR mn) | FY21a | FY22a | FY23a | FY24e | FY25e | FY26e |

| Revenue | 287 | 303 | 338 | 523 | 636 | 775 |

| Gross profit | 179 | 188 | 212 | 328 | 399 | 486 |

| EBITDA | 84 | 81 | 89 | 144 | 175 | 213 |

| Net Income | 66 | 59 | 66 | 113 | 139 | 170 |

| Revenue Growth (%) | -5% | 5% | 12% | 54% | 22% | 22% |

| GP Growth (%) | -1% | 5% | 12% | 55% | 22% | 22% |

| EBITDA Growth (%) | -7% | -4% | 10% | 61% | 22% | 22% |

| Net Income Growth (%) | -9% | -10% | 11% | 71% | 23% | 23% |

| GP Margin (%) | 62% | 62% | 63% | 63% | 63% | 63% |

| EBITDA Margin (%) | 29% | 27% | 26% | 28% | 28% | 28% |

| NP Margin (%) | 23% | 20% | 19% | 22% | 22% | 22% |

| Net Debt (Cash) (SAR mn) | 84.6 | 82.3 | 66.8 | 36.4 | 30.9 | 20.9 |

| PER (x) | 38.6x | 43.1x | 38.9x | 22.7x | 18.4x | 15.0x |

| PBV (x) | 9.6x | 9.1x | 8.4x | 7.4x | 6.6x | 5.7x |

| ROE (%) | 24.8% | 21.2% | 21.5% | 4.4% | 5.4% | 6.7% |

Multiples are calculated based on the current market Price.

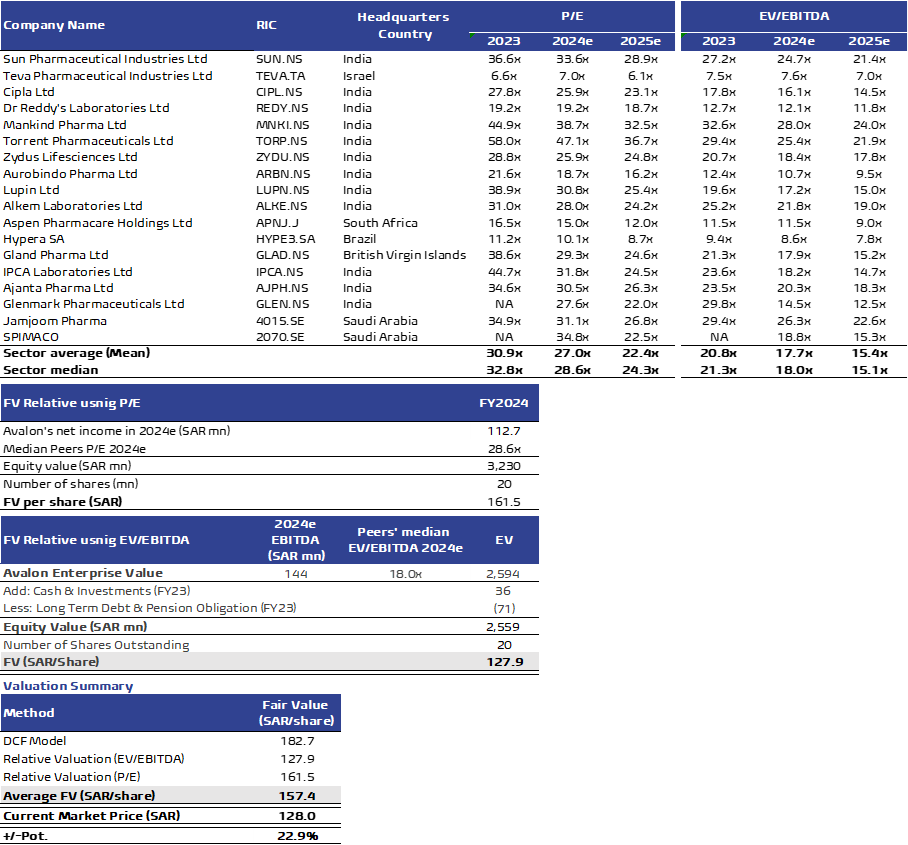

Avalon Pharma Valuation

Avg. Fair Values is SAR157.4 / share

Our average Fair Value stands at SAR157.4/ Share: In addition to our discounted cash flow (DCF) model which yielded a fair value of SAR182.7/ share as depicted in the right table, we also conducted a relative valuation using the median P/E and EV/EBITDA multiples for FY24 for Avalon’s peers. We used emerging markets peers’ median P/E and EV/EBITDA FY24 multiples and applied them to Avalon’s expected earnings and EBITDA in FY24 to arrive at a fair value for the stock. We assign equal weights to each valuation technique, reaching an average fair value of SAR157.4/share, which is 22.9% higher than the current market price of SAR128 per share.

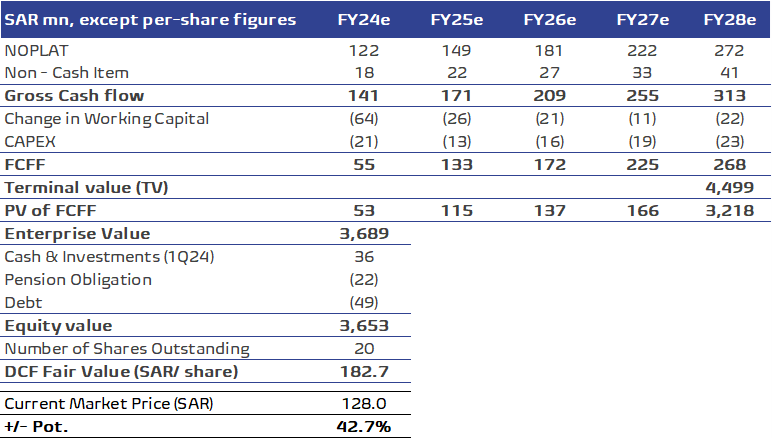

DCF – fair value SAR182.7/ share: We discounted Avalon’s free cash Flow to the firm over the coming five years (2024-2028) (FCFF) based on the following assumptions:

- Revenues to grow at a 5Y CAGR of 28% to SAR1.2bn by 2028, on the back the company’s recent regulatory approval for new production lines at its Avalon Factory (2) facility, which will double the company’s total production capacity.

- EBITDA to grow at a 5Y CAGR of 29.2% to SAR320.4mn by 2028, with EBITDA margin to stand at 28% in the forecasted period, in line the Avalon’s historical average.

- Cumulative Capex of SAR91mn, averaging around 2% of revenues annually during 2025-2028).

- Average Cost of Equity (COE) is 9.7% during forecasted period, derived as follows: (1) SKA implied risk-free rate of 3.2% on average (based on US risk free rate and inflation differential between KSA vs. USA), (2) KSA’s Equity Risk Premium (ERP) of 6.3% (based on a US market ERP of 5.94% and a relative standard deviation of 1.06 between US and KSA equity markets returns), and (3) a Beta of 1.03.

- After tax cost of debt 2.5% on average.

- Capital structure of 97.3% equity and 2.7% debt, based on the market value of Avalon’s equity and the current level of debt.

- Hence, we used a WACC of 9.6% in 2024e, which eventually declines to 9.1% by 2028e, with terminal year growth rate of 3%.

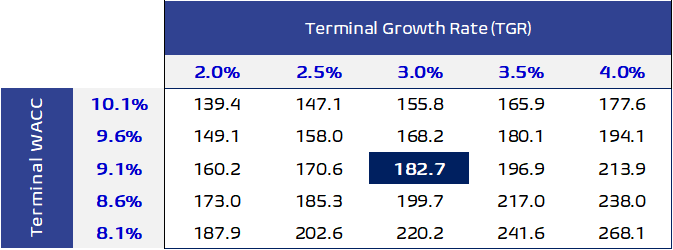

Sensitivity analysis: Our DCF fair value is highly sensitive to the changes in both WACC and growth rate in the terminal year. Therefore, we conducted a sensitivity analysis for any changes in both WACC and growth rate in the terminal year which resulted in fair values ranged from SAR139.4 to SAR268.1 / share.

FV sensitivity to TGR and WACC

Avalon pharma Valuation (Cont.’d)

A Possible 22.9% Upside Potential

Multiples valuation: We used emerging markets peers’ median P/E and EV/EBITDA FY24 multiples and applied them to Avalon’s expected earnings and EBITDA in FY24 to arrive at a fair value for the stock as follows:

- P/E: Using peers’ median FY24 P/E of 28.6x and our forecasted net income for FY24, we arrived at a fair value of SAR161.5/ share.

- EV/EBITDA: By applying peers’ median FY24 EV/EBITDA of 18x to our forecasted FY24 EBITDA, we arrived at a fair value of SAR127.9/ share.

- Our FV is SAR157.4 / share based on equal weights: We assign equal weights to both valuation techniques, reaching a fair value of SAR157.4/ share, which represents 22.9% higher than the current market price of SAR128 per share.

Investment rationale:

- One of the fastest growing home-grown pharmaceutical manufacturing companies in the Kingdom of Saudi Arabia.

- Defensive industry and favorable regulatory framework.

- Optimal business model with a diversified list of suppliers and customers, mitigating supply chain risks.

- A sizable and growing market share ahead as the company has recently completed a major expansion by doubling its manufacturing capacity, which is expected to start production by the second quarter of 2024.

- Avalon Pharma is the market leader in the market of dermatological products, medicines and skin care products, a fast-growing category in Saudi Arabia, with an 8.9% market share.

- Avalon Pharma is one of the top four manufacturers in Respiratory therapeutic category, with a 9.1% market share.

- The company’s plans to expand its export market, a fast-growing channel for Avalon, including the introduction of new sub-distribution partnerships in key countries.

Key Risks to valuation

- Avalon must always adhere to the pricing rules approved by the Food and Drug Authority that may affect the company’s profit margin.

- Fierce competition.

- The company is exposed to the risk of withdrawing its products from the market.

- Concentrated exposure to certain products

- Delay in the ramp- up of facilities could reduce future growth